Growth of fund capital stock slowed down by large redemptions in Q3

Investors repatriated their assets heavily from investment funds in the third quarter of 2018, over EUR 1.1 billion in net terms. This was the most since the second quarter of 2010, when redemptions from funds exceeded EUR 1.6 billion. Due to the large redemptions, growth of the fund capital of investment funds slowed down and the stock grew by EUR 0.6 billion in the third quarter (0.5%). The growth of the stock is explained by positive valuation changes. At the end of September 2018, the aggregate value of the fund capital stood at EUR 122 billion.

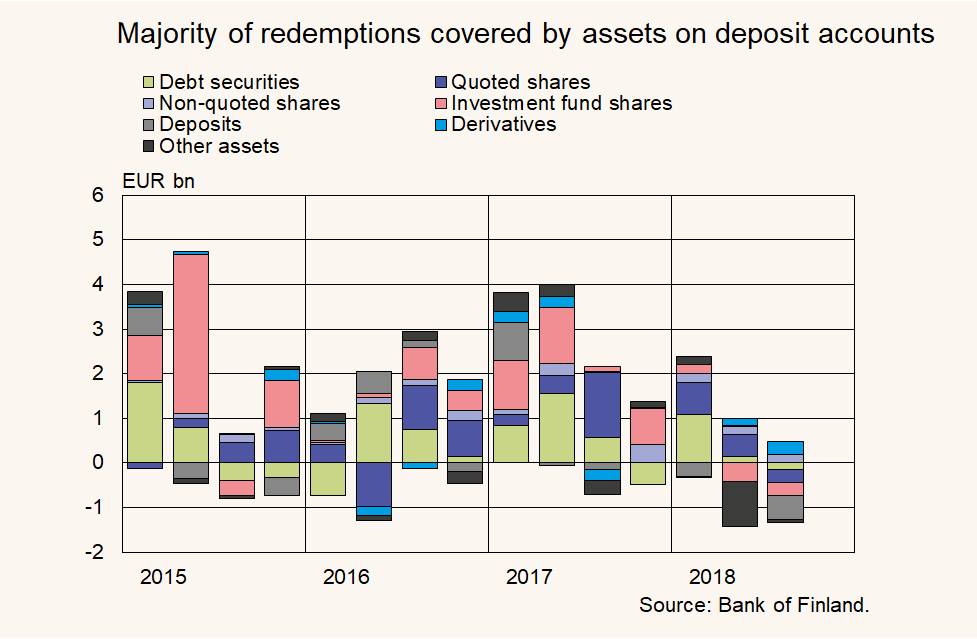

When investors redeem their units in a fund, the fund must either sell its investments or pay the redemptions out of assets on their bank accounts. The majority (62%) of redemptions in the third quarter of 2018 was covered by reducing assets on deposit accounts (EUR 0.5 bn in net terms).

Investment funds also significantly reduced their investments in other asset classes – only derivatives contracts and non-quoted shares saw positive net investments.

Cross-holdings between funds have decreased

The large redemptions in the third quarter are explained to a significant degree by a reduction in cross-holdings between Finnish funds: the investments of domestic funds in other domestic funds decreased in net terms by EUR 0.8 bn. At the end of September 2018, cross-holdings amounted to EUR 19.9 bn, accounting for approximately 16% of the stock of fund capital. In addition, general government and insurance institutions redeemed their assets from funds to a significant degree in the third quarter, a total of EUR 0.7 bn in net terms. At the same time, households' fund investments increased by EUR 0.3 bn. The largest redemptions were made from equity funds, whereas real estate funds remained in favour and had net investments of EUR 0.2 billion.

Key statistical data on investment funds registered in Finland, preliminary data

- Breakdown of investment funds’ fund-share liability by sector of holder

- Securities-based assets of investment funds by area

- Securities-based assets of investment funds by instrument, area and sector

For further information please contact:

Juuso Koppanen, tel. +358 9 183 2257, email: juuso.koppanen@bof.fi

Anne Turkkila, tel. +358 9 183 2175, email: anne.turkkila@bof.fi

The next investment fund news release will be published at 1 pm on 1 February 2019.