Real estate funds in the Bank of Finland’s financial statistics

Classification of real estate funds

The Bank of Finland collects statistical data on real estate investment funds registered in Finland through the collection of balance sheet data on investment funds (SIRA) and the collection of balance sheet data on private equity funds (PEF). In the SIRA survey, data are collected monthly basis, while in the PEF survey, data are collected quarterly.

Real estate funds are classified in statistics based on the characteristics of each fund into separate classes, with some overlap in the classification (Table 1). Fund classifications also differ across statistical institutions. For instance, the Financial Supervisory Authority categorises forest funds as real estate funds, whereas in the Bank of Finland's statistical framework, these funds are predominantly classified under the category “other funds”.

Investment funds are divided into two groups depending on whether they are UCITS funds (Undertakings for Collective Investment in Transferable Securities) or Alternative Investment Funds (non-UCITS). A UCITS is a fund compliant with the UCITS Directive, which is registered in an EU member state and can be marketed in all EU member states. The Directive sets out rules, for example, concerning the diversification of risk arising from investment operations, and its purpose is to harmonise investment rules and investor protection across EU member states. Of the 175 real estate funds registered in Finland, only six are UCITS funds, with the remaining real estate funds being Alternative Investment Funds.

Moreover, funds are broken down into open-end and closed-end funds based on the variability of their capital. The division into open-end and closed-end funds used in the Bank of Finland's statistics is based on the European Central Bank's Manual, which differs slightly from the division used in the markets[1]. In the ECB's Manual, an open-end fund refers to an investment fund whose units or shares are repurchased or redeemed out of the fund’s assets. In contrast, closed-end funds have a fixed number of issued units and shares, which must be purchased or sold by the holders to enter or leave the fund. In terms of the net asset value of the principal investment assets, open-end real estate funds invest primarily in residential real estate, health care properties, office and commercial real estate as well as plots, forests and production assets. Under the ECB's classification, all UCITS funds registered in Finland are open-ended, but non-UCITS funds under the AIF category may include both open-end and closed-end funds. Meanwhile, private equity funds are closed-end Alternative Investment Funds. Of the real estate funds registered in Finland, 35 are open-ended, while 140 are classified as closed-end funds.

The Bank of Finland and the Financial Supervisory Authority classify funds further by AIF type into five categories based on whether the fund is aimed solely at institutional investors or also marketed to retail investors. Non-retail and non-retail AIFs are aimed solely at professional investors, whereas Retail, Retail AIF and Other retail funds may be marketed to professional and non-professional investors alike. Of the real estate funds registered in Finland, 79 are only marketed to institutional investors (Non-retail), while the remaining 96 are also marketed to retail investors (Retail + Other retail). Non-retail and Other retail funds are closed-end AIFs. Retail funds are open-end UCITS funds, whereas Retail AIF non-UCITS funds are open-end non-UCITS funds in terms of fund type.

Table 1 Classification of real estate funds registered in Finland for statistical purposes

