Payment

Payment is a critical activity for the functioning of society. Payments can be recurring or based on daily purchase decisions. Electronic payment is very popular in Finland, with the majority of recurring payments and daily payments being carried out electronically as credit transfers or card payments. Cash payment also continues to play a part in daily payments.

To put it simply, payment is transferring money from one party to another, and it is a key factor in all economic activity. Payments can be examined on the basis of the nature of the payment or the payment method.

Some payments are recurring, such as wages, pensions and payments of housing charges and electricity bills. Credit transfers are typically used as the payment method in these recurring payments. Daily payments concern making purchases at the point-of-sale in a shop or service point, or online.

The most common payment method in daily payments is debit card payment, but cash continues to play a role in daily payments.

Payment is a basic function in society and the lifeblood of economic activity.

The Bank of Finland’s payments policy summarises the tasks and objectives set by the Bank of Finland for guiding the assessment and development of payment systems.

The payments policy is based on three pillars:

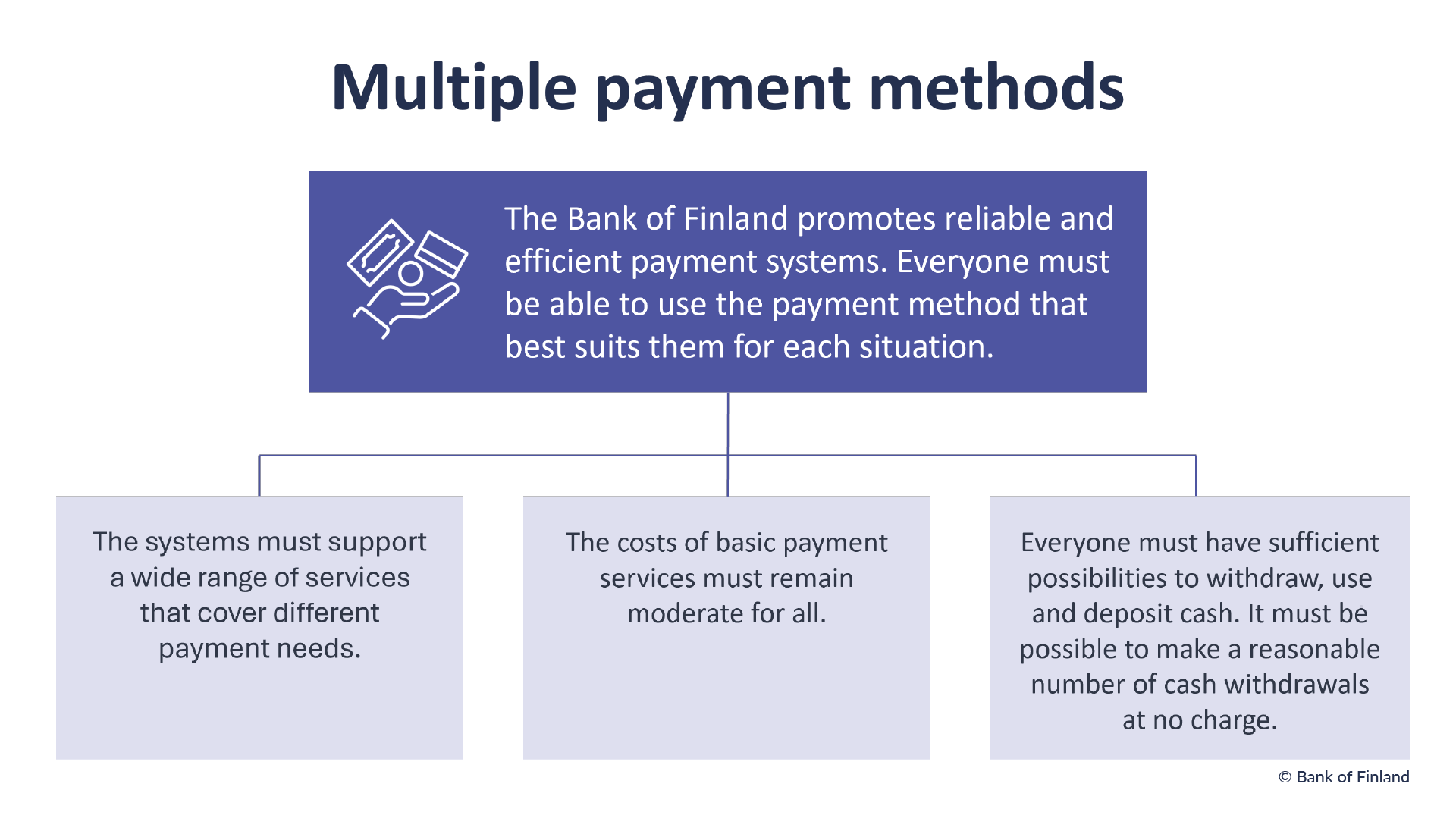

· Multiple payment methods

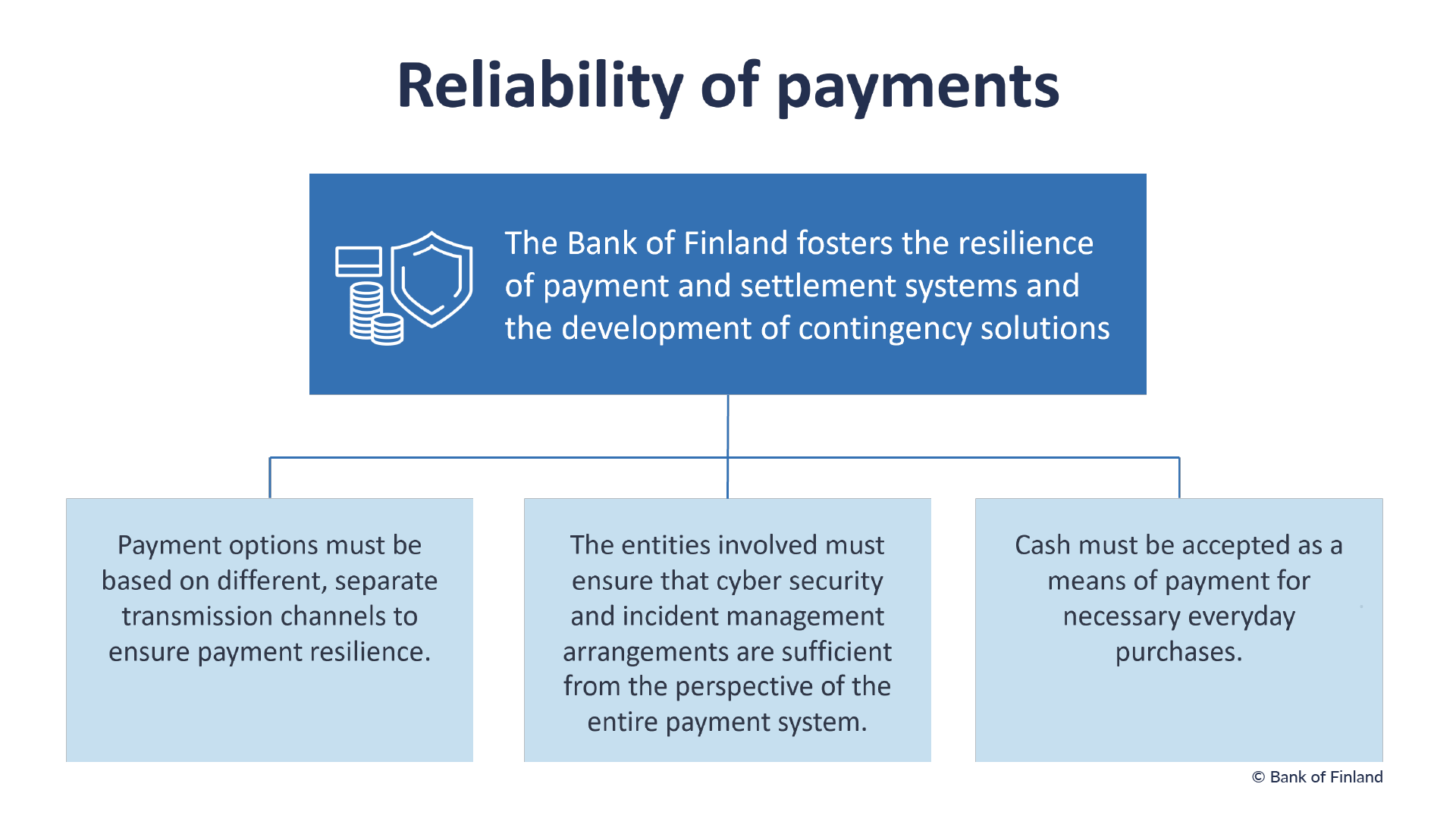

· Reliability of payments

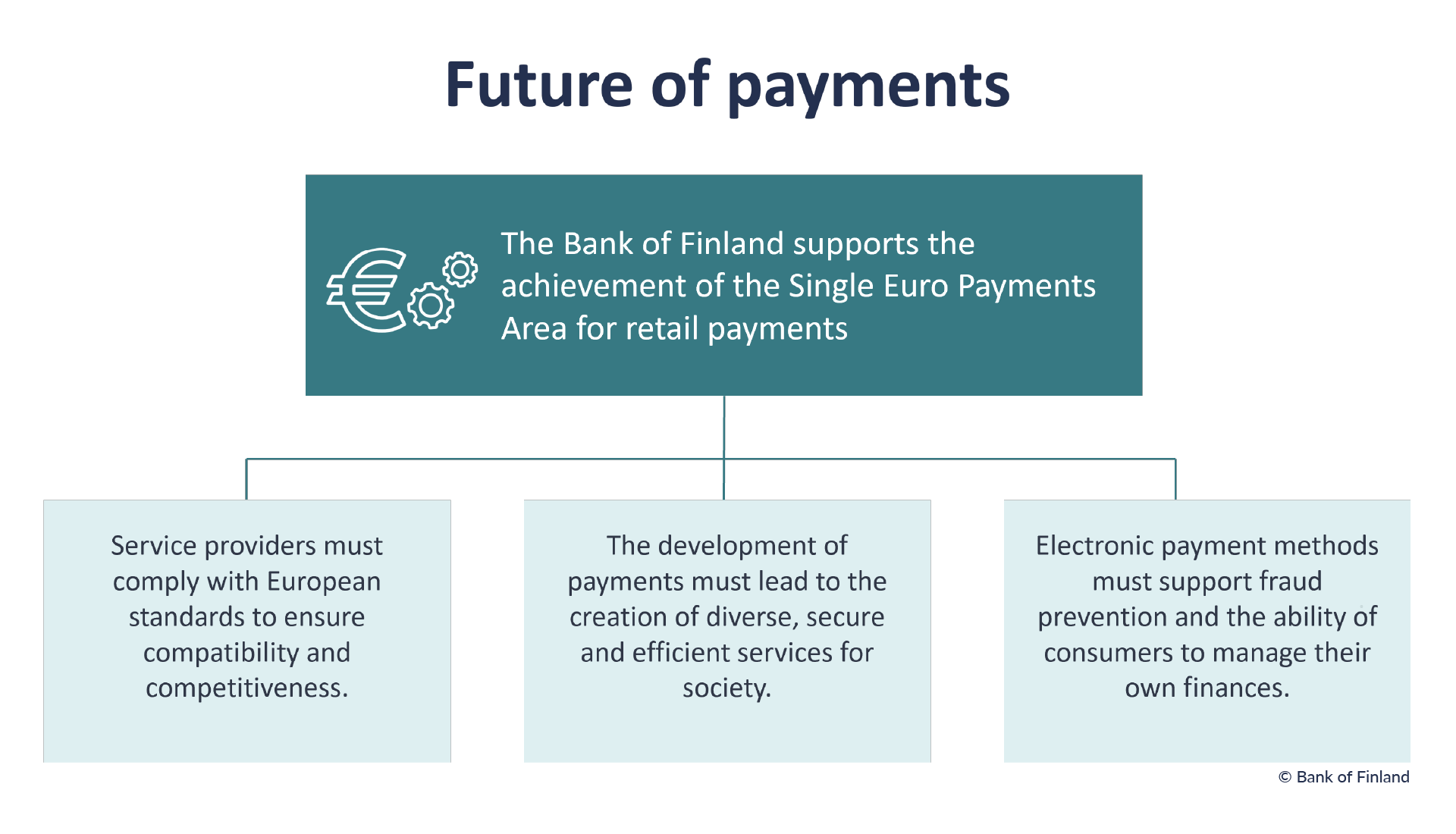

· Future of payments

Multiple payment methods

By supporting a wide variety of payment options, we want to make sure that different groups of users are able to choose the payment method that suits them best in different situations. The costs of basic payment services must remain moderate for all. Cash is still part of a well-functioning payment system, and people must have access to sufficient cash services. With diverse and moderately priced payment services and sufficient cash services, we will ensure that the ability of all consumers, entrepreneurs and businesses to operate in society is guaranteed. A wide variety of payment methods will also promote preparedness and the ability to function during any payment system disruptions.

Reliability of payments

The Bank of Finland is actively working to ensure payment resilience. We are involved in the cooperation between financial market authorities in matters related to preparedness and in the work of the National Emergency Supply Organisation. Payment resilience also requires that there are genuine alternatives when it comes to payment transmission mechanisms. Similarly, the cyber security and incident management arrangements of the entities involved must extend to the level of the entire payment system. This will prevent the spread of problems from one entity to another. Cash can ultimately also be used independently of electronic systems. Therefore, cash must always be an accepted form of payment at least for people’s essential everyday purchases.

Future of payments

Finland is strongly integrated into Europe not only by having euro as its currency but also through European payment infrastructures and the European legislation on payments.It follows that the development of payments should inlcude a commitment to comply with European standards in order to ensure compatibility and competitiveness. This will also enable the creation of efficient and secure payment services as part of a wider market. Particular attention must be paid to how payment methods can prevent payment fraud and support consumers in managing their own finances.

Through its activities and statements, the Bank of Finland is promoting the achievement of its payments policy objectives. By publishing its payments policy, the Bank aims to enhance predictability and consistency.