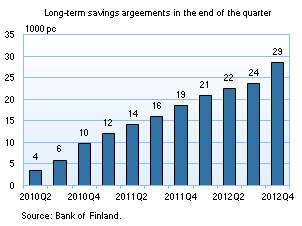

EUR 21 million invested in long-term savings accounts in 2012

Finnish households concluded just over 5,000 new long-term savings agreements in the fourth quarter of 2012. The Government's proposal in spring to raise the age limit for withdrawal of savings as from the beginning of 2013 was instrumental to the increase in new agreements in 2012. The higher age limit affects all long-term savings accounts opened in 2013, as savings from these accounts may not be withdrawn until age 68. Old accounts are governed by the old act, so that withdrawal of such savings is possible at age 63.

Finnish households concluded just over 5,000 new long-term savings agreements in the fourth quarter of 2012. The Government's proposal in spring to raise the age limit for withdrawal of savings as from the beginning of 2013 was instrumental to the increase in new agreements in 2012. The higher age limit affects all long-term savings accounts opened in 2013, as savings from these accounts may not be withdrawn until age 68. Old accounts are governed by the old act, so that withdrawal of such savings is possible at age 63.

A total of EUR 6.5 million was invested in long-term savings accounts in the fourth quarter of the year. Willingness to save typically peaks in the last quarter, as savers suddenly notice that they still need to save in order to have enough savings to get the annual maximum tax deduction. At the end of the year, the number of the agreements was 28,500, EUR 21 million worth of new savings having flowed into long-term savings accounts during the year. The value of the savings at end-December totalled EUR 47 million. The bulk of the savings is invested in mutual fund shares. At the end of 2012, mutual fund shares accounted for two-thirds of investments in long-term savings accounts.

Loans

Households' new drawdowns of housing loans amounted to EUR 1.3 billion in December 2012, which is EUR 0.3 billion less than a year earlier. The average interest rate on new housing loan drawdowns was 1.84% in December, up by 0.02 percentage point on November. At end-December the stock of euro-denominated housing loans was EUR 86 billion and the average interest rate on the stock was 1.63%. The annual growth rate of the housing loan stock continued to decline in December, to 5.6%. At end-December household credit comprised EUR 13 billion in consumer credit and EUR 15 billion in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 3.3 billion in December, which is EUR 0.7 billion more than a year earlier. The average interest rate on new corporate-loan drawdowns rose by 0.05 percentage point from November, to 2.02%. At end-December the stock of euro-denominated loans to non-financial corporations was EUR 63 billion, of which loans to housing corporations accounted for EUR 16 billion. The annual growth rate of the corporate loan stock fell by 0.2 percentage point, to 5.2% in December.

Deposits

At end-December the stock of household deposits amounted to EUR 82 billion. The average interest rate on the stock was 0.72%. Overnight deposits accounted for EUR 48 billion and deposits with agreed maturity for EUR 20 billion of the total deposit stock. In December households concluded EUR 1.2 billion of new agreements on deposits with agreed maturity. The average interest rate on these declined to 1.10%, from 1.16% in November.

Notes:

MFIs comprise all monetary financial institutions operating in Finland.

Loans and deposits comprise all euro-denominated loans and deposits vis-à-vis the euro area as a whole, with countries other than Finland accounting for a very small share of total volumes.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| October, EUR million |

November, EUR million |

EUR million |

December, 12-month change1, % |

Average interest rate, % | |

| Loans to households2, stock | 114.327 | 114.701 | 114.798 | 4.9 | 2.01 |

| - of which housing loans | 85.775 | 86.140 | 86.346 | 5.6 | 1.63 |

| Loans to non-financial corporations2, stock | 63.256 | 63.528 | 63.282 | 5.2 | 1.95 |

| Deposits by households2, stock | 81.953 | 81.472 | 82.378 | -0,3 |

0.72 |

| Households' new drawdowns of housing loans | 1.669 | 1.590 | 1.254 | – | 1.84 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Analytical accounts of the banking sector (MFIs) in Finland

For further information, please contact:

Essi Tamminen, tel. +358 10 831 2395, email: essi.tamminen (at)bof.fi

Jaakko Suni, tel. +358 10 831 2454, email: jaakko.suni (at)bof.fi

The next news release will be published at 1 pm on 28 February 2013.

Related statistical data and graphs are also available on the Bank of Finland website: http://www.suomenpankki.fi/fi/tilastot/Pages/default.aspx.