|

AIF type |

Investment fund type |

UCITS/non-UCITS |

Open-end/closed-end |

For whom |

|

Retail |

Investment fund |

UCITS |

Open-end |

Institutional and retail investors |

|

Retail AIF |

Non-UCITS |

Non-UCITS |

Open-end |

Institutional and retail investors |

|

Other retail |

PEF |

Non-UCITS |

Closed-end |

Institutional and retail investors |

|

Non-Retail |

PEF |

Non-UCITS |

Closed-end |

Institutional investors |

|

Non-retail AIF |

Non-UCITS |

Non-UCITS |

Closed-end |

Institutional investors |

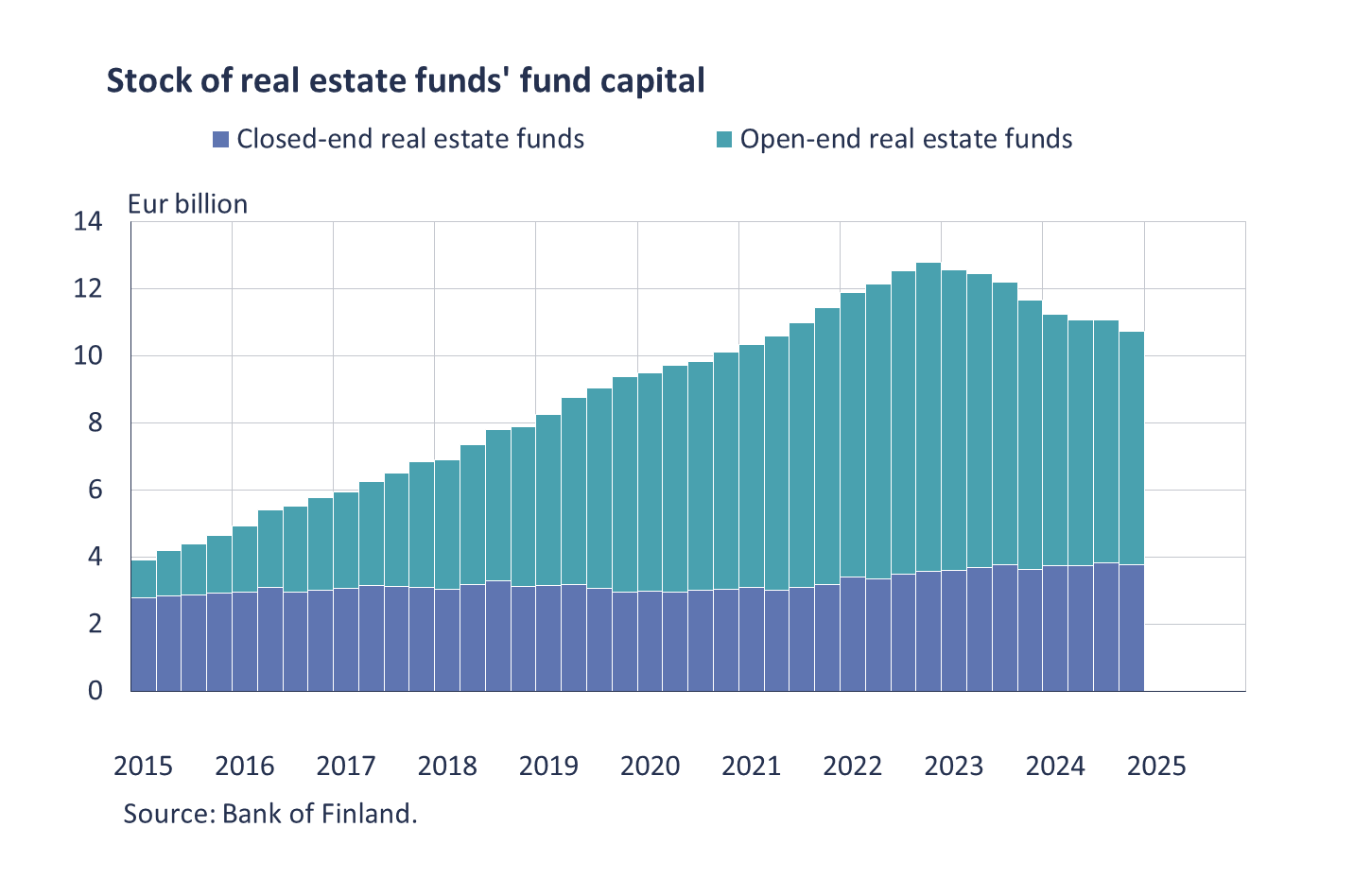

Evolution of capital stock in real estate funds

At the end of 2024, the capital stock of open-end real estate funds amounted to approximately EUR 6.9 billion, while that of closed-end real estate funds amounted to some EUR 3.7 billion (Chart 1). The capital stocks of open and closed-end real estate funds have trended in different directions. The stock of capital in open-end real estate funds grew steadily from 2015 to 2022 but has declined since the beginning of 2023. Over the same period, the stock of fund capital in closed-end real estate funds has shown moderate growth.

