Housing loan drawdowns in January 2025 outpaced previous two years

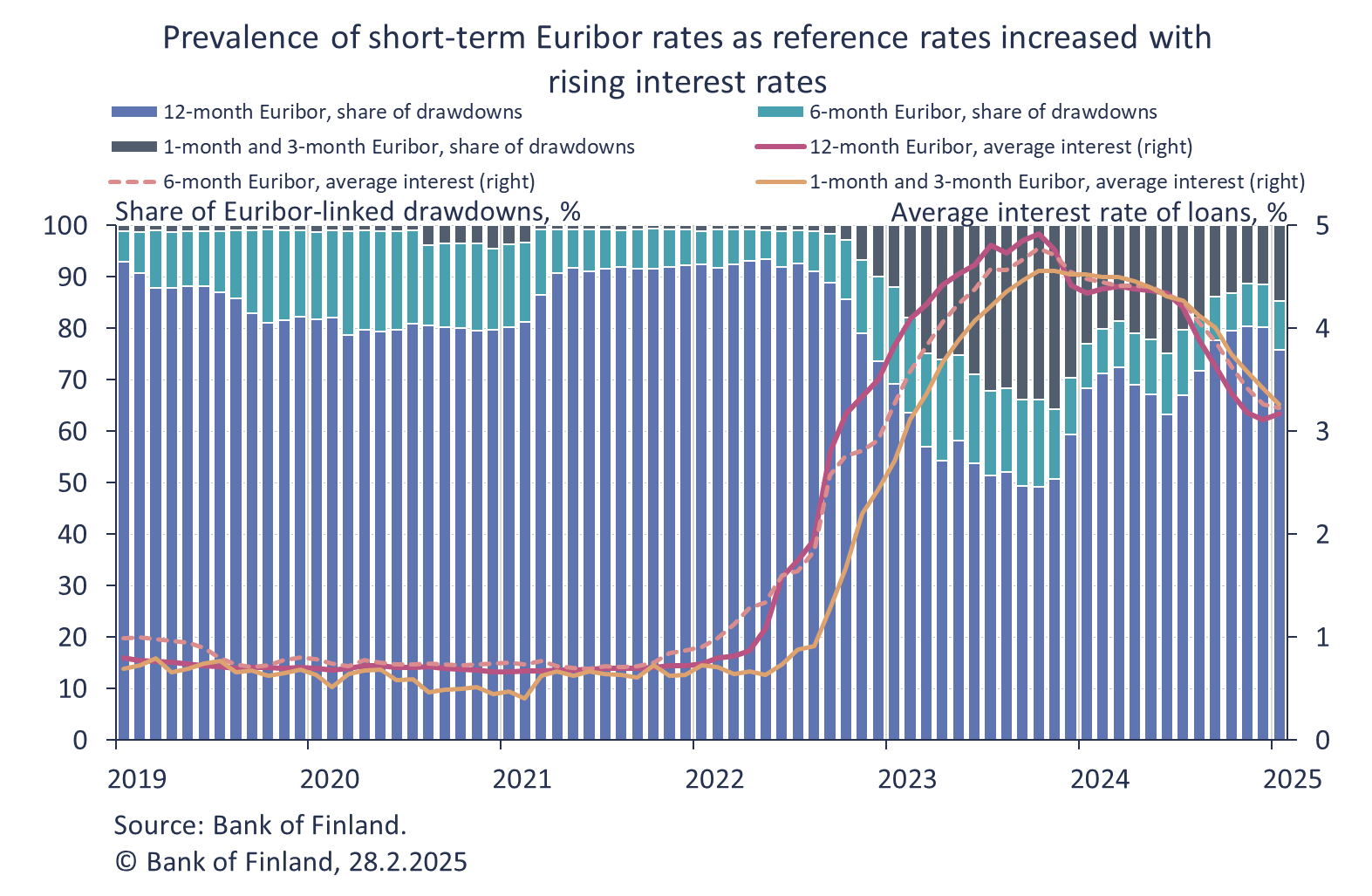

Drawdowns of housing loans in January exceeded the level of the same period in the two previous years, while remaining below the long-term January average. At the same time, the average interest rate on new drawdowns declined considerably year-on-year. In recent years, short-term Euribor and other rates gained popularity as reference rates for housing loans while the level of interest rates rose; however, they have seen reduced use lately as interest rates declined.

