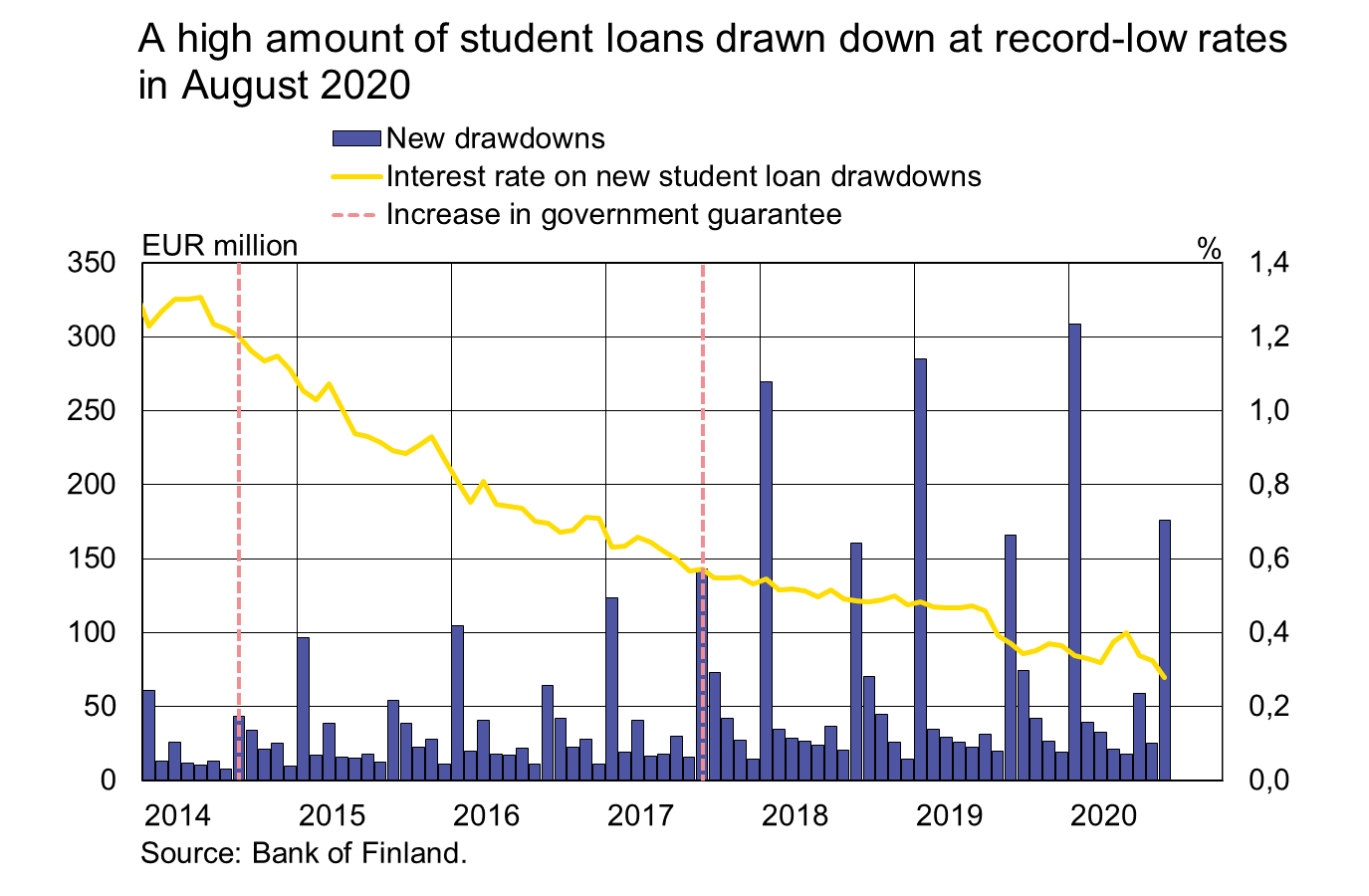

A high amount of student loans drawn down at record-low rates in August 2020

Drawdowns of student loans in August 2020[1] totalled EUR 176 million, an increase of 6% on August a year earlier. The average interest rate on student loan drawdowns was record low in August, at 0.28%. Thanks to government guarantees, student loans pose a low risk for banks, which is reflected in the low margins on these loans.