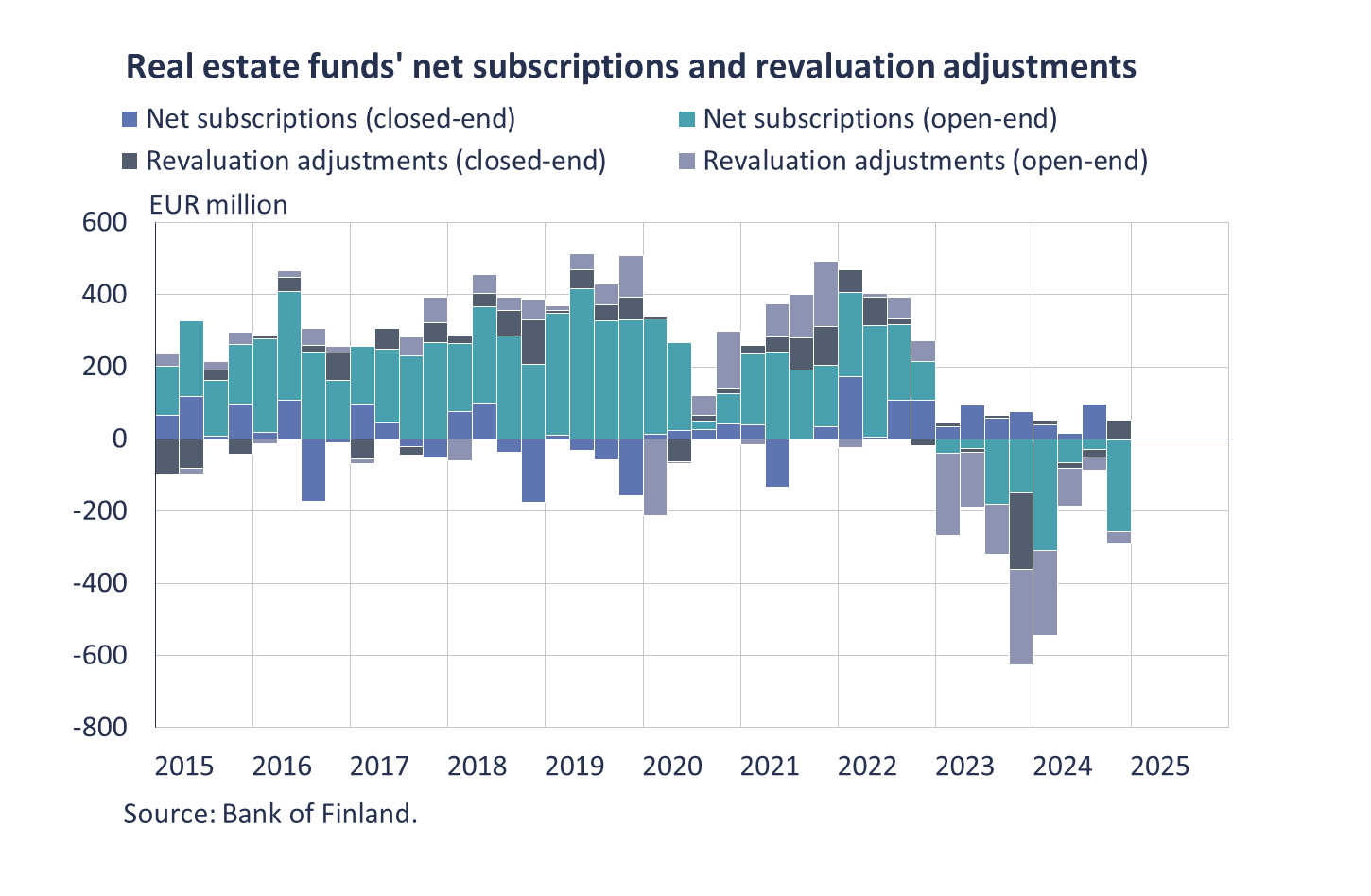

Redemptions from the funds have exceeded subscriptions; in other words, net subscriptions have been negative (Chart 2). Moreover, revaluation adjustments have simultaneously been negative. Net subscriptions were positive until the third quarter of 2024 but turned negative in the fourth quarter. Revaluation adjustments have shown fluctuations over time, but since 2023, they have been negative more often than positive.

