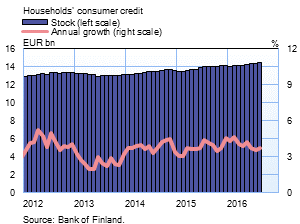

Consumer credit on the increase

|

The volume of consumer credit extended by non-financial corporations has rebounded since the beginning of 2016. The stock of consumer credit has grown during the past six months by over EUR 300 million, to EUR 14.4 bn at the end of August. In annual terms, the growth rate of the consumer credit stock has remained close to the average of the past two years, standing at 3.7% in August. The highest rate of growth has recently occurred in consumer credit with longer (over 5 years) maturities. In August 2016, new consumer credit drawdowns (excl. overdrafts and credit card credit) totalled EUR 360 million, of which over 5-year loans accounted for EUR 207 million. Consumer credit covers all loans to households for consumption purposes, including e.g. car loans.

|

|

|

Almost 60% of consumer credit (excl. overdrafts and credit card credit) is secured. Collateralised consumer credit is granted at a notably lower interest rate than non-collateralised consumer credit. In August 2016, the annual interest rate on the stock of collateralised consumer credit was 2.72%, while that on the stock of non-collateralised consumer credit was 5.31%. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 1.3 bn in August 2016. The average interest rate on new corporate-loan drawdowns rose from July, to 2.28%. At the end of August, the stock of euro-denominated loans to non-financial corporations was EUR 74.6 bn, of which loans to housing corporations accounted for EUR 24.9 bn. |

|

Deposits At end-August, the stock of household deposits totalled EUR 84.3 bn. The average interest rate on the stock was 0.21%. Overnight deposits accounted for EUR 60.0 bn and deposits with agreed maturity for EUR 9.6 bn of the total deposit stock. In August, households concluded EUR 0.5 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.52%. Notes: |

Key figures of Finnish MFIs' loans and deposits, preliminary data

| June, EUR million | July, EUR million | August, EUR million | August, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 123,566 | 123,888 | 124,112 | 2,8 | 1,60 |

| - of which housing loans | 93,087 | 93,293 | 93,387 | 2,5 | 1,12 |

| Loans to non-financial corporations2, stock | 74,261 | 74,464 | 74,575 | 4,2 | 1,53 |

| Deposits by households2, stock | 84,151 | 85,128 | 84,294 | 3,8 | 0,21 |

| Households' new drawdowns of housing loans | 1,805 | 1,372 | 1,446 | 1,18 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

For further information, please contact:

Olli Tuomikoski, tel. +358 10 831 2146, email: olli.tuomikoski(at)bof.fi,

Markus Aaltonen, tel. +358 10 831 2395, email: markus.aaltonen(at)bof.fi

The next news release will be published at 1 pm on 31 October 2016.

Related statistical data and graphs are also available on the Bank of Finland website:

http://www.suomenpankki.fi/link/2331b6266da3492f832ec75e0f654bd9.aspx?epslanguage=en.

Preliminary information on the renewal of the Bank of Finland website

The Bank of Finland’s public website (www.suomenpankki.fi) will be renewed in January 2017. The website will be updated to correspond with current mobile practices by redesigning the website’s user interface and look, and by building the website to be as responsive as possible.

The information content of the Statistics section will remain mostly unchanged but, due to a technical update of the statistical system, the web addresses of statistical reports (graphs and tables) will change as a result of the modification of the system. Data search may continue to be integrated where applicable into users’ own systems, but continuity in automatic searches will require users to update the web addresses.

The most frequently used statistical content, such as daily exchange rates, will be offered in future in various ways, for example as open data. Further information on the website renewal will be published during the latter part of 2016 in newsletters, the social media and at www.suomenpankki.fi.