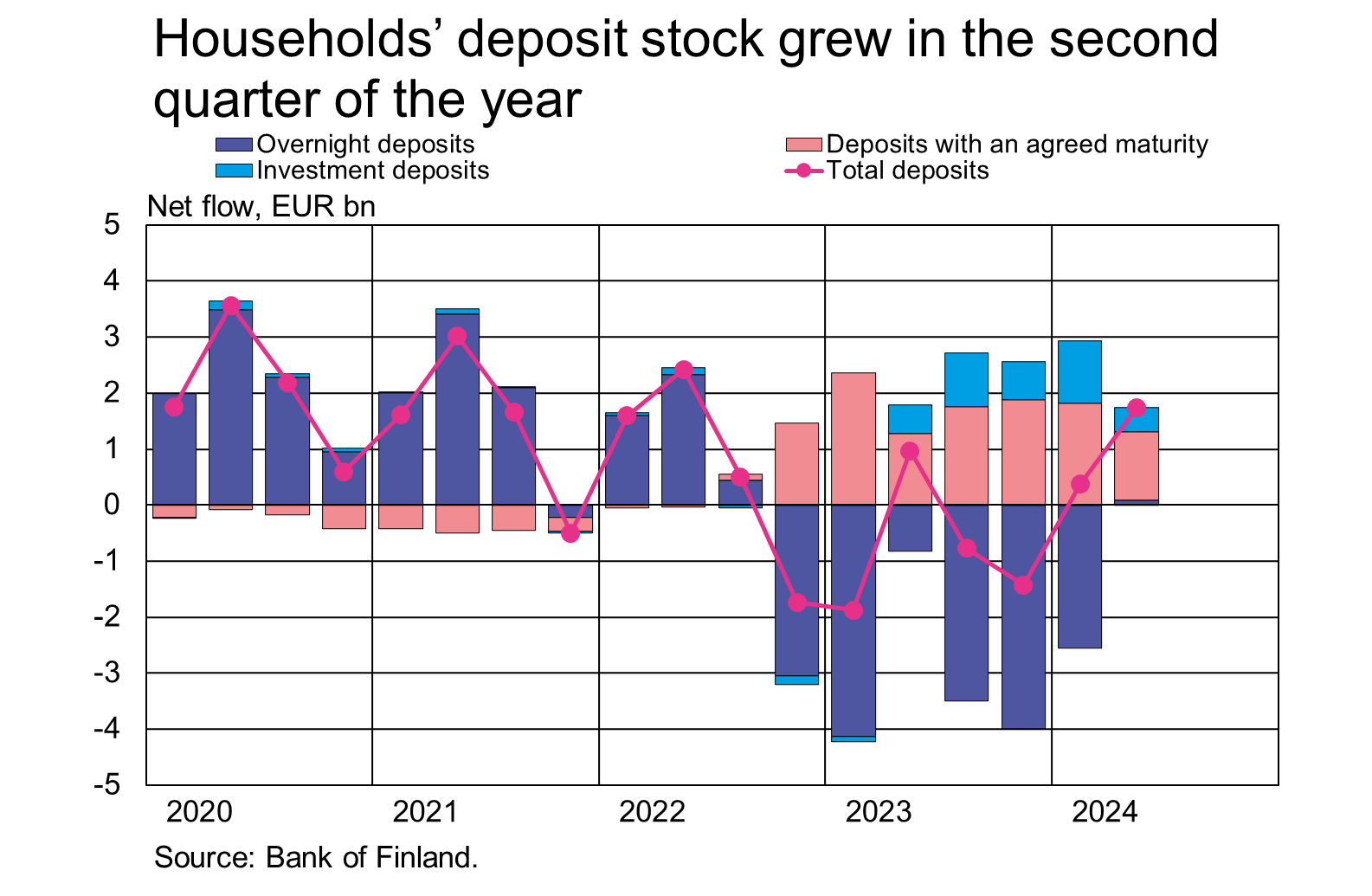

In the second quarter of 2024, the stock of Finnish households’ deposit stock grew by EUR 1.7 billion in net terms. Most of all, households reallocated their assets to fixed-term deposit accounts (EUR 1.2 billion) and second most to investment deposit accounts[1] (EUR 420 million). Meanwhile, households deposited EUR 80 million on overnight deposit accounts[2]. At a quarterly level, the last period with positive growth in overnight deposits was in the third quarter of 2022. At the end of June, EUR 68.1 billion of households’ deposits were overnight deposits, EUR 14 billion deposits with an agreed maturity and EUR 28.7 billion investment deposits.

