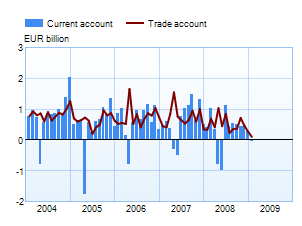

Current account posts a slight deficit in January 2009

Current accountThe current account posted a deficit of EUR 27 million in January 2009. This was largely due to the weaker performance of the goods account, which posted only a slight surplus.1 In recent years the current account has posted a deficit only in those months when listed companies have distributed dividends to foreign investors.

1 BOP goods trade data differ from the Board of Custom’s foreign trade statistics because of freight and insurance cost adjustments: in BOP statistics, the share of foreign carriers and insurers is deducted from the Board of Customs’ CIF-based goods imports and added to transportation and insurance costs.

|

|

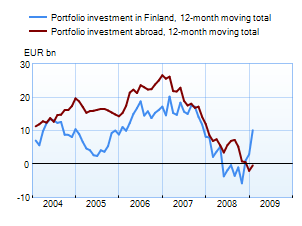

Financial account and international investment position Capital flows in January remained inward on net, as in previous months. There was a net inflow of EUR 1.1 billion in direct investment and EUR 4.2 billion in portfolio investment. Other investments (loans, deposits and trade credits) recorded a net capital outflow of EUR 2.0 billion. In central government asset management there were large movements of capital in both assets and liabilities. In respect of derivatives there has been a larger net inflow of capital into Finland in recent months than previously. In securities-based assets, the 12-month moving total has been declining since the end of 2007 apart from a couple of exceptional months. Recent months have seen a repatriation of capital on such a scale that the outward flow of investment for 2008 as a whole has become negative. This was due to sales of foreign securities by the employment pension funds. In January 2009, capital was once again invested abroad, in the amount of EUR 1 billion.

|

|

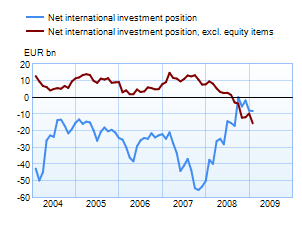

Apart from recent months, the trend in securities-based liabilities has been similar to the trend in assets. The 12-month moving total in securities-based liabilities became positive in December 2008. Towards the end of 2008, central government increased its level of borrowing from foreign sources. In January , foreign borrowing by Finnish residents continued, with a capital inflow of EUR 5.2 billion. At the end of January, Finnish residents’ foreign liabilities exceeded their foreign assets by EUR 8.2 billion. The upward trend in net assets that began towards the end of 2007 has been due to a decline in the market value of Finnish listed companies that has lowered the value of their foreign holdings. In the most recent months, the level of gross foreign debt has begun to grow again, partly because of the increase in foreign borrowing by central government. At the end of January, excluding equity items, Finnish residents’ foreign liabilities exceeded their foreign assets by EUR 15.5 billion. The net international investment position excluding equity items became negative already in August 2008 following a good five years of positive figures. |

|

Year 2008, |

December 2008, EUR million |

January 2009, EUR million |

12 month moving sum, EUR million | |

| Current account | 3,789 | 287 | -27 | 3,356 |

| Goods | 6,192 | 274 | 107 | 5,966 |

| Services | 778 | -54 | -65 | 635 |

| Income | -1,623 | 270 | 104 | -1,687 |

| Transfers | -1,559 | -203 | -173 | -1,559 |

| Capital account* | 165 | – | – | – |

| Financial account | 7,821 | 2,027 | 3,845 | 13,503 |

| Direct investment | -3,979 | 2,310 | 1,123 | -2,423 |

| Portfolio investment** | 4,939 | 2,173 | 4,162 | 10,536 |

| Other investment | 5,466 | -3,473 | -2,021 | 2,929 |

| Reserve assets | -192 | -103 | 60 | -161 |

| Financial derivatives | 1,587 | 1,121 | 522 | -2,623 |

| Errors and omissions | -11,774 | -2,328 | -3,818 | -17,010 |

The statistics become final more than two years after the end of the reference year.

* Capital account is not estimated monthly. The figures are published first after the yearly data are prepared.

** Beginning with the data on the stock of portfolio investment in December 2008, the statistics on portfolio investment are based on security-by-security data collection. Because of the change in statistical methodology, the figures from January onwards are not entirely comparable with earlier periods.

More information

Jaakko Suni tel. +358 10 831 2454 and Anne Turkkila +358 10 831 2175, email firstname.surname(at)bof.fi