New corporate loans smaller than before

|

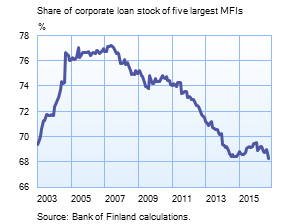

In October 2016, new drawdowns of loans to non-financial corporations totalled EUR 1.8 bn, which was EUR 120 million less than in October 2015. From January 2016 until the end of October, new corporate-loan drawdowns contracted slightly from the corresponding period in 2015. Drawdowns were smaller for large corporate loans of over EUR 1 million, which decreased in January–October 2016 by 9.7% on a year-earlier period. Drawdowns of smaller corporate loans, in turn, have grown by 9.4% in the corresponding period. The stock of loans to non-financial corporations is growing at a steady pace, and growth is more evenly distributed among monetary financial institutions. In October 2016, five largest MFIs granting corporate loans accounted for 68% of the Finnish corporate loan stock. The share has contracted from the peak in May 2007, when the five largest MFIs still accounted for 77% of the loan stock. From the perspective of financial stability, the decrease in market concentration is positive for Finland, because the structural indicators published by the ECB show that the Finnish banking sector ranks among the most concentrated in all EU countries. |

|

|

Loans The average interest rate on new corporate-loan drawdowns rose from September, to 1.88%. At the end of October, the stock of euro-denominated loans to non-financial corporations was EUR 75.4 bn, of which loans to housing corporations accounted for EUR 25.4 bn. |

|

Deposits At the end of October, the stock of household deposits totalled EUR 83.9 bn, and the average interest rate on the deposits was 0.20%. Overnight deposits accounted for EUR 60.1 bn and deposits with agreed maturity for EUR 9.3 bn of the total deposit stock. In October, households concluded EUR 0.6 bn worth of new agreements on deposits with agreed maturity. The average interest rate on these was 0.41%. Notes: |

Key figures of Finnish MFIs' loans and deposits, preliminary data

| August, EUR million | September, EUR million | October, EUR million | October, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 124,112 | 124,498 | 124,610 | 2,6 | 1,58 |

| - of which housing loans | 93,386 | 93,647 | 93,819 | 2,4 | 1,10 |

| Loans to non-financial corporations2, stock | 74,575 | 74,922 | 75,400 | 4,9 | 1,51 |

| Deposits by households2, stock | 84,294 | 84,079 | 83,857 | 2,6 | 0,20 |

| Households' new drawdowns of housing loans | 1,446 | 1,595 | 1,581 | 1,14 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

For further information, please contact:

Olli Tuomikoski, tel. +358 10 831 2146, email: olli.tuomikoski(at)bof.fi,

Anne Turkkila, tel. +358 10 831 2175, email: anne.turkkila(at)bof.fi.

The next news release will be published at 1 pm on Friday 30 December 2016.

Related statistical data and graphs are also available on the Bank of Finland website:

http://www.suomenpankki.fi/link/2331b6266da3492f832ec75e0f654bd9.aspx?epslanguage=en.

You can also subscribe to the monthly Loans, deposits and interest rates –newsletter to your email from the Bank of Finland website