Growth of e-commerce showed in card payments

In 2022, the number of card payments initiated on a computer or mobile device increased by a third, and their total volume grew 41% year on year. Of these payment transactions, 90% were made on e-commerce platforms. The most common type of payment card used by Finns in e-commerce purchases is a debit card.

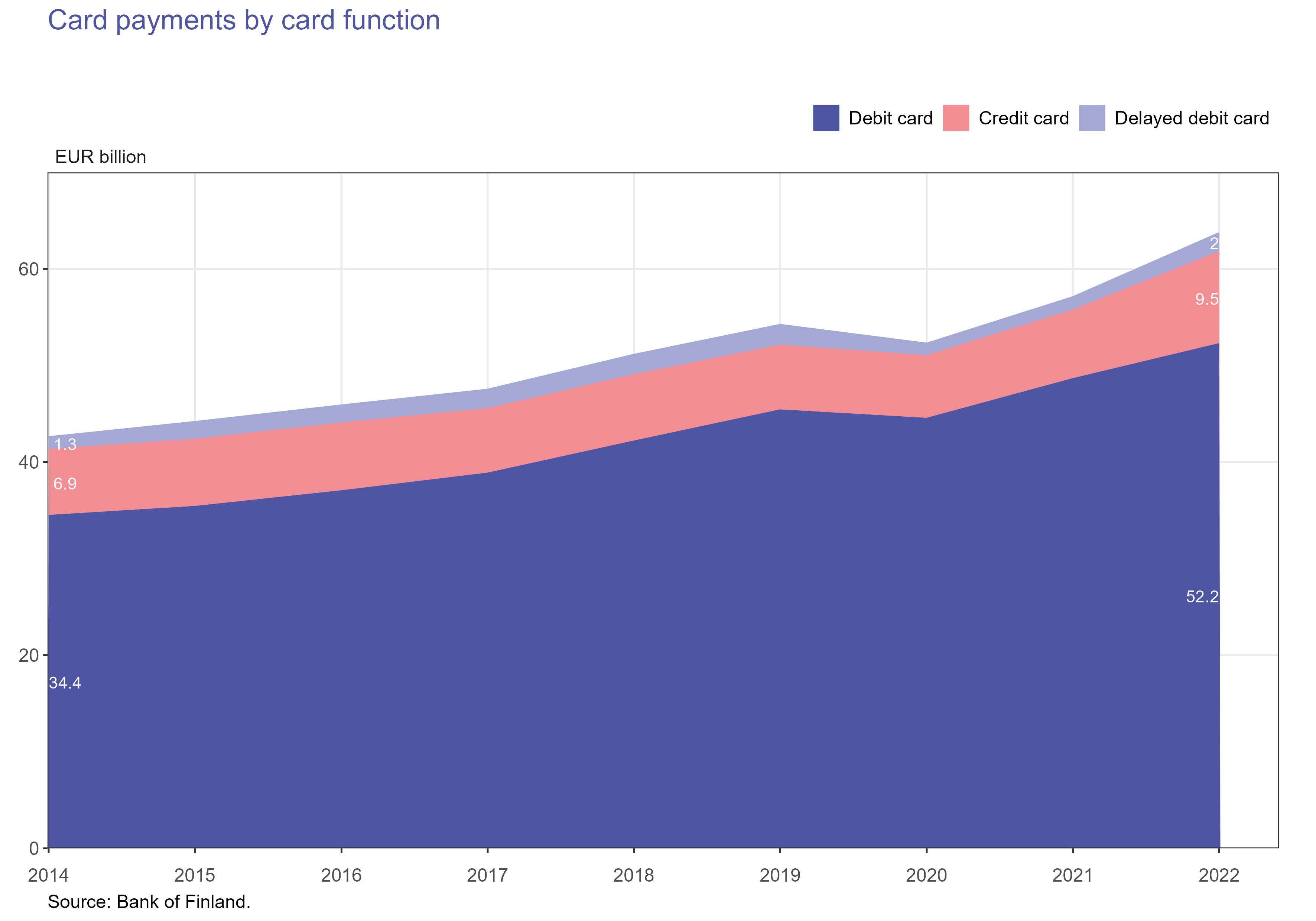

In 2022, a total of 2.1 billion card payments were made using Finnish payment cards, which was 11% more than in 2021. The total value of card payments grew 12% from 2021 to EUR 64 billion. In 2022, the most common type of card in payment transactions was a debit card, which was used in 90% of all card payment transactions, accounting for 82% of the total value of card payment transactions.

A computer or mobile device was used to make 295 million electronic[1] transactions, with a total value of EUR 11 billion. In 2022, the number of these transactions increased by a third, and their total value grew 41% from the previous year. 90% of these payment transactions were made in e-commerce. Other points of transaction for remote payments include peer-to-peer payments initiated using a mobile payment solution.

The growth of contactless payment levelled off in 2022, and electronic card payments using the contactless feature of a payment card accounted for 60% of all card payment transactions. A year earlier, the corresponding share was 59%. In 2022, the average value of contactless payment transactions[2] was EUR 15.4.

The number of electronic card payments using a microchip or magnetic strip in 2022 was 548 million. However, in terms of aggregate value, they continued to be the largest type of card payments in 2022 (EUR 33 billion), accounting for 52% of the total value of all card payments.

Terminals located in Finland were used to receive a total of 1.5 billion card payments with a total value of EUR 44 billion in 2022. The majority (98%) of the card payments received were made using domestic payment cards. As to the rest of the card payments received, the card had been issued in the euro area in 1% of the payments and in other countries in 1% of the payments. Contactless payment was the most common way of using the card also in payments on foreign cards.

