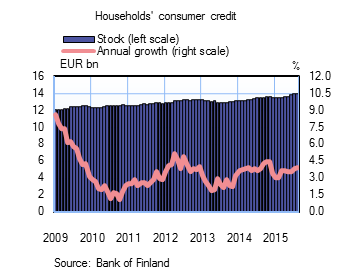

Households’ consumer credit increased

The stock of households’ consumer credit has grown steadily in the last few years. In August 2015, the growth rate of the consumer credit stock was 4%, and the stock rose to EUR 14 bn. Consumer credit is considered to include loans granted to households for the acquisition of consumer goods and services, and purchases by credit card. Overdrafts and credit card credit account for about a third, ie EUR 4.6 bn, of total consumer credit. As a rule, no collateral is required for these types of credit. The bulk of consumer credit (EUR 7.9 bn) is unsecured consumer credit, on which the annual interest rate was 6.35% at the end of August. Meanwhile, the interest rate on secured consumer credit (EUR 6.1 bn) was 2.90%. |

|

Consumer credit granted by banks represents approximately 90% of households’ total consumer credit. Other financial institutions operating without credit-institution authorisation also grant consumer credit to households. According to Statistics Finland, the stock of credit granted to households by other financial institutions (excl. insurance companies) was EUR 2 bn at the end of June 2015. Of this amount, consumer credit accounted for 95%.

Loans In August 2015, households’ new drawdowns of housing loans amounted to EUR 1.3 bn, which is nearly as much as a year earlier in August. The average interest rate on new housing-loan drawdowns was 1.47% in August 2015. The stock of euro-denominated housing loans totalled EUR 91.1 bn at the end of August, and the annual growth rate of the housing-loan stock was 2.1%. At the end of August, household credit comprised EUR 14.0 bn in consumer credit and EUR 15.9 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in August to EUR 1.6 bn. The average interest rate on new corporate-loan drawdowns rose from July, to 2.13%. The stock of euro-denominated loans to non-financial corporations at the end of August was EUR 71.5 bn, of which loans to housing corporations accounted for EUR 22.6 bn. | ||||||||||||||||||||||||||||||||||||

Deposits At the end of August, the stock of household deposits totalled EUR 81.2 bn, and the average interest rate on the deposits was 0.32%. Overnight deposits accounted for EUR 56.8 bn of the total deposit stock and deposits with agreed maturity for EUR 11.1 bn. In August, households concluded EUR 0.7 bn of new agreements on deposits with agreed maturity. The average interest rate on these increased slightly from July, to 0.96% in August. | ||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

For further information, please contact The next news release will be published at 1 pm on 30 October 2015. |