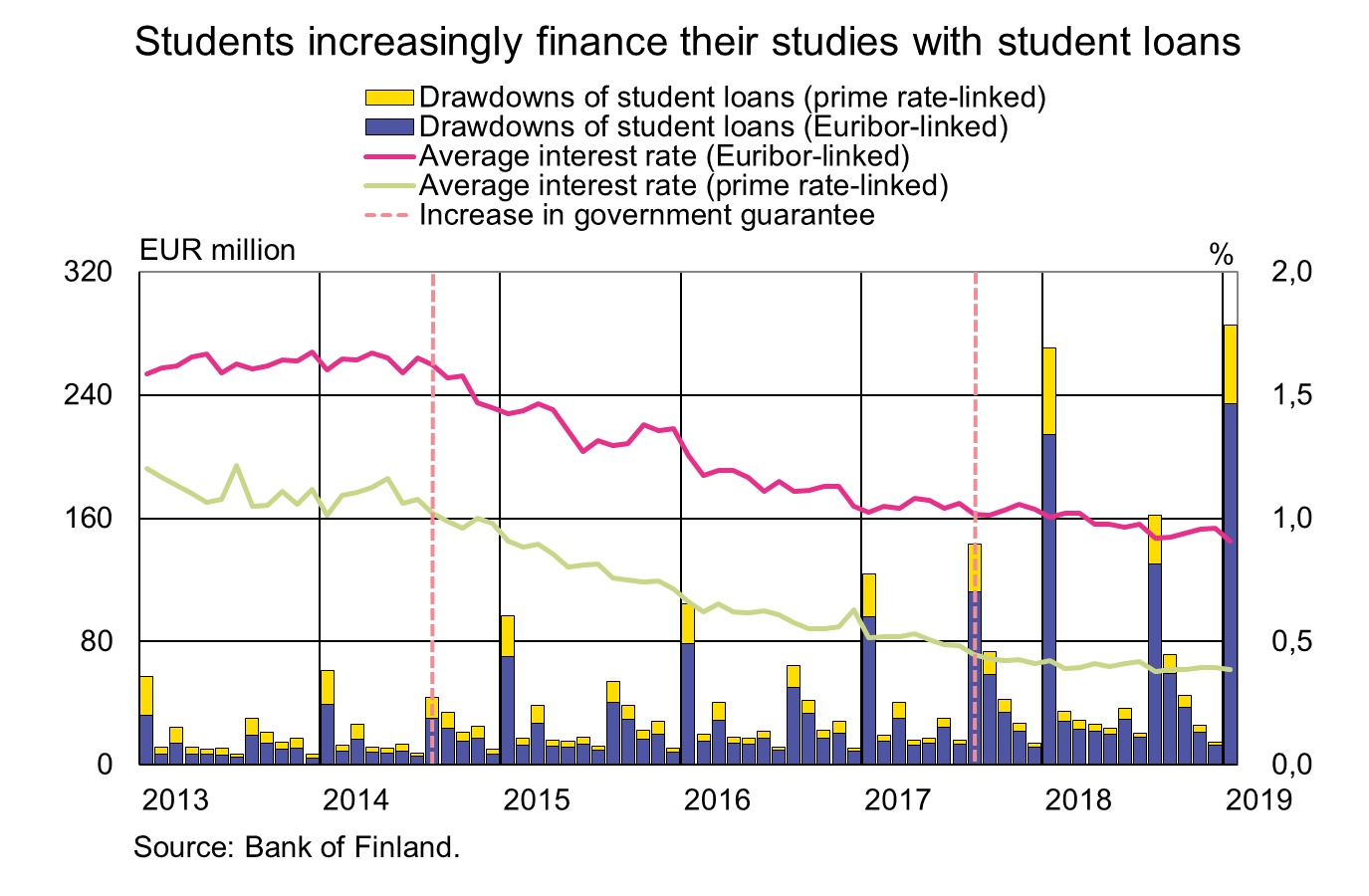

Student loan drawdowns record high in January

In January 20191, drawdowns of student loans amounted to EUR 285 million, which is EUR 15 million more than in the corresponding period a year earlier and also more than ever before. The average interest rate on student loans drawn down in January 2019 was 0.48%. Of the new loans, 82% were linked to Euribor rates and 18% to prime rates. The average interest rate on Euribor-linked loans was 0.39%, while that on prime rate-linked loans was 0.91%. Student loans are linked to banks’ own reference rates considerably more often than other household loans.

The stock of student loans reached a new record at the end of January 2019, totalling EUR 3.6 bn. The student loan stock has grown at a brisk pace since the student financial aid reform of August 2017. Since the reform, the stock has expanded by as much as EUR 1.1 bn. In January 2019, the growth rate of the stock was 20.2%.

Growth in the student loan stock does not stem solely from higher loan amounts granted as a result of the student financial aid reform. The number of persons taking out a student loan has also increased, which has been reflected in recent years as a notable increase in the total number of persons with outstanding student loan debt. According to the statistics of the Social Insurance Institution of Finland (Kela), there were already over 400,000 persons with outstanding student loan debt in the academic year 2017–2018, as opposed to 354,735 two years earlier.

Loans

Households’ new drawdowns of housing loans in January 2019 amounted to EUR 1.3 bn, roughly the same as in the corresponding period a year earlier. The average interest rate on new housing-loan drawdowns declined from December, to 0.83%. At the end of January 2019, the stock of euro-denominated housing loans totalled EUR 97.9 bn and the annual growth rate of the stock was 2.0%. Household credit at end-January comprised EUR 15.8 bn in consumer credit and EUR 17.2 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in January to EUR 2.0 bn. The average interest rate on new corporate-loan drawdowns declined from December, to 2.00%. At the end of January, the stock of euro-denominated loans to non-financial corporations was EUR 85.4 bn, of which loans to housing corporations accounted for EUR 32.4 bn.

Deposits

The stock of household deposits at end-January totalled EUR 89.8 bn and the average interest rate on the deposits was 0.12%. Overnight deposits accounted for EUR 76.6 bn and deposits with agreed maturity for EUR 5.3 bn of the deposit stock. In January, households concluded EUR 0.3 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.31%.

1Students could withdraw the spring term portion of the loan in January.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| November, EUR million | December, EUR million | January, EUR million | January, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 130,855 | 130,745 | 130,912 | 2,4 | 1,48 |

| - of which housing loans | 97,759 | 97,781 | 97,885 | 2,0 | 0,97 |

| Loans to non-financial corporations2, stock | 85,496 | 85,320 | 85,390 | 7,7 | 1,35 |

| Deposits by households2, stock | 91,172 | 92,785 | 93,478 | 7,4 | 0,11 |

| Households' new drawdowns of housing loans | 1,613 | 1,239 | 1,303 | 0,83 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi

The next news release will be published at 1 pm on 1 April 2019.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.