Households sold EUR 1 billion worth of mutual fund shares in net terms in the last quarter of 2007

Financial assets underwent substantial shifts in the last quarter of 2007, when households transferred their assets away from mutual funds and shares to deposits. Net redemptions of households' mutual fund holdings amounted to EUR 1.0 billion, in addition to which households sold EUR 0.2 billion worth of quoted shares in net terms. However, an increase of as much as EUR 2.5 billion in household deposits cannot only be explained by reorganisation of financial assets following market turbulence, but the attractiveness of deposits was also boosted by tighter interest rate competition and, as an exceptional factor, by a change leading to the statistical treatment of savings fund deposits as bank deposits, recorded in the last quarter of 2007.1) Households reduced their holdings of money market fund shares in particular, of which net redemptions accounted for 9.6% of the market value at the end of the previous quarter.

Financial assets underwent substantial shifts in the last quarter of 2007, when households transferred their assets away from mutual funds and shares to deposits. Net redemptions of households' mutual fund holdings amounted to EUR 1.0 billion, in addition to which households sold EUR 0.2 billion worth of quoted shares in net terms. However, an increase of as much as EUR 2.5 billion in household deposits cannot only be explained by reorganisation of financial assets following market turbulence, but the attractiveness of deposits was also boosted by tighter interest rate competition and, as an exceptional factor, by a change leading to the statistical treatment of savings fund deposits as bank deposits, recorded in the last quarter of 2007.1) Households reduced their holdings of money market fund shares in particular, of which net redemptions accounted for 9.6% of the market value at the end of the previous quarter.

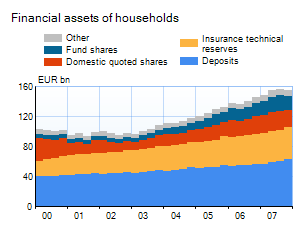

Households' financial assets2) declined in October–December 2007 by a total of EUR 2.4 billion, because of unfavourable price developments in shares, in particular, but also in mutual funds. This notwithstanding, financial assets of EUR 154.0 billion at the end of the year were up EUR 7.9 billion, ie 5.4%, year-on-year. In contrast, households' loan-based liabilities increased by 11.0% from the previous year, to EUR 86.5 billion. October–December was the second consecutive quarter during which households' net financial assets decreased: the level of EUR 67.5 billion was down 5.7% from the end of September.

This information appears from the financial accounts statistics compiled quarterly by the Bank of Finland, which provide an overview of the financial assets and liabilities of the various sectors of the national economy and of the related transactions in the form of flows. The financial accounts flow data is published for the first time in connection with this statistical press release. It enables, for example, decomposition of changes in the stock of shares into transactions (difference between purchases and sales) and into other changes, mainly resulting from changes in share prices and possibly from exchange rates changes or reclassifications.

1) In the Bank of Finland's financial accounts, only MFIs can have deposit liabilities. Savings fund deposits were statistically classified as non-financial corporations' loan-based liabilities to households. At the end of September 2007, these deposits totalled EUR 0.7 million.

2) Data excludes unquoted shares and other equity, and other accounts receivable. Shares in housing corporations are also excluded from financial assets.

Further information:

Eero Savolainen, tel. +358 10 831 2235, email:forname.lastname@bof.fi

Ismo Muhonen, tel. +358 10 831 2411, email:forname.lastname@bof.fi