Classification change in MFI data collection (RATI)

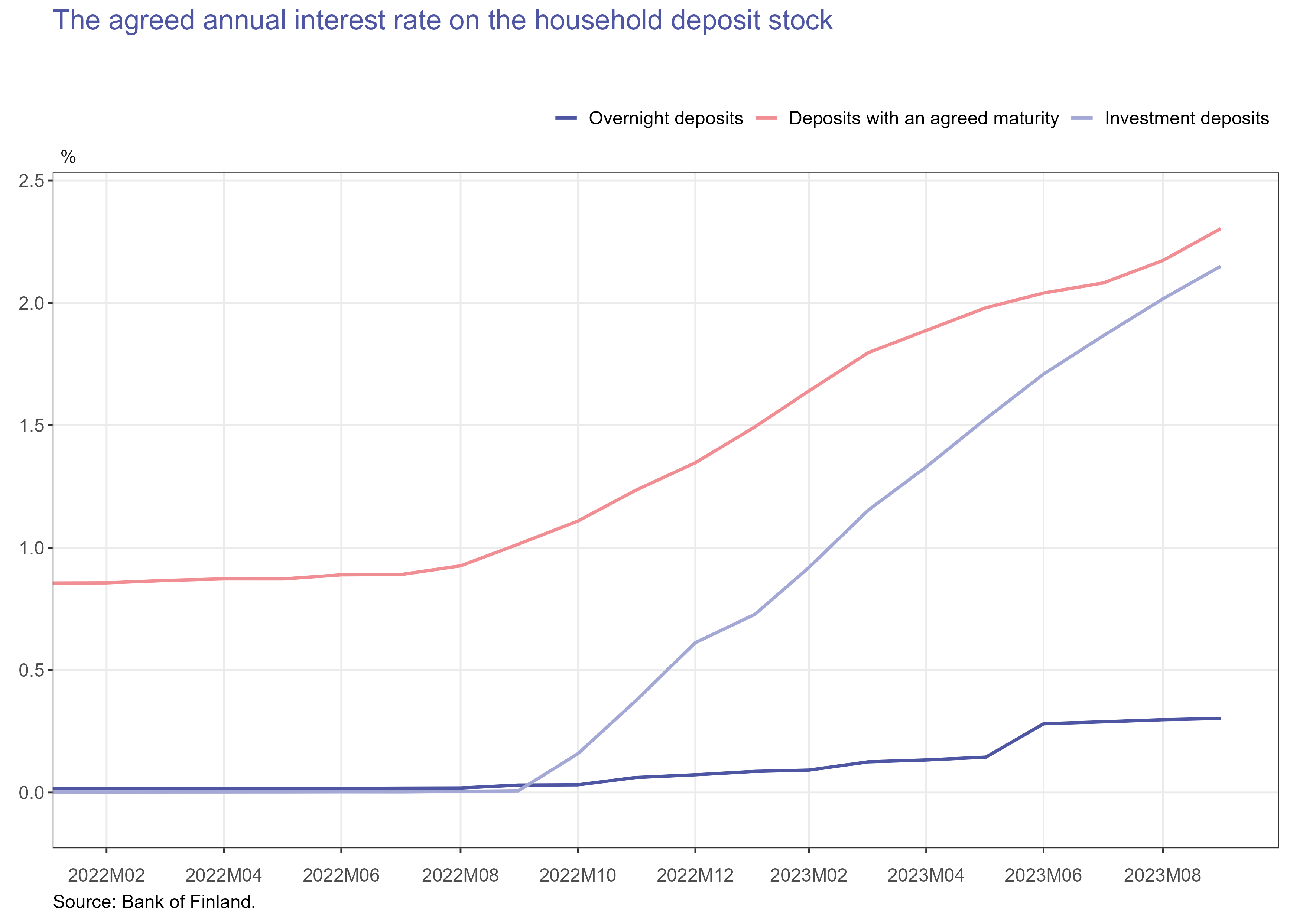

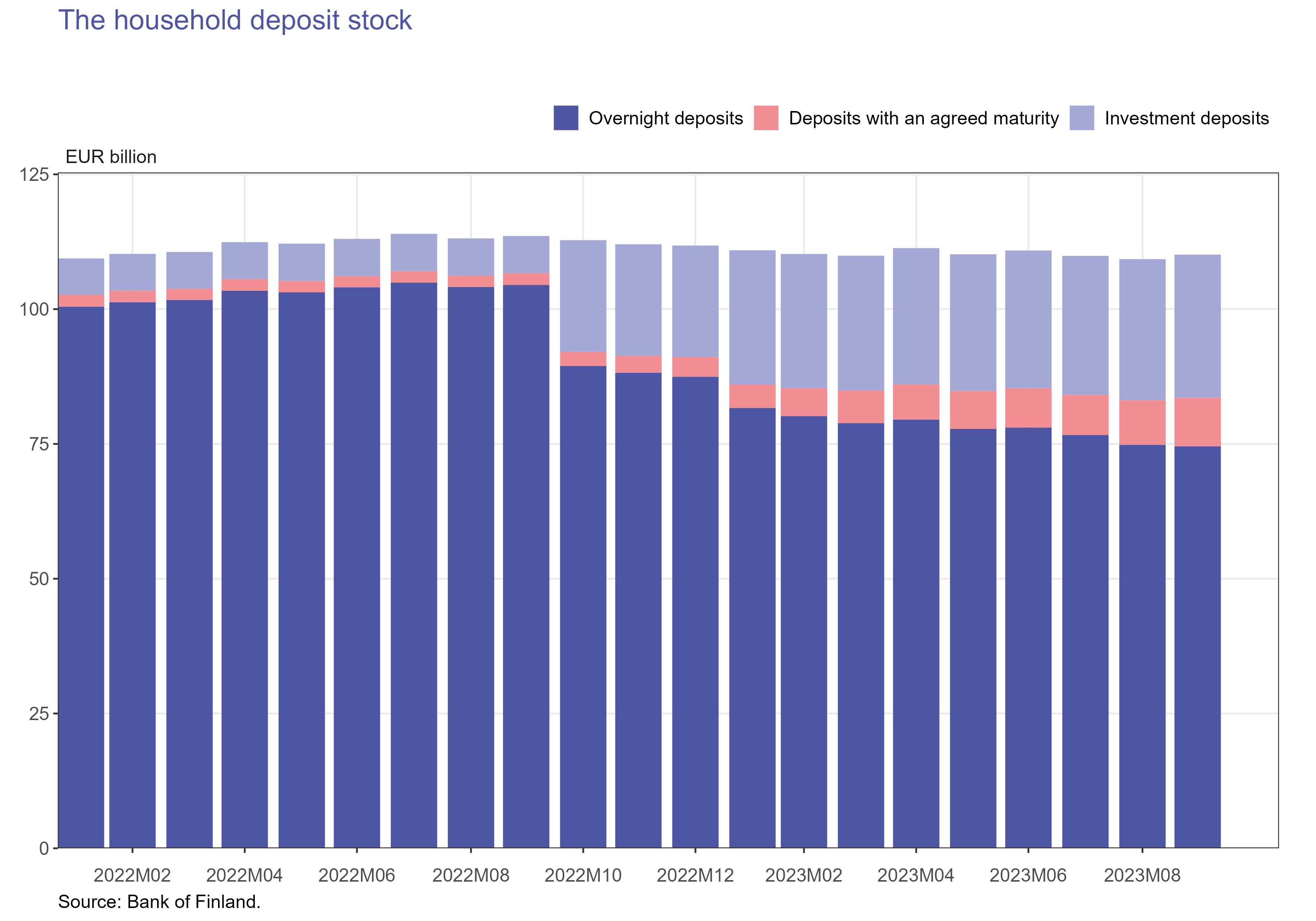

We have reviewed the development of interest rates on deposit and savings accounts provided by credit institutions as reported in the RATI survey[1] after the rise in the general level of interest rates. Based on this review, it has been discovered by that some deposit accounts subject to restrictive drawing provisions[2] or a period of notice have been incorrectly reported as overnight deposits. Therefore, the interest rate reported in the statistics for overnight deposits has been distorted. However, this has not affected the volume or average interest rate of the deposit stock since the issue is a classification error within the deposit stock.

The reclassification will be reflected in the data released in October. We have corrected historical data from October 2022. Corrections are visible in October 2022, January 2023, March 2023, and July 2023.

The charts below show the breakdown of deposits across different account types and development of respective average interest rates. Overnight deposits include transaction accounts and other overnight deposits.

For further information please contact:

Tuomas Nummelin, tel. +358 9 183 2373, email: tuomas.nummelin(at)bof.fi,

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi.

[1] Collection of statistical data on monetary financial institutions. (https://www.suomenpankki.fi/en/statistics2/to-the-reporter/mfi-data-collection/)

[2] For example, a restriction of the number of free-of-charge withdrawals in a month.