Vehicle loans drawdowns continued at previous rate

In the first half of 2024, households drew down a comparable amount of vehicle loans as a year earlier. At the same time, households drew down less unsecured consumer credit than before. The group of OFIs monitored by the Bank of Finland has contracted in 2024.

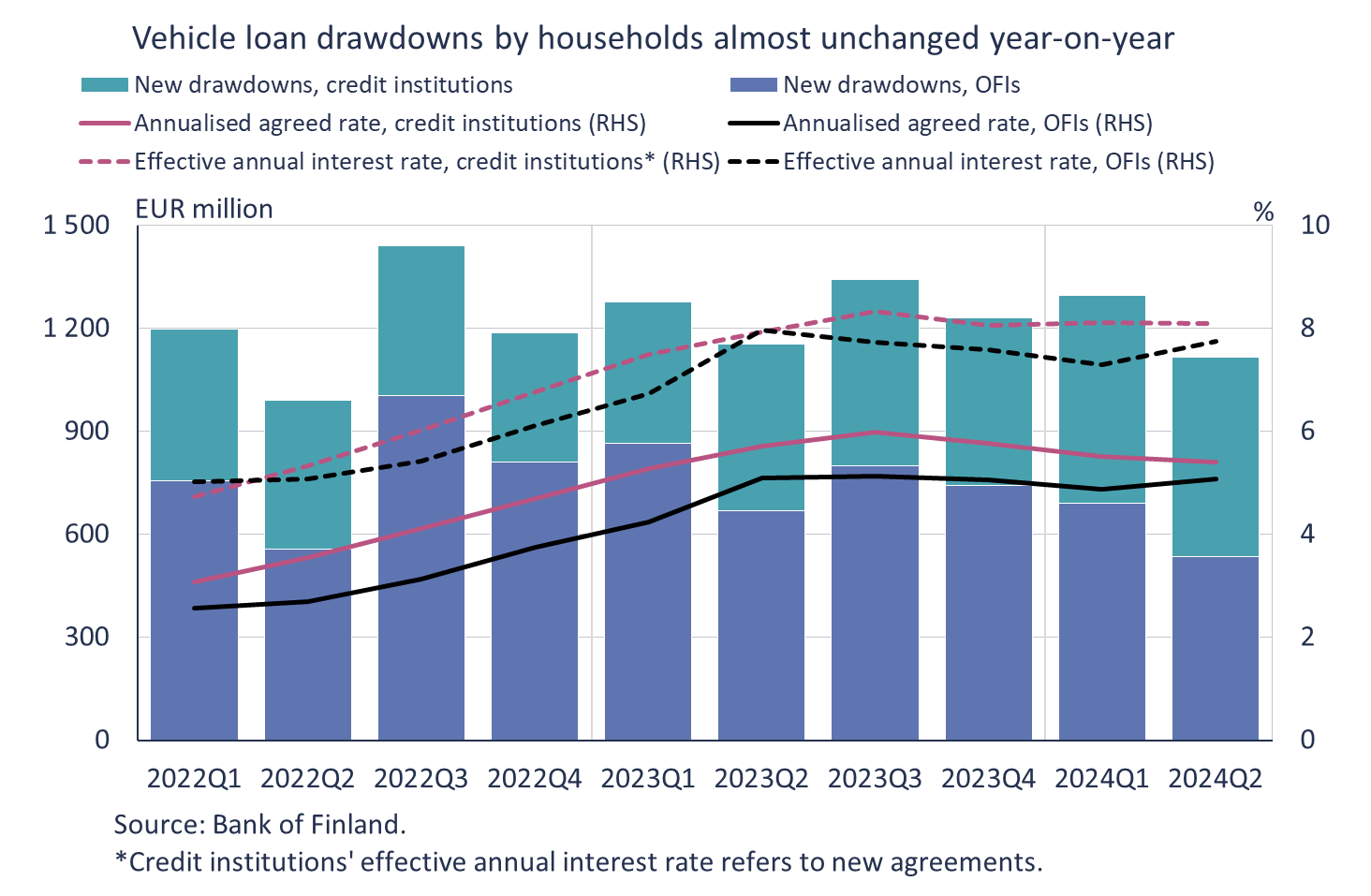

In the second quarter of 2024, Finnish households drew down a total of EUR 536 million of new vehicle loans from other financial institutions (OFIs), which was about 20% less than a year earlier. Meanwhile, vehicle loans drawn down by households from credit institutions totalled EUR 580 million, representing a year-on-year growth of approximately 20%.[1] In total, new vehicle loans drawn down from other financial institutions and credit institutions in the second quarter of 2024 totalled EUR 1.1 billion, which is about 3% less than in the same period last year.