Despite the growth in the second quarter, the total household deposit stock (EUR 110.8 billion) contracted by 0.1% from a year earlier. The deposit stock has contracted on a year-on-year basis since February 2023, but the rate of decline has slowed down this year. The total deposit stock has decreased due to the reduction in balances on overnight deposit accounts. In the last 12 months, the volume of overnight deposits has decreased by EUR 10 billion. Due to the reduction of deposit funds, the overnight deposit stock declined by 12.8% year-on-year in June 2024.

Meanwhile, the increased popularity of fixed-term and investment deposits due to the rising interest rate level has slowed down the contraction of the deposit stock. In June, the annual rate of growth of the stock of deposits with an agreed maturity was over 90%, while the stock of investment deposits grew by 12.5% year-on-year. In euro terms, households have moved EUR 6.7 billion of their assets to deposit accounts with an agreed maturity and EUR 3.2 billion to investment deposit accounts over the past 12 months.

At the end of June 2024, the average interest rate on the total deposit stock stood at 1.34%. The highest average interest was paid on deposits with an agreed maturity (3.17%) and the second-highest on investment deposits (2.17%). The average interest rate on the overnight deposit stock was 0.47%. In June, the average interest rate on new deposit agreements with an agreed maturity was unchanged from May at 3.56%.

The average interest rate on the stock of deposits with an agreed maturity has risen continuously ever since mid-2022. From a year ago, the average interest rate has risen by 1.13 percentage points. The rise in the interest rate on investment deposits and overnight deposits has slowed down this year, and the respective average rates declined slightly from May. From a year earlier, the average interest rate on the stock of investment deposits has risen by 0.81 percentage points, while the average interest rate on overnight deposits rose by 0.19 percentage points.

| Finnish deposits and investments (EUR million), 2024Q2 | ||||||

| All** | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 239 779 | 5 687 | 48 475 | 1 662 | 45 749 | 1 219 |

| (1 240) | (352) | (-145) | ||||

| - in domestic shares | 121 726 | -1 482 | 41 592 | 1 430 | 17 651 | -399 |

| (809) | (242) | (305) | ||||

| Bonds | 219 231 | -97 | 2 352 | 11 | 28 954 | -91 |

| (-5) | (-24) | (81) | ||||

| - in domestic bonds | 90 686 | -311 | 1 865 | 5 | 4 431 | -16 |

| (-3 980) | (-18) | (415) | ||||

| Fund shares | ||||||

| Domestic investment funds | 126 976 | 1 858 | 36 821 | 552 | 5 692 | 66 |

| (1 018) | (395) | (133) | ||||

| Foreign funds | 181 528 | 2 416 | 7 665 | 247 | 130 595 | 1 385 |

| (1 213) | (269) | (1 042) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 137 897 | 50 | 68 090 | 3 | 4 299 | 1 |

| (1 827) | (84) | (242) | ||||

| Other deposits | 52 258 | 3 | 42 694 | 0 | -* | -* |

| (2 133) | (1 652) | -* | ||||

* Confidential.

** Insurance corporations' securities and mutual fund information is missing.

For further information, please contact:

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website:

https://www.suomenpankki.fi/en/statistics2/.

The next news release on saving and investing will be published at 10 am on 11 November 2024.

[1] Investment deposits are deposits redeemable at notice. They do not have a fixed maturity date (unlike deposits with an agreed maturity), but they have a notice period, during which the deposit cannot be converted into cash without consequences (unlike overnight deposits). This class also includes investment accounts without a period of notice or agreed maturity but which have restrictive drawing provisions.

[2] Overnight deposits include transaction accounts and other types of accounts from which funds may be withdrawn or transferred freely.