Growth in corporate lending through crowdfunding platforms

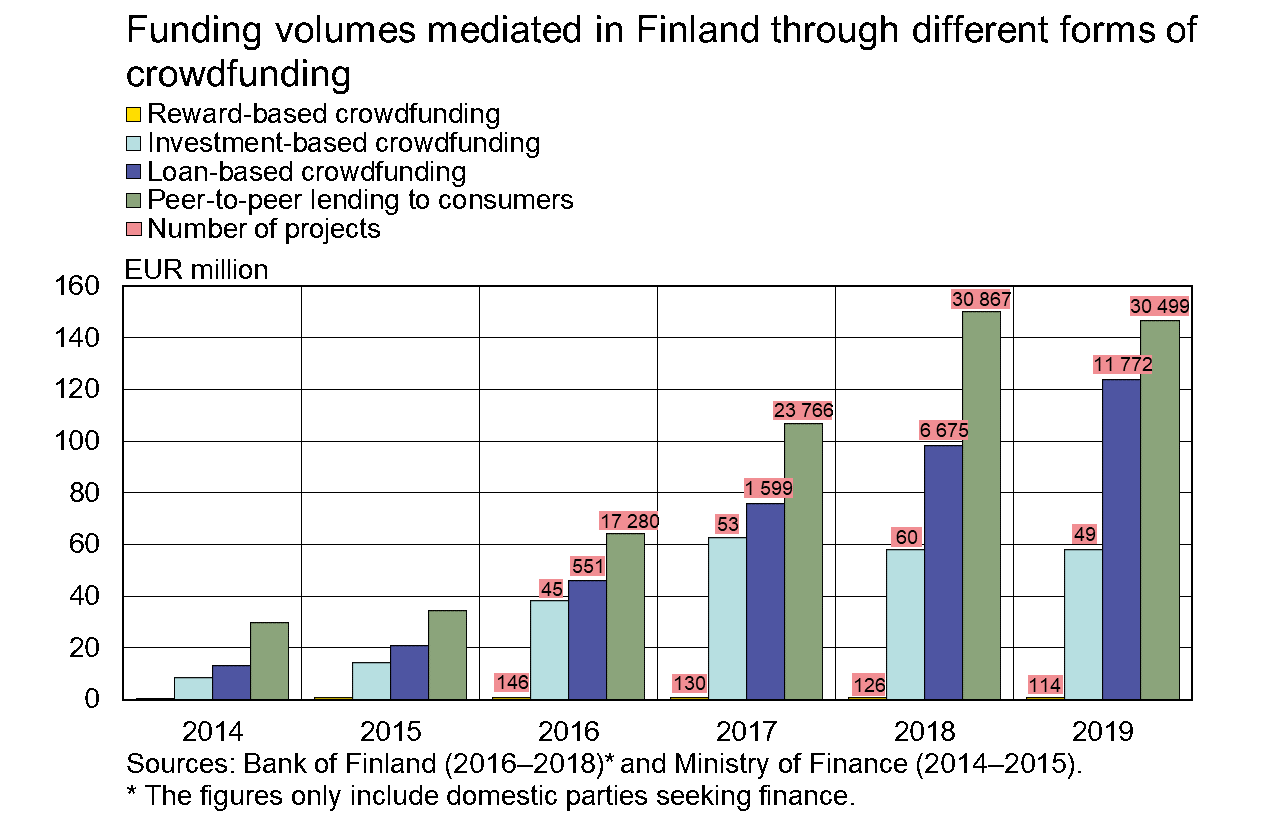

In 2019, the total funding volume mediated in the peer-to-peer and crowdfunding markets in Finland was about EUR 330 million.[1] The Finnish peer-to-peer and crowdfunding markets have continued to grow strongly, particularly in loan-based crowdfunding.

