Deposits continue to be households' most favoured financial assets

Households' financial assets in the third quarter of 2007 increased to EUR 156.3 billion, up 10.7% from a year earlier. Financial assets were boosted by both net investments and favourable valuation changes in investments. This information is evident from the Bank of Finland's quarterly financial accounts data, which describe the financial assets and liabilities of the various sectors of the national economy.1)

Households' financial assets in the third quarter of 2007 increased to EUR 156.3 billion, up 10.7% from a year earlier. Financial assets were boosted by both net investments and favourable valuation changes in investments. This information is evident from the Bank of Finland's quarterly financial accounts data, which describe the financial assets and liabilities of the various sectors of the national economy.1)

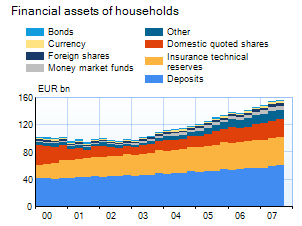

In the third quarter of 2007, the bulk of household investments were placed in fixed-term deposits and deposits redeemable at notice. The combined stock of these deposits grew by EUR 2.1 billion, on annualised terms by as much as 37%. Deposits have also retained their position as households' main financial asset item, accounting for 38.3% of total financial assets. Coming next were insurance technical reserves, followed by quoted shares, accounting for 26.7% and 19.1% of the total, respectively. The stock of households' investments in mutual fund shares in the third quarter of 2007 declined by 1.9%, mainly due to increased redemptions.

Households' loan-based liabilities expanded to EUR 84.8 billion, a 12.2% higher outcome than a year ago. Given that monetary financial institutions (MFIs) extend as much as 98% of household loans, the Bank of Finland's monthly MFI balance sheet statistics provide a highly comprehensive analysis of household indebtedness.

1) Data excludes unquoted shares and other equity, and other accounts receivable. Shares in housing corporations are also excluded from financial assets.

Further information:

Eero Savolainen, tel. +358 10 831 2235, email:forname.lastname@bof.fi

Ismo Muhonen, tel. +358 10 831 2411, email:forname.lastname@bof.fi