The impact of the coronavirus crisis was particularly evident in drawdowns of student loans in June 2020: the total amount taken out was EUR 59 million, almost twice the amount compared with June a year earlier. One of the factors explaining this increase could be that there have been fewer summer jobs available during the coronavirus crisis. In addition to the greater popularity on student financial aid for the summer, many students may also have taken out their student loan for the academic year 2019–2020 as late as June this year. This was also the first time when most of the summer aid recipients could take out their student loan instalment for the autumn term already in June, which contributed to reducing the amounts drawn down in August more than in previous years. In summer 2020, student loan drawdowns were 20% higher than in the corresponding period a year earlier.

Fuelled by the high amount of drawdowns in the summer, the stock of student loans grew to EUR 4.5 bn in August 2020. The annual growth rate of the student loan stock was still brisk in August (16.1%), even though it has moderated over the past two years. Since the student financial aid reform of 2017, the student loan stock has grown by EUR 2 bn. This growth stems not only from larger loans granted as a result of the reform, but also from a higher number of borrowers, which in turn partly reflects the low level of interest rates.

Despite the brisk growth in the student loan stock, the stock of claims on government guarantees[2] contracted slightly in 2019. The repayment of student loans usually begins after the completion of studies, and the interest is capitalised as long as a student receives financial aid. Hence, any problems with loan repayment may be reflected in the stock of claims on government guarantees with a delay.

Loans

Households’ drawdowns of new housing loans in August 2020 amounted to EUR 1.7 bn, the same as in August a year earlier. At the end of August 2020, the stock of euro-denominated housing loans totalled EUR 102.1 bn and the annual growth rate of the stock was 2.7%. Household credit at end-August comprised EUR 16.8 bn in consumer credit and EUR 18.2 bn in other loans.

Drawdowns of new loans by non-financial corporations (excl. overdrafts and credit card credit) in August amounted to EUR 1.5 bn. The average interest rate on new corporate loan drawdowns declined from July, to 1.77%. The stock of euro-denominated corporate loans at end-August totalled EUR 97.4 bn, of which loans to housing corporations accounted for EUR 36.7 bn.

Deposits

The stock of Finnish households’ deposits at end-August 2020 amounted to EUR 101.4 bn and the average interest rate on the deposits was 0.07%. Overnight deposits accounted for EUR 88.8 bn and deposits with an agreed maturity for EUR 4.3 bn of the deposit stock. In August, households concluded EUR 450 million of new agreements on deposits with an agreed maturity, at an average interest rate of 0.07%.

Key figures of Finnish MFIs' loans and deposits, preliminary data |

|||||

| June, EUR million | July, EUR million | August, EUR million | August, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 136,068 | 136,586 | 137,055 | 3,0 | 1,41 |

| - of which housing loans | 101,488 | 101,757 | 102,074 | 2,7 | 0,87 |

| Loans to non-financial corporations2, stock | 96,941 | 97,037 | 97,412 | 10,2 | 1,31 |

| Deposits by households2, stock | 104,768 | 105,290 | 105,707 | 7,5 | 0,07 |

| Households' new drawdowns of housing loans | 1,827 | 1,703 | 1,653 | 0,73 | |

* Includes euro-denominated loans and deposits to euro area.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi

The next news release will be published at 1 pm on 30 October 2020.

[1] The instalment for the autumn term could be taken out starting 1 August 2020.

[2] Claims on government guarantees are loan amounts which Kela (Social Insurance Institution of Finland) has repaid to banks in its capacity as the guarantor of student loans and which it later collects from students. In 2019, the stock of claims on government guarantees amounted to EUR 113.3 million.