Finnish households drew down new housing loans[1] amounting to EUR 1.0 billion in January 2025. This amount was 24% higher than in January 2024 and 18% higher than in January 2023 but still about 14% lower than in January 2011–2024 on average. The average interest rate on new drawdowns rose slightly from December, reflecting an increase in the 12-month Euribor, the most widely used reference rate. In January, the average interest rate was 3.20%, or 1.16 percentage points less than a year earlier. EUR 104 million, or approximately 10% of the new drawdowns, consisted of buy-to-let mortgages.

Euribor rates are by far the most widely used reference rates for housing loans. In January 2025, almost 96% of new housing loans were linked to the Euribor rates. Out of these, 75.8% were linked to the twelve-month Euribor, 9.7% to the six-month Euribor and 14.6% to the one- or three-month Euribor. The popularity of different Euribor tenors varies with the prevailing interest rate level, so that tenor with the lowest rate rises as a share of drawdowns at any given time.[2] The prevalence of Euribor rates shorter than one year peaked in October 2023, when more than half of Euribor-linked housing loans were tied to these tenors.

Other reference rates along with short-term Euribor rates also gained in popularity after the general level of interest rates bottomed out in 2022. The prevalence of banks’ own reference rates, such as prime rates,[3] peaked in November 2023 when 7.1% of new housing loans were tied to banks’ own reference rates. In January 2025, following a decline in the interest rate level, only one-third of a percent of new housing loans were still linked to these reference rates.

The demand for fixed interest rates is more stable, peaking in April 2024 when 6.6% of new housing loans had a fixed interest rate, the average interest rate on them being 0.6 percentage points lower than the average interest rate on Euribor-linked housing loans. In January 2025, 3.6% of new housing loans had a fixed interest rate, and their average interest rate was almost equal to the average interest rate on Euribor-linked housing loans. In January 2025, the fixing period of fixed interest rates was over 10 years for about 34% of the whole new lending volume, with the rest having a shorter period. The interest rate fixing period refers to the period during which the interest rate cannot change.

Loans

At the end of January 2025, the housing loan stock totalled EUR 105.6 billion, and its year-on-year growth amounted to -0.6%. Buy-to-let housing loans accounted for EUR 8.8 billion of the housing loan stock. At the end of January, Finnish households’ loan stock included EUR 17.7 billion of consumer credit and EUR 17.6 billion of other loans.

Drawdowns of new loans[4] by Finnish non-financial corporations in January amounted to EUR 2.4 billion, with loans to housing corporations accounting for EUR 530 million. The average interest rate on new corporate-loan drawdowns rose slightly from December, to 4.27%. At the end of January, the stock of loans granted to Finnish non-financial corporations stood at EUR 106.4 billion, including EUR 45.2 billion of housing corporation loans.

Deposits

At the end of January 2025, Finnish households’ aggregate deposit stock totalled EUR 111.2 billion, and the average interest rate on these deposits was 1.16%. Overnight deposits accounted for EUR 67.6 billion and deposits with agreed maturity for EUR 15.0 billion of the total deposit stock. In January, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 1.2 billion, at an average interest rate of 2.66%.

Loans and deposits to Finland, preliminary data* |

|||||

| November, EUR million | December, EUR million | January, EUR million | January, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 141,218 | 140,962 | 140,906 | -0.4 | 4.06 |

| - of which housing loans | 106,019 | 105,760 | 105,626 | -0.6 | 3.49 |

| - of which buy-to-let mortgages | 8,786 | 8,809 | 8,820 | 3.63 | |

| Loans to non-financial corporations2, stock | 107,885 | 106,384 | 106,443 | -0.3 | 3.96 |

| Deposits by households, stock | 110,974 | 110,152 | 111,175 | 2.7 | 1.16 |

| Households' new drawdowns of housing loans | 1,313 | 1,140 | 1,002 | 3.20 | |

| - of which buy-to-let mortgages | 124 | 124 | 104 | 3.31 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

The next news release on money and banking statistics will be published at 10:00 on 28 March 2025.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics/.

[1] Owner-occupied and buy-to-let mortgages.

[2] The prevalence of the various Euribor rates and other rates as reference rates for housing loans may also depend on the availability of these reference rates by banks.

[3] Some banks have ceased to provide their own reference rates due to their low demand.

[4] Excl. overdrafts and credit card credit.