Households' net financial assets dropped to spring-2005 level

The turbulence on the financial markets affected households' investment decisions in the second quarter of 2008, with households adding to their deposits and selling mutual fund shares on net. Households' deposits grew in April–June by as much as EUR 3.1 bn, the bulk of which went into fixed-term deposits. Households have moved exceptionally large amounts of funds into deposits, EUR 9.4 bn in the last 12 months.

In contrast, households' net redemptions of mutual fund shares (EUR 0.7 bn) were only half of the total recorded for the previous quarter. In the period from July 2007 to June 2008 households' net redemptions of mutual fund shares amounted to EUR 3.4 bn. Holding losses of EUR 1.9 bn also reduced the value of holdings.

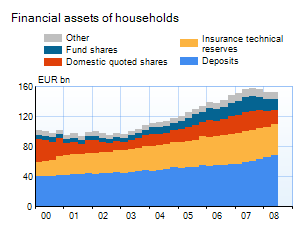

The value of households' direct shareholdings declined in the second quarter by EUR 3.5 bn, mainly due to the fall in share prices, while the value of insurance investment remained virtually unchanged.

Household's financial assets1 declined in April–June 2008 by EUR 0.8 bn owing to the declining value of high-risk financial assets. Financial assets amounted to EUR 151.42 bn at end-June, which was EUR 5.3 bn (3.4%) lower than a year earlier. In contrast, households' loan-based liabilities continued to grow steadily, reaching EUR 90.9 bn, 10.5% higher than a year earlier.

Owing to shrinking financial assets and expanding liabilities, households' net financial assets continued on the declining trend that started in summer 2007. In June 2008 net financial assets totalled EUR 60.5 bn, which was EUR 13.9 bn (18.7%) less than a year earlier. Households' net financial assets have not been at such a low level since March 2005.

The above information has been excerpted from the quarterly financial accounts statistics compiled by the Bank of Finland. These provide an overview of the stocks of financial assets and liabilities of the different sectors of the national economy and of the related transaction flows.

1) Data excludes unquoted shares and other equity, and other accounts receivable. Shares in housing corporations are also excluded from financial assets.

2) Data on households' bond holdings were revised upwards, with the introduction of a new data source. The revision for June 2008 totalled EUR 2.3 billion. The revisions go back to the first half of 2004.

Further information:

Eero Savolainen, tel. +358 10 831 2235, email:forname.lastname@bof.fi