Upturn in households’ financial assets in April–June 2009

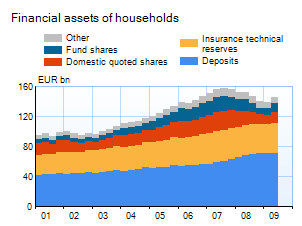

Households’ financial assets1 increased in April–June 2009 by a total of EUR 7.7 billion. Three quarters of the growth was attributable to higher prices of high-risk financial assets. However, at EUR 145.8 billion in June 2009, households’ financial assets were EUR 5.5 billion or 3.7% lower than a year earlier.

Despite continued moderation of the annual growth in households’ loan-based liabilities, the stock of loans (EUR 95.6 billion) was 5.2% higher than in June 2008. However, owing to growth in financial assets, the contraction of households’ net financial assets, ongoing since summer 2007, came to a halt. Nonetheless, net financial assets fell by EUR 10.3 billion (17.0%) from a year earlier, to EUR 50.2 billion in June 2009.

Over the course of the financial market crisis, households have transferred a substantial amount of money from fund shares to deposits. This trend was reversed already in the first quarter of the year. In April–June 2009, households’ net subscriptions of fund shares totalled EUR 0.7 billion and their deposit holdings increased by EUR 0.4 billion.

The stock of corporate loans (excl. loans between Finnish non-financial corporations) amounted to EUR 99.1 billion in the second quarter of 2009, up by EUR 14.2 billion from a year earlier. The stock of debt securities issued by non-financial corporations totalled EUR 25.6 billion, up by EUR 2.7 billion on the corresponding quarter in 2008. Aggregate debt financing grew at an annual rate of 15.7%.

Non-financial corporations’ listed share-based liabilities increased rapidly in the second quarter of 2009, along with the increase in share prices: in June 2009 they were EUR 105.6 billion, which is still 34.7% less than in June 2008.

The above information has been excerpted from the quarterly financial accounts statistics compiled by the Bank of Finland. These provide an overview of the stocks of financial assets and liabilities of the different sectors of the national economy and of the related transaction flows.

1)Data excludes unquoted shares and other equity, and other accounts receivable. Shares in housing corporations are also excluded from financial assets.

More information:

Hanna Häkkinen, tel. +358 10 831 2552, email: firstname.surname@bof.fi