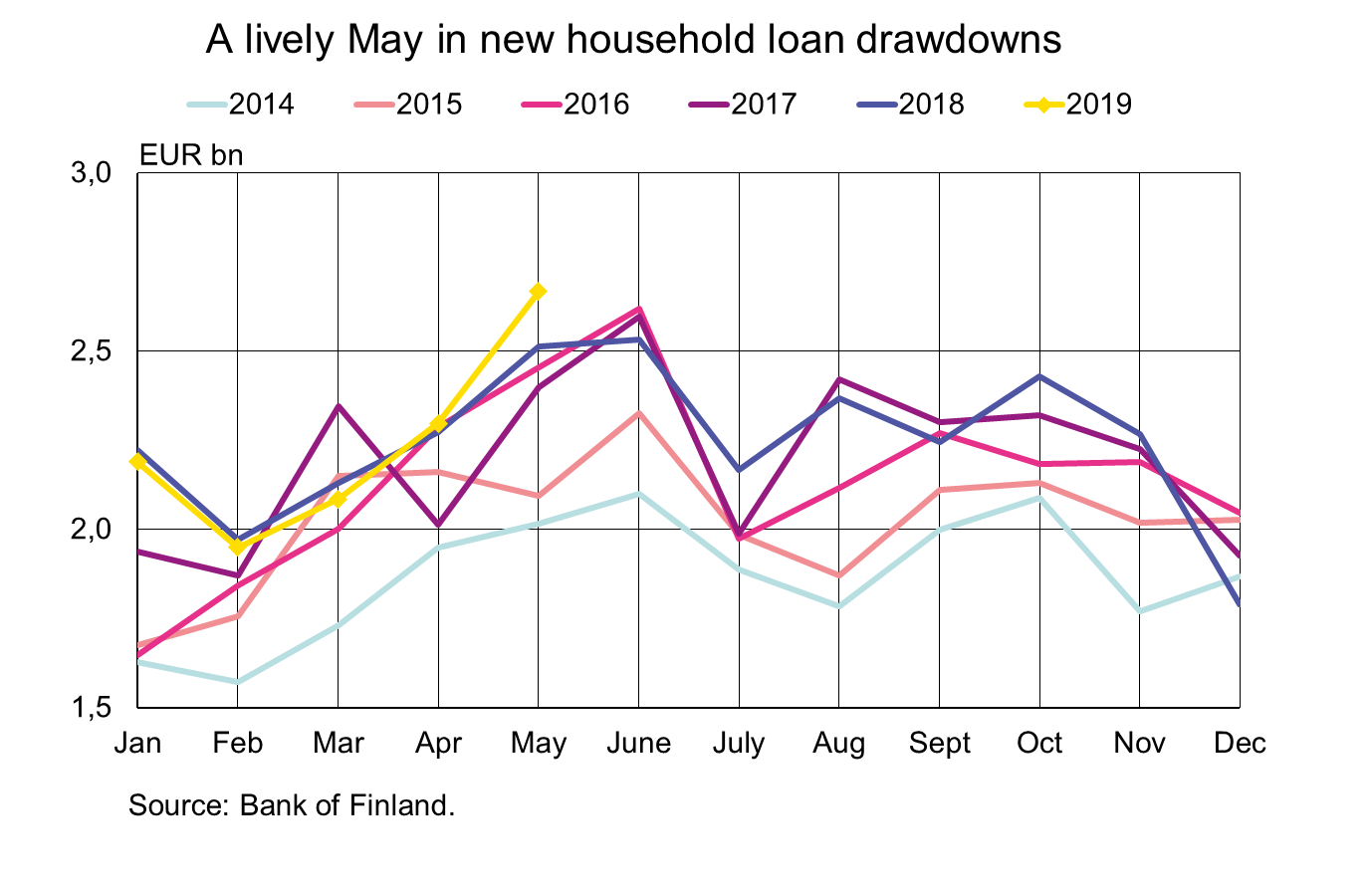

A lively May in household loan drawdowns

In May 2019, households drew down EUR 1.9 bn worth of new housing loans, which is EUR 130 million more than in the corresponding period a year earlier. Housing loan drawdowns have last been higher in June 2012. In January–May 2019, the drawdowns were 1.5% up on the year-earlier period. Due to the high volume of housing loan drawdowns, the stock of housing loans increased to EUR 98.5 bn and the growth rate in May (2%) was the fastest since July 2018. The annualised agreed rate on new housing loans fell from April, to 0.78%.

Unsecured consumer credit continued to grow at a brisk pace. In May 2019, new drawdowns of unsecured consumer credit1 from credit institutions totalled EUR 290 million. This was more than ever before in month-on-month terms. The stock of unsecured consumer credit (EUR 5.4 bn) grew at an annual rate of almost 12%. As a result, the stock of consumer credit granted by credit institutions to households increased in May to EUR 16 bn. A growing share of consumer credit is granted outside the credit institutions sector or from abroad. At the end of March 2019, the total stock of household consumer credit2 was estimated at EUR 22 bn.

Demand for holiday residence loans usually peaks in May–September. In May 2019, new drawdowns of holiday residence loans amounted to EUR 93 million, an increase of 7% on the year-earlier period. The interest rate on new holiday residence loans was record low in May (0.95%). At end-May, the stock of holiday residence loans totalled EUR 3.6 bn and the annual growth rate of the stock was 2.5%. At the same time, the stock of loans granted by credit institutions to households3 amounted to EUR 131.9 bn.

Loans

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in May to EUR 2.0 bn. The average interest rate on new corporate-loan drawdowns rose from April, to 2.36%. At the end of May, the stock of euro-denominated loans to non-financial corporations was EUR 87.3 bn, of which loans to housing corporations accounted for EUR 33.0 bn.

Deposits

The stock of household deposits at end-May totalled EUR 92.4 bn and the average interest rate on the deposits was 0.11%. Overnight deposits accounted for EUR 79.2 bn and deposits with agreed maturity for EUR 5.2 bn of the deposit stock. In May, households concluded EUR 0.2 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.31%.

1Excl. overdrafts and credit card credit.

2In addition to credit institutions, consumer credit is also provided by companies specialising in car financing, payday providers, peer-to-peer lenders and foreign digital banks.

3Household loans comprise housing loans, consumer credit, holiday residence loans, student loans and loans for other purposes.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| March, EUR million | April, EUR million | May, EUR million | May, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 131,289 | 131,334 | 131,870 | 2,4 | 1,48 |

| - of which housing loans | 98,067 | 98,138 | 98,479 | 2,0 | 0,97 |

| Loans to non-financial corporations2, stock | 86,591 | 86,986 | 87,265 | 7,1 | 1,36 |

| Deposits by households2, stock | 95,345 | 96,228 | 96,704 | 7,9 | 0,11 |

| Households' new drawdowns of housing loans | 1,458 | 1,622 | 1,899 | 0,78 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi,

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi.

The next news release will be published at 1 pm on 31 July 2019.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.