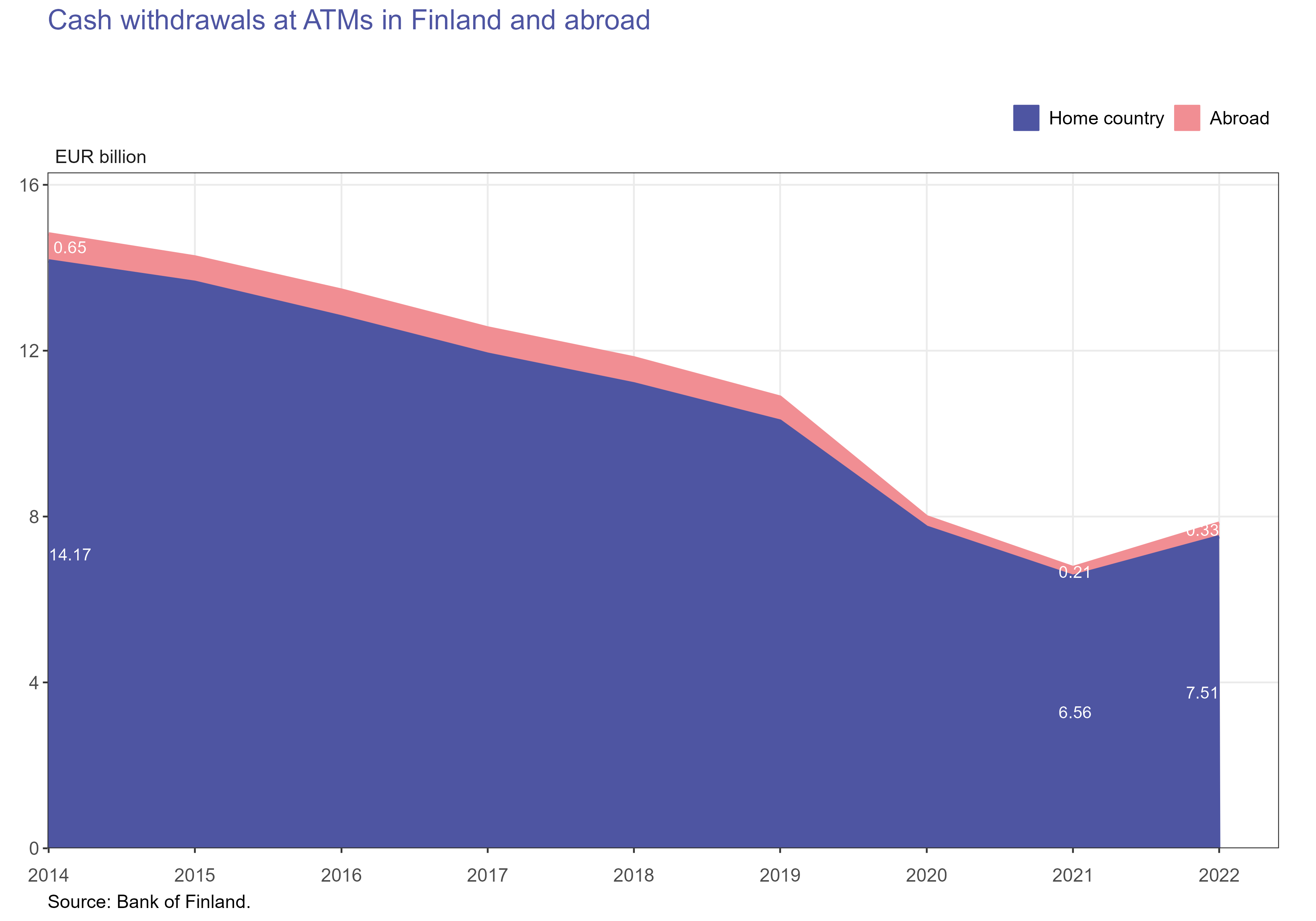

Finnish cards were used domestically to withdraw a total of EUR 7.5 billion of cash in 2022. By comparison, a total of EUR 6.6 billion was withdrawn in 2021 and EUR 10.3 billion in 2019. Meanwhile, Finnish cards were used to withdrawn cash abroad to the value of EUR 328 million, which was barely half of the average annual amount in 2017–2019.

A total of 1.2 billion credit transfers were made from Finnish accounts in 2022. The total value of these credit transfers[3] was EUR 4,071 billion, with single electronic credit transfers accounting for 81% of the total. Credit transfers related to e-commerce accounted for 9% of the share of single credit transfers.

The figures discussed in this news release have been published in the payment statistics dashboard.

For further information, please contact:

Tia Kurtti, tel. +358 9 183 2043, email: tia.kurtti(at)bof.fi

Tuomas Nummelin, tel. +358 9 183 2373, email: tuomas.nummelin(at)bof.fi.

[1] Card-based payment transactions are considered electronic if they are initiated at an electronic funds transfer at point of sale (EFTPOS), ATM or other physical terminal that allows electronic payment initiation or remotely by electronic means of information transmission. Card-based payment transactions are considered non-electronic if they are initiated at a physical terminal through a manual authorisation procedure (e.g. imprinters) or via mail order or telephone order (MOTO).

[2] EUR 50 is the maximum amount currently allowed by the European Banking Authority for a single contactless payment using a payment card. Amounts exceeding the contactless payment limit always require the card to be inserted into the reader of the card terminal. The EUR 50 contactless limit does not apply to payments using certain mobile payment solutions.

[3] As of 2022, credit transfers include payments related to securities trade and settlement services, increasing their volume in comparison with previous years.