Liquidity of the banking system

The balance sheet of the central bank and its composition are of key importance for the liquidity of the entire banking system and the implementation of monetary policy. The amount of liquidity has an impact on how money market rates track the different policy rates of the ECB. The Eurosystem forecasts the development of all balance sheet items as part of the liquidity management process.

Central bank balance sheet

The Eurosystem is the sole supplier of the euro-denominated monetary base, which consists of cash and bank reserves with the central bank (central bank money). These always remain on the balance sheet of the central bank – cash held by the public and banks’ central bank deposits constitute the bulk of the liability side of the central bank’s balance sheet.

The central bank’s assets consist of credit granted to credit institutions in monetary policy operations, securities held for monetary policy purposes and the central bank’s own investment assets, including foreign reserves. The balance sheet of the central bank and its composition are of key importance for the liquidity of the entire banking system and the implementation of monetary policy.

Banks need central bank money

The liquidity of the banking system is determined on the basis of the supply and demand for central bank money. Banks need central bank money to meet their liquidity needs, which primarily consist of the minimum reserve requirements, banknotes and preparations for sudden payment needs. The minimum reserve requirements can only be met by depositing reserves with the central bank. Demand for central bank money is also driven by growth in the stock of banknotes, since banks have to redeem the cash from the central banks.

Central bank money is primarily supplied through monetary policy credit operations and monetary policy purchases of securities. Liquidity in the banking system is also boosted by growth in central banks’ own investment assets.

In addition to the most significant items, the supply and demand for liquidity also reflects changes in other autonomous factors. ‘Autonomous factors’ refer to items on the central bank’s balance sheet which have an impact on the liquidity of the banking system but cannot be directly influenced by the implementation of monetary policy (e.g. banknotes, government deposits with the central bank, central banks’ own investment portfolios). ‘Other autonomous factors’ include revaluation accounts and changes in central banks’ capital and reserves. The Eurosystem forecasts the development of all balance sheet items as part of the liquidity management process.

Simplified balance sheet of the Eurosystem |

|

| Assets (liquidity supply) | Liabilities (liquidity demand) |

| Monetary policy credit to banks | Credit institutions’ deposits with the central bank |

| Marginal lending facility | Overnight deposits |

| Monetary policy securities purchases | Cash |

| Investment assets | Other autonomous factors (net) |

Management of liquidity in the banking system

The monetary policy of the Eurosystem has been conducted in an environment of excess liquidity as monetary policy securities purchases have increased the amount of excess liquidity significantly above the banking system’s reserve requirements and payment needs. In a regime of ample liquidity, the amount of liquidity is not actively regulated. As the existing holdings of monetary policy securities gradually mature, the amount of excess liquidity will gradually decrease. Excess liquidity will not be allowed to shrink indefinitely, however. Instead, the Eurosystem will use credit operations and a structural portfolio of securities to maintain a high level of liquidity in the banking system. In an environment of ample liquidity, the interest rate on the deposit facility – the interest paid on excess liquidity holdings – is the key policy rate for steering market interest rates.

Minimum reserve requirements are to be met over a period of 6–7 weeks, i.e. the reserve maintenance period. The system is based on the averaging of reserve holdings over the maintenance period (‘averaging provision’), meaning banks can meet their reserve requirements flexibly as the maintenance period progresses.

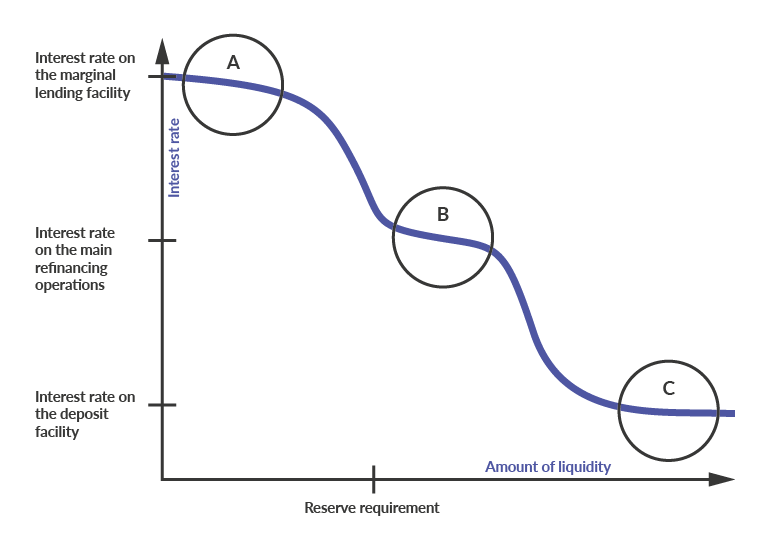

Banks also trade with each other in central bank money. In a regime where interest rates are steered based on the averaging of reserve holdings, one can identify three liquidity situations where short-term interest rates evolve in a stable manner, and two situations where interest rates are more sensitive to changes in the amount of liquidity (see chart).

If it is highly likely that the amount of central bank money will be so low that banks will have to resort to the marginal lending facility, the interbank money market rate will rise very close to the interest rate on the marginal lending facility (area A in the chart). Correspondingly, when there is a very high liquidity surplus, banks will have to make overnight deposits with the central bank and the interbank rate will sink close to the deposit facility rate (area C). The third situation where the interest rate will show minimum elasticity to changes in liquidity is when market interest rates are close to the interest rate on the main refinancing operations (MROs) (area B). The ECB has decided to keep the amount of liquidity in the banking system at a sufficiently high level so that the interbank rate remains close to the deposit facility rate (area C). The decision to reduce the spread between the MRO rate and deposit facility rate (narrow interest rate corridor) as of September 2024 will also reduce the sensitivity of interest rates to changes in liquidity.

Before the global financial crisis, the Eurosystem conducted monetary policy by steering short-term market rates close to MRO rate by adjusting the amount of liquidity offered in the market operations in accordance with the prevailing situation (area B). Since the global financial crisis, the amount of liquidity in the banking system has risen to a high level due to the fixed rate full allotment (FRFA) tender policy, the longer-term refinancing operations and securities purchases. As a consequence, short-term money market rates such as the unsecured overnight rate €STR (replaced EONIA, published as of 2 October 2019) have been close to the deposit facility rate (area C). With the maturing of monetary policy securities holdings, excess liquidity in the Eurosystem will decrease from the previous peak levels. As liquidity is shrinking towards levels where interest rates are sensitive to liquidity changes (area B), the Eurosystem will use structural credit operations and securities purchase programmes to ensure that liquidity remains at a sufficiently ample level. This will ensure that short-term money market rates remain in the vicinity of the deposit facility rate (area C).