Households incur debt via housing corporations

In June 2016, drawdowns of new loans by housing corporations1 (excl. overdrafts and credit card credit) amounted to EUR 690 million, which is a record amount since 2010.2 Although housing corporations are included in the corporate sector in the statistics on monetary financial institutions (MFIs), in practice households are responsible for a portion of the loans of housing corporations. Households pay off their housing corporation loan liabilities in the form of a regular funding charge. According to calculations by Statistics Finland, households' share of the corporate loans of housing companies amounted to EUR 15.2 bn in March 2016. The stock of loans granted by MFIs to housing corporations totalled EUR 24.4 bn in June 2016 (EUR 23.8 bn in March 2016). |

|

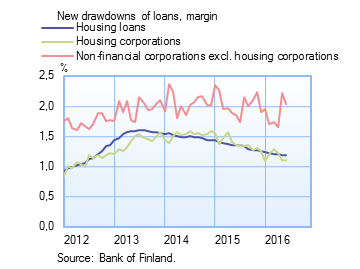

The stock of housing corporation loans attributable to households has nearly tripled in the last 10 years. The annual increase in such loans (12% in March 2016) clearly exceeded the annual increase in households' housing loans (2.5% in March 2016). Housing corporation loans are mainly drawn down in order to finance renovation work and new housing. The average interest rate on new housing corporation loans was 1.13 %, of which the margin accounted for 1.11%. The margin on housing corporation loans was slightly narrower than that on new housing loans and clearly smaller than the margin on new corporate loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 2.8 bn in June 2016. The average interest rate on the drawdowns fell to 1.59%. At the end of June, the stock of euro-denominated loans to non-financial corporations was EUR 74.3 bn, of which loans to housing corporations accounted for EUR 24.4 bn. |

Deposits At end-June, household deposits totalled EUR 84.2 bn, and the average interest rate on these deposits was 0.22%. Overnight deposits accounted for EUR 59.9 bn and deposits with agreed maturity for EUR 9.7 bn of the total deposit stock.- In June, households concluded EUR 0.4 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.61%. Notes: |

Key figures of Finnish MFIs' loans and deposits, preliminary data

| February, EUR million | March, EUR million | April, EUR million | April, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 122,718 | 123,009 | 123,566 | 2,8 | 1,63 |

| - of which housing loans | 92,471 | 92,707 | 93,087 | 2,7 | 1,14 |

| Loans to non-financial corporations2, stock | 73,551 | 73,665 | 74,261 | 4,5 | 1,54 |

| Deposits by households2, stock | 83,664 | 83,241 | 84,151 | 2,7 | 0,22 |

| Households' new drawdowns of housing loans | 1,608 | 1,748 | 1,805 | 1,20 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

1 Housing corporations include all corporate forms of housing units: housing companies, housing cooperatives, residential real estate companies, right of occupancy associations and other housing corporations as well as companies engaged in renting, ownership and management of housing (excl. management of real estate on a fee or contract basis).

2 Statistical information on housing corporations' drawdowns of loans has been collected since June 2010.

For further information, please contact:

Markus Aaltonen, tel. +358 10 831 2395, email: markus.aaltonen(at)bof.fi,

Johanna Honkanen, tel. +358 10 831 2992, email: johanna.honkanen(at)bof.fi

The next news release will be published at 1 pm on 31 August 2016.

http://www.suomenpankki.fi/link/2331b6266da3492f832ec75e0f654bd9.aspx?epslanguage=en.