P2P lending to foreign countries increased

The volume of peer-to-peer (P2P) loans mediated has continued to grow. In 2019, the volume of P2P lending mediated to consumers amounted to EUR 160.8 million. P2P loans[2] mediated to foreign countries increased. In 2019, they amounted to EUR 11.5 million more than in 2018. The value of P2P loans mediated domestically decreased 2%, amounting to EUR 146.7 million in 2019. Although the volume of P2P loans mediated through service platforms has shown strong growth in recent years, their share in the total stock of Finnish households’ consumer credit[3] has remained low at about 1%.

Almost 38,000 successful P2P lending rounds were conducted in 2019 on service platforms. Domestic consumers conducted somewhat fewer P2P lending rounds in 2019 compared to 2018. However, the number of successful cross-border P2P lending rounds increased significantly in 2019.

The share of loan-based crowdfunding grew

In 2019, the volume of funding mediated by crowdfunding platforms[4] totalled EUR 182.5 million. The popularity of crowdfunding as a source of finance for companies has increased in recent years. However, funds raised through crowdfunding platforms only amounted to 1% of the corporate loan stock borrowed from credit institutions.

Loan-based crowdfunding is a more important source of finance for Finnish companies than investment-based[5] crowdfunding. In 2019, loan-based crowdfunding mediated to Finnish companies amounted to EUR 124.1 million, which is more than double the amount of investment-based crowdfunding raised by companies. The volume of loan-based crowdfunding was also 26% higher than in 2018.

Finnish companies conducted almost 12,000 successful loan-based crowdfunding rounds in 2019. The number of successful funding rounds almost doubled from 2018. However, the average loan size in loan-based crowdfunding continued to decrease due to the higher growth of the number of successful funding rounds relative to the total volume of loans received. The average loan size was slightly below EUR 11,000 in 2019. The reduction in loan size is primarily explained by the increasing popularity of loans mediated for factoring.

The volume of funding mediated through investment-based crowdfunding increased slightly in 2019 from 2018. The volume of investment-based crowdfunding mediated to Finnish companies in 2019 was EUR 58.3 million. The popularity of investment-based crowdfunding is limited in part by the high level of risk of the investments, the difficulty of assessing the value of the target companies and the lack of opportunities to exit the investments.

The number of successful funding rounds in investment-based crowdfunding was lower than in loan-based crowdfunding, as reflected in the higher average amount of funding raised. In 2019, the average amount of capital raised by Finnish companies through investment-based crowdfunding was EUR 1.2 million.

Of the different forms of crowdfunding, the lowest volume mediated was through reward-based crowdfunding. The volume of funding mediated through reward-based crowdfunding totalled EUR 0.8 million in 2019, up 8% from 2018.

Funding volumes mediated in Finland through different forms of crowdfunding

|

|

2017, EUR million |

2018, EUR million (12-month change) |

2019, EUR million (12-month change) |

|

Loan-based crowdfunding |

76.0 (64 %) |

98.3 (29 %) |

124.1 (26 %) |

|

Investment-based crowdfunding |

62.8 (64 %) |

58.0 (-8 %) |

58.3 (1 %) |

|

Reward-based crowdfunding |

1.0 (4%) |

0.7 (-27%) |

0.8 (8%) |

|

Peer-to-peer lending to consumers |

106.9 (67%) |

150.1 (40%) |

146.7 (-2%) |

|

Total |

246.7 (65%) |

307.2 (24%) |

329.9 (7%) |

* The figures include domestic parties seeking finance.

For further information, please contact:

Antti Alakiuttu, tel. + 358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Miska Jokinen, tel. +358 9 183 2122, email: miska.jokinen(at)bof.fi.

[1] Comprises investment-, loan- and reward-based crowdfunding as well as peer-to-peer lending to consumers. The figures only include successful projects of domestic parties seeking finance. The figures also include anchor investors and co-investors.

[2] Both in terms of value and number of contracts.

[3] Consumer credit drawn from credit institutions.

[4] Investment- and loan-based crowdfunding.

[5] Direct equity investment in a non-listed company through a crowdfunding platform.