The average interest rate on vehicle loans granted by credit institutions is slightly higher than on those granted by OFIs. The annualised agreed rate on vehicle loans drawn down from OFIs in the second quarter of 2024 was 5.1%, while the effective annual interest rate, which also includes other expenses, was 7.8%. In contrast, new vehicle loans drawn down from credit institutions in the same period carried an annualised agreed rate of 5.4%, and new agreements[2] carried an effective interest rate of 8.2%. The majority of vehicle loans, about 70% of those drawn down from OFIs and over 90% of those from credit institutions, had a fixed interest rate in the second quarter of 2024.

Drawdowns of unsecured consumer credit from OFIs have declined

In the second quarter of 2024, Finnish households drew down a total[3] of EUR 48 million of unsecured consumer from other financial institutions, which represents a decline of 26% year-on-year. The average interest rate on these new drawdowns was 8.7% in the second quarter of 2024, as opposed to 9.3% in the same period a year earlier. The majority of unsecured consumer credit is linked to Euribor rates.

At the end of the second quarter of 2024, the stock of Finnish households’ unsecured consumer credit from OFIs was EUR 467 million, and the average interest rate on the stock was 14.0%. A year earlier, the stock stood at EUR 555 million, with an average interest rate of 15.4%. Unsecured consumer credit drawn down from OFIs accounted for an estimated 3% of the total stock of Finnish households’ unsecured consumer credit (excl. vehicle loans)[4] at the end of the second quarter of 2024. In recent years, foreign digital banks have become more prominent in the origination of consumer credit to households. The largest proportion (63%) of the estimated stock of households’ unsecured consumer credit was granted by credit institutions operating in Finland.

Population subject to the data collection has decreased

The number of entities[5] within the scope of the Bank of Finland’s OFI data collection has decreased in 2024. As a result, the comparability of the figures as such with previous publications has decreased significantly, and economic phenomena should be assessed in conjunction with information derived from the Bank of Finland’s other data collections.

The group of entities belonging to the scope of the data collection has varied constantly ever since the data collection began at the end of 2020. Small entities have been relieved from the data collection while new entities have been included. In the second quarter of 2024, the data collection covered 46 entities, as opposed to a maximum of 64 entities ever included concurrently by the survey. Many companies that have granted consumer credit to households have discontinued either the origination of new loans or their operations altogether after the introduction of the interest rate cap on consumer credit in 2019 and its tightening in 2023. On the corporate finance side, many entities previously included in the data collection have either been granted a banking authorisation or merged into a credit institution, thereby exiting from the OFI survey into the MFI (credit institution) survey. Hence, the credit institution survey provides a useful counterpart to the MFI data collection, for example when reviewing Finnish households’ consumer loans or corporate credit.

Other financial institutions’ figures have been presented in a new dashboard updated on a quarterly basis, allowing the users to review the contents of the data collection extensively. The dashboard is found on the Bank of Finland’s website behind this link.

For further information, please contact:

Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi.

The next Other financial institutions release will be published in Spring 2025.

STOCK OF LOANS GRANTED BY OFIS TO FINNISH NON-FINANCIAL CORPORATIONS AND HOUSEHOLDS, 2024Q2:

|

|

Non-financial corporation loans (EUR million) |

Household loans (EUR million) |

|

Secured |

1,637 |

3,668 |

|

Unsecured and with collateral deficit |

3,002 |

475 |

|

Total |

4,639 |

4,143 |

[1] The high intra-sector rates of change are largely explained by a shift of institutions from OFIs into the credit institution sector, see the last section.

[2] In the MFI data collection, the effective annual interest rate is collected on new agreements, while in the OFI data collection, it is collected on new drawdowns.

[3] Excl. overdrafts and credit card credit.

[4] Aggregated stock including other financial institutions, credit institutions operating in Finland and the estimated stock of foreign digital banks.

[5] The population subject to the data collection can be gauged to some extent with the FIN-FSA’s list of supervised entities by selecting “Consumer credit providers and peer-to-peer lenders” under “Credit market entities”.