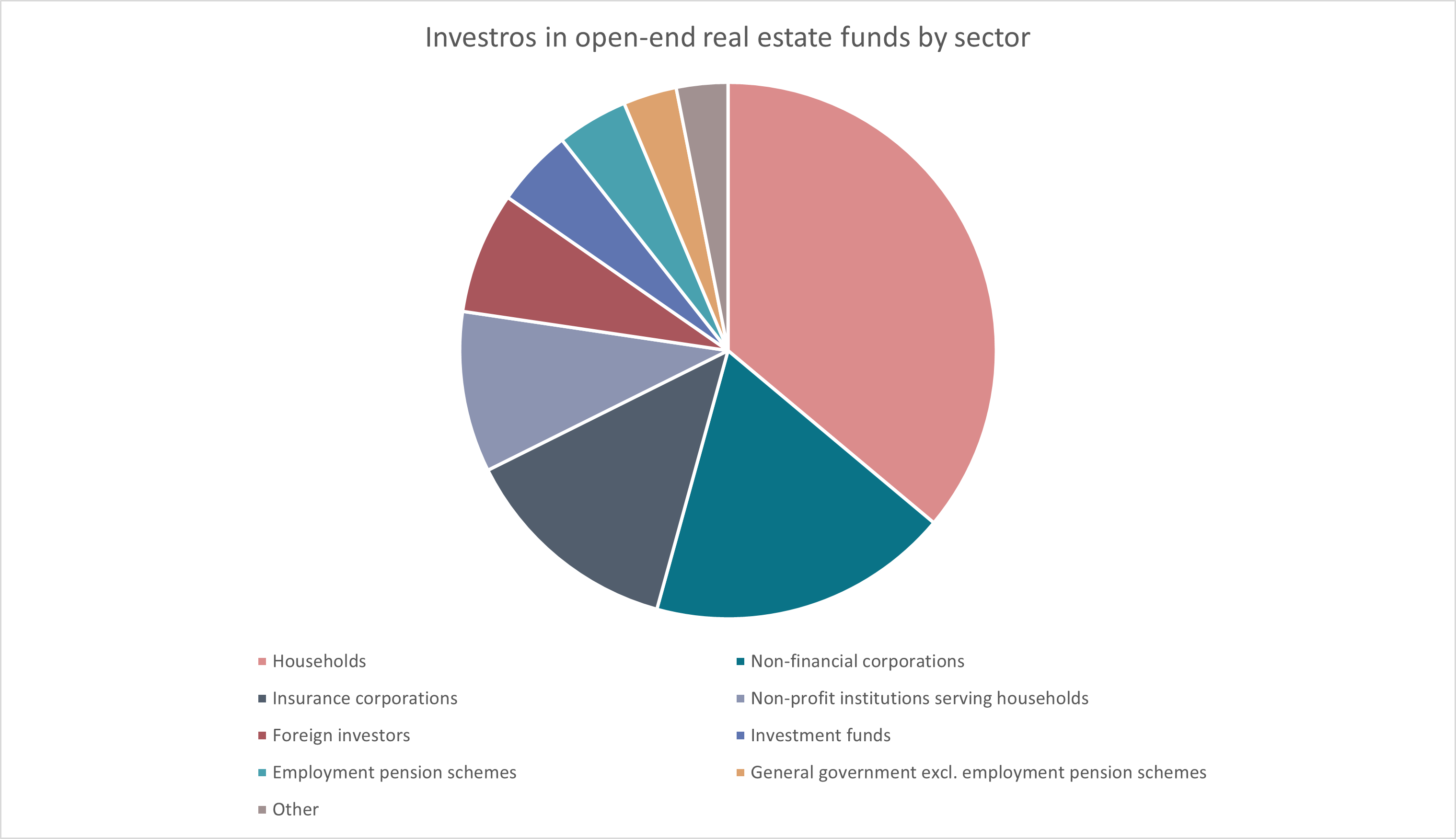

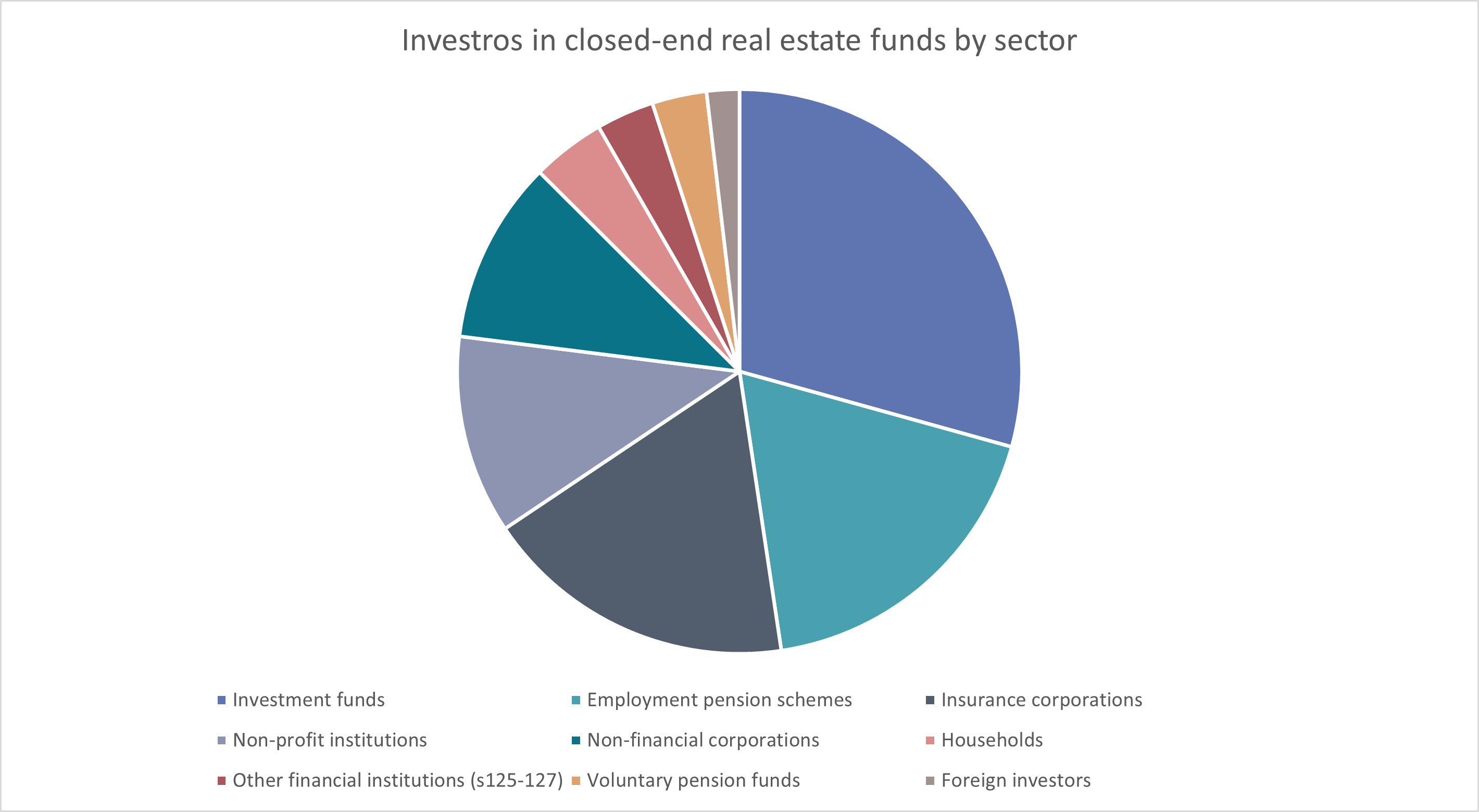

Investors in real estate funds by sector

Open-end real estate funds have received most of their capital from households and non-financial corporations (Chart 3). Moreover, insurance corporations and non-profit organisations have been significant investors in open-end real estate funds.

Meanwhile, the most significant investors in closed-end funds, which are typically marketed to institutional investors, have included insurance corporations, non-profit organisations as well as other investment funds and employee pension institutions (Chart 4). Households have accounted for a significantly smaller share investors in closed-end funds than in open-end funds.

[1] In the markets, open-end funds refer to funds where investors can make subscriptions and redemptions at regular intervals, and they are typically highly liquid. However, the management company has the right to suspend redemptions on a temporary basis if its cash funds required for redemptions must be acquired by selling the funds’ investments. In contrast, a closed-end fund is open for subscriptions only for a certain period of time, and they do not accept investments at any time.