Drawdowns of unsecured consumer credit higher in July than a year earlier

In July 2020, drawdowns of unsecured consumer credit (excl. overdrafts and credit card credit) amounted to EUR 302 million, a slight increase on July a year earlier. This was the second-highest monthly amount in the 10-year history of the statistical series.

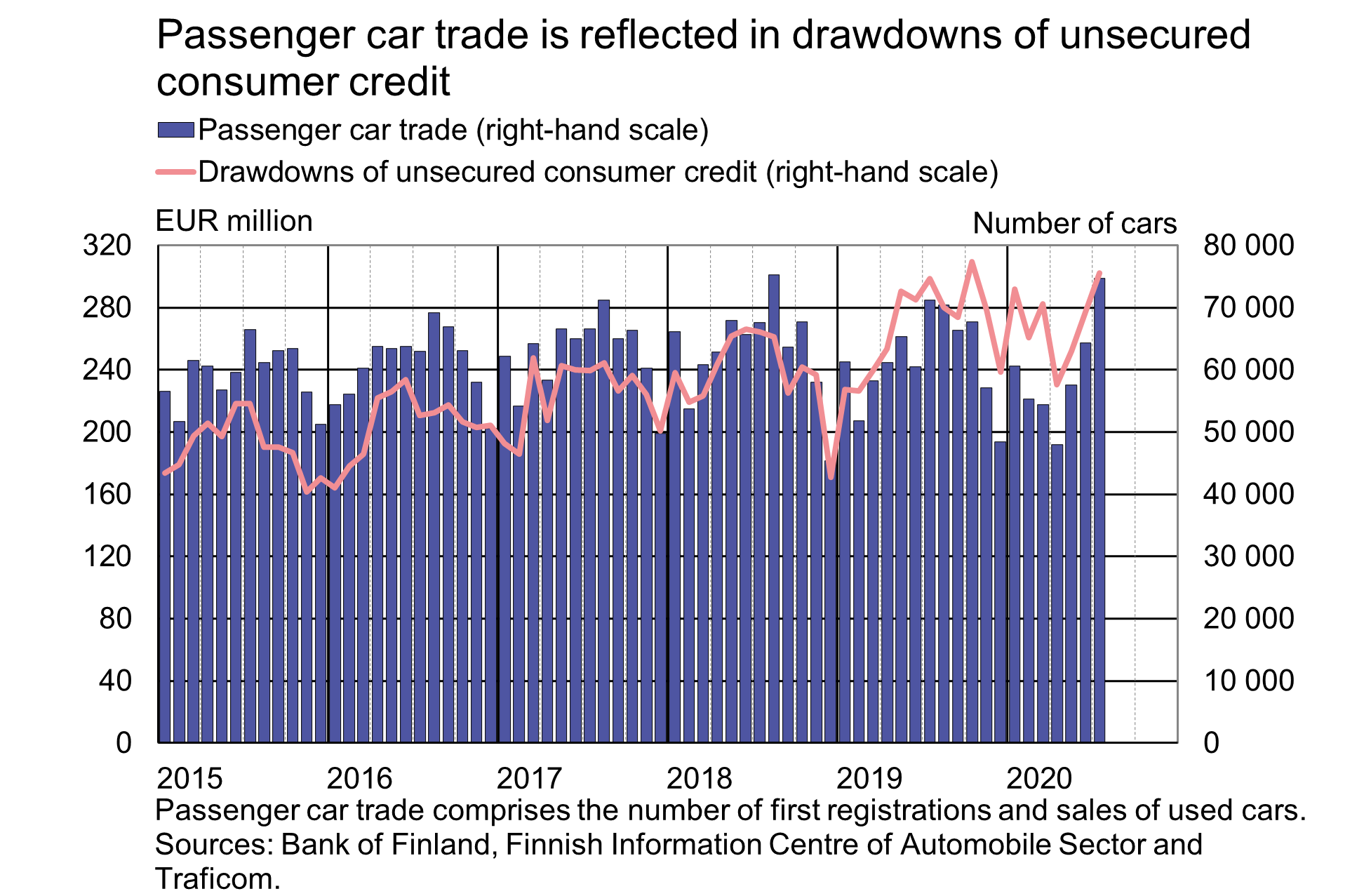

The amounts of unsecured consumer credit drawn down decreased during the coronavirus-related exceptional circumstances, but the recovery has been rapid. Consumer confidence and willingness to purchase durables are partly reflected in the demand for unsecured consumer credit. Some of the fluctuation in unsecured consumer credit drawdowns appears to be due to developments in passenger car trade[1], but there is also a longer-term upward trend visible in these drawdowns.

At the beginning of July 2020, a temporary 10% interest rate cap on certain consumer credits became effective in Finland. In July, the average interest rate on unsecured consumer credit drawn down from credit institutions operating in Finland was 5.67%. The July average rate was the lowest for the year, but not exceptionally low. Interest rates have last been equally low in May 2019.

The stock of consumer credit of credit institutions operating in Finland amounted in July 2020 to EUR 16.7 bn. Of this, unsecured consumer credit totalled EUR 6.4 bn, secured consumer credit EUR 5.9 bn and overdrafts and credit card credit EUR 4.4 bn. These consumer credits account for about 70% of households’ total consumer credits.

Loans

Households’ drawdowns of new housing loans in July 2020 amounted to EUR 1.7 bn, an increase of EUR 31 million on the same month a year earlier. At the end of July, the stock of euro-denominated housing loans totalled EUR 101.8 bn and the annual growth rate of the stock was 2.8%. Household credit at end-July comprised EUR 16.7 bn in consumer credit and EUR 18.1 bn in other loans.

Drawdowns of new loans to non-financial corporations (excl. overdrafts and credit card credit) in July amounted to EUR 1.2 bn. The average interest rate on new corporate loan drawdowns rose from June, to 2.22%. The stock of euro-denominated corporate loans at end-July totalled EUR 97.0 bn, of which loans to housing corporations accounted for EUR 36.5 bn.

Deposits

The stock of Finnish households’ deposits at end-July 2020 totalled EUR 101.0 bn and the average interest rate on the deposits was 0.07%. Overnight deposits accounted for EUR 88.7 bn and deposits with an agreed maturity for EUR 4.0 bn of the deposit stock. In July, households concluded EUR 139 million of new agreements on deposits with an agreed maturity, at an average interest rate of 0.17%.

Key figures of Finnish MFIs' loans and deposits, preliminary data |

|||||

| May, EUR million | June, EUR million | July, EUR million | July, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 135,590 | 136,068 | 136,586 | 3,2 | 1,42 |

| - of which housing loans | 101,152 | 101,488 | 101,757 | 2,8 | 0,88 |

| Loans to non-financial corporations2, stock | 97,283 | 96,941 | 97,037 | 10,7 | 1,31 |

| Deposits by households2, stock | 104,046 | 104,768 | 105,290 | 8,1 | 0,07 |

| Households' new drawdowns of housing loans | 1,489 | 1,827 | 1,703 | 0,72 | |

* Includes euro-denominated loans and deposits to euro area.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

The next news release will be published at 1 pm on 30 September 2020.

[1] For the purposes of the Bank of Finland’s statistics on monetary financial institutions, secured credit comprises loans that are secured by collateral recognised under Regulation (575/2013) of the European Parliament and of the Council on prudential requirements for credit institutions and investment firms. Passenger cars are not collateral recognised by the Regulation, and credits secured by a passenger cars are therefore regarded as unsecured.