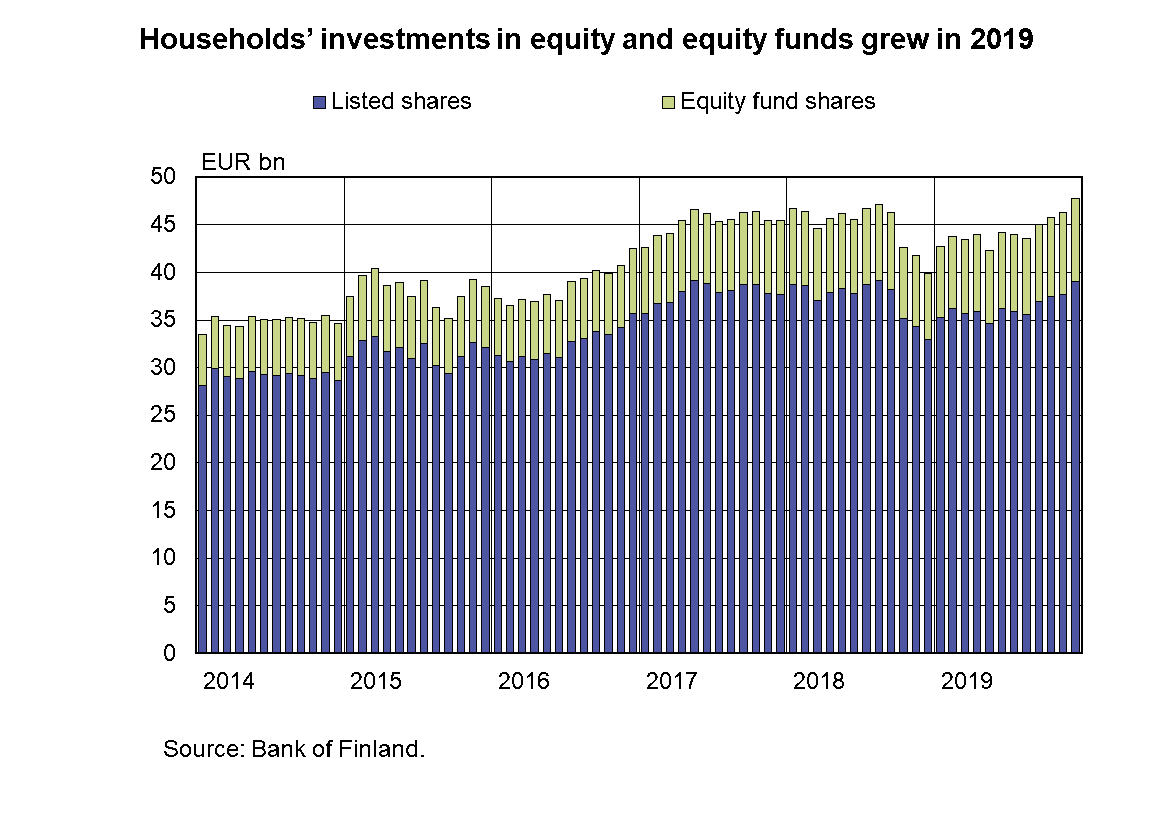

Households’ investments in equity and equity funds grew in 2019

At the end of December 2019, Finnish households owned listed shares worth EUR 39.0 billion. In 2019, the value of listed shares owned by households increased by over EUR 6 billion. The value of the shareholdings rose by EUR 5.7 billion due to positive market performance. In addition, households invested EUR 0.6 billion of new capital in net terms in equities during the year. Over 90% of the equity investments were made in domestic companies.

The largest monthly increase in households’ shareholdings in 2019 took place in January, when the holdings increased by EUR 2.3 billion. In December 2019, the value of shareholdings increased by EUR 1.4 billion and households sold more shares than they bought, in net terms EUR –0.1 billion.

In spite of the appreciation of equity investments in 2019 and the investment of new capital, households’ listed shareholdings remain at a slightly lower level than in August 2018 or May 2017, when they amounted to EUR 39.1 billion.

In addition to direct equity holdings, Finnish households have indirect holdings in listed shares through investment funds. At the end of December 2019, households held investments worth EUR 8.8 billion in equity funds1 registered in Finland. Equity fund investments increased by EUR 1.8 billion in 2019. The growth is mainly explained by positive equity market performance. In addition, households made more subscriptions to equity funds than redemptions from them in 2019, EUR 0.2 billion in net terms. Households also have indirect equity holdings for example through mixed funds. A significant proportion of households’ indirect equity holdings through investment funds are in foreign listed shares.

Households’ assets are also channelled to investment funds and thereby to shares through unit-linked insurance policies made with insurance companies. Households had an estimated EUR 10 billion invested in equity funds and EUR 0.8 billion directly in listed shares through unit-linked insurance policies.

1 UCITS funds.

Finnish deposits and investments (EUR million), 2019Q4

| All | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 189 654 | 11 015 | 39 011 | 2 279 | 29 643 | 1 739 |

| (-1 862) | (-39) | (-2 158) | ||||

| - in domestic shares | 128 672 | 7 151 | 35 655 | 2 050 | 16 646 | 1 006 |

| (653) | (-73) | (-850) | ||||

| Bonds | 197 369 | -2 537 | 2 310 | 23 | 35 071 | -589 |

| (214) | (-49) | (-585) | ||||

| - in domestic bonds | 66 725 | -1 064 | 1 461 | 14 | 3 667 | -49 |

| (-1 766) | (-46) | (-475) | ||||

| Fund shares | ||||||

| Domestic investment funds | 100 747 | 2 703 | 25 336 | 779 | 6 147 | 183 |

| (-166) | (583) | (-93) | ||||

| Foreign funds | 151 862 | 3 662 | 2 766 | 129 | 107 893 | 2 402 |

| (3 964) | (167) | (2 553) | ||||

| Finnish bank deposits | ||||||

| Transaction accounts | 152 940 | -24 | 82 299 | -3 | 5 766 | 3 |

| (4 276) | (705) | (209) | ||||

| Other deposits | 47 542 | -2 | 12 830 | 0 | -* | -* |

| (767) | (-123) | -* | ||||

*confidential

For further information, please contact:

Antti Alakiuttu, tel. + 358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing.

The next news release on saving and investing will be published at 1 pm on 14 May 2020.