Households sold EUR 1.4 billion worth of mutual fund shares in net terms in the first quarter of 2008

The turbulence on the financial markets affected households' investment decisions in the first quarter of 2008. The trend that began in the second half of 2007 continued, with households selling mutual fund shares in net terms and increasing their deposits.

The turbulence on the financial markets affected households' investment decisions in the first quarter of 2008. The trend that began in the second half of 2007 continued, with households selling mutual fund shares in net terms and increasing their deposits.

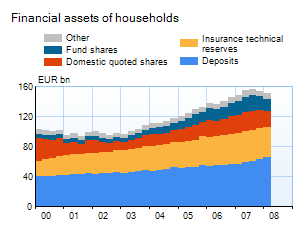

Households' net redemptions of mutual fund shares in January–March totalled EUR 1.4 billion, equal to 8.7% of the market value of the household sector's mutual fund holdings at the turn of the year. Over all, for the half year October 2007 – March 2008, households' net redemption of mutual fund shares totalled EUR 2.4 billion.

Households' deposits grew by EUR 1.9 billion in the first quarter of the year. This corresponds fairly closely to the trend in the final quarter of 2007, given that, of the EUR 2.7 billion flow of deposits recorded in the final quarter, EUR 0.7 billion was due to the reclassification as deposits of savings fund deposits previously entered under loans.

The value of households' direct share holdings declined by EUR 2.3 billion due to the fall in share prices. The weak performance of shares and mutual funds also affected the value of insurance investments: households' life insurance and pension fund savings entered under insurance technical reserves declined by EUR 0.8 billion, above all as a consequence of the drop in value of investment-linked insurance.

Households' financial assets1 declined in January–March 2008 by a total of EUR 3.6 billion due to the declining value of high-risk financial assets. This notwithstanding, financial assets of EUR 154.0 billion at the end of March were still EUR 0.9 billion, or 0.6%, higher than a year earlier. In contrast, households' loan-based liabilities continued their steady growth, reaching EUR 88.3 billion, an increase of 10.9% on a year earlier. In January–March, households' net financial assets declined for the third quarter in a row, the new level of EUR 61.7 billion representing a drop of 8.0% from the end of the year. Households' net financial assets were last this low in June 2005.

The above information has been gleaned from the quarterly financial accounts statistics compiled by the Bank of Finland. These provide an overview of the financial assets and liabilities of the various sectors of the national economy and of the related transactions in the form of flows.

1) Data excludes unquoted shares and other equity, and other accounts receivable. Shares in housing corporations are also excluded from financial assets.

Further information:

Terhi Koivula, tel. +358 10 831 2416, email:forname.lastname@bof.fi