Low interest rates are channelling fund investments increasingly into non-financial corporations

|

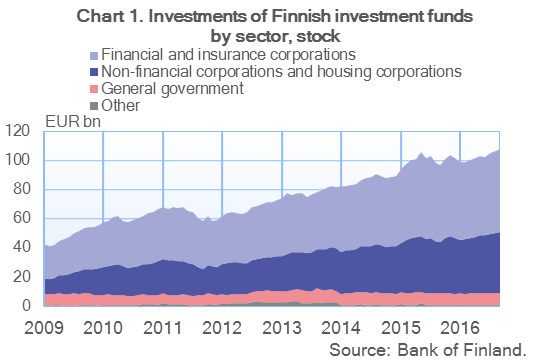

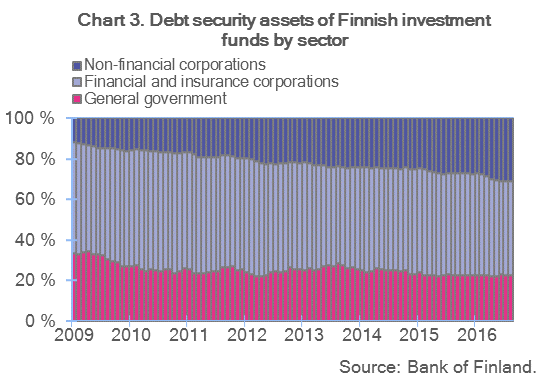

Lower interest income has decreased the relative attractiveness of fund investments in general government entities and increased the relative attractiveness of fund investments in non-financial corporations in Finland. In 2008, about 20% of Finnish investment funds’ assets were in general government entities (mainly government bonds), but by the end of September 2016 their share had decreased to below 8%. At the same time, investment funds have attracted considerable amounts of new capital, and the share of investment funds’ investments in non-financial corporations has increased from 25% to about 40% (Chart 1). The majority of investment funds’ investments are targeted at financial and insurance corporations. About half of these investments are in other investment funds. Most of these investments in recent years have been to funds investing in equities and corporate loans. The corporate sectors in which Finnish investment funds have invested most are the manufacturing and the information and communications sectors. About 30% of Finnish investment funds’ corporate investments are targeted at domestic non-financial corporations. Large inflows of new capital in investment

funds in recent months At the end of September 2016, the value of Finnish investment funds’ fund capital was EUR 104 bn.

New investments boosted fund capital in July–September by about EUR 2.4 bn, on net (2.5%). Of these investments, the largest share was by households. |

|

|

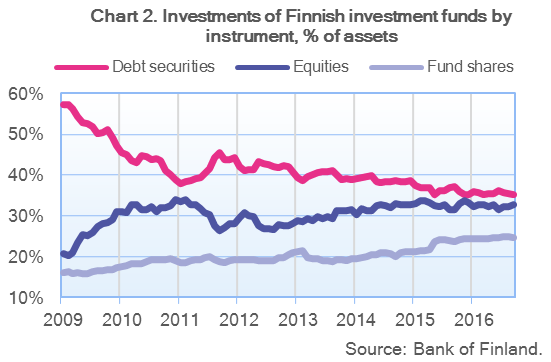

Equity funds collected the largest inflows of new capital, attracting EUR 1.1 bn. However, almost half of this was due to a single fund merger, in which a Swedish fund was merged with a Finnish fund. Investments in bond funds totalled EUR 0.8 bn, on net. These investments went primarily to debt securities issued by financial institutions and non-financial corporations. Besides new investments, the fund capital of Finnish investment funds increased in July–September by EUR 2.9 bn (2.9%) on account of the rising values of equities and debt securities. |

|

Key statistical data on investment funds registered in Finland, preliminary data |

|

For further information, please contact

Topias Leino, tel. +358 10 831 2315, email: topias.leino(at)bof.fi. The next investment fund news release will be published at 1 pm on 31 January 2017. |