Households’ investment fund holdings increased in 2024

Households’ investment fund holdings increased in 2024. Foreign equities held by Finnish households outperformed domestic equities in 2024. Interest rates on deposits with agreed maturity and investment deposits have declined.

In 2024, Finnish households invested a further EUR 1.6 billion in net terms in Finnish investment funds[1]. Equity funds attracted clearly the largest investments (EUR 1.0 billion), followed by bond funds (EUR 500 million). Of the fund types, only real estate funds recorded more redemptions than new investments, totalling EUR 240 million, on net.

In addition to new investments, the value of domestic investment fund holdings also appreciated by over EUR 3 billion in 2024. At the end of 2024, households’ holdings in domestic investment funds totalled EUR 38.7 billion. Households also had a significant amount of holdings (estimated at EUR 25.1 billion[2]) in domestic investment funds through unit-linked insurance policies.

In 2024, Finnish households also invested a further EUR 1.2 billion in foreign investment funds[3], and the value of these holdings appreciated by EUR 1.0 billion. At the end of 2024, foreign investment fund units held by households amounted to EUR 8.6 billion, compared with EUR 6.5 billion a year earlier. Households also had holdings in foreign investment funds (estimated at EUR 10.5 billion) through unit-linked insurance policies.

Foreign equities held by Finnish households outperformed domestic equities in 2024

At the end of 2024, households owned listed equities[4] worth EUR 46.5 billion, an increase of 1% year-on-year. Most (85%) of the listed equities held by households were domestic companies’ equities. However, the proportion of foreign equities has increased. At the end of 2024, foreign equities accounted for 15% of households’ holdings of listed equities, as opposed to 13% a year earlier. In 2024, households invested a further EUR 1.6 billion in net terms[5] in listed equities.

The rate of return[6] on domestic companies’ equities held by households was zero in 2024. The return on foreign companies’ equities was 18%. In 2024, households received dividends worth EUR 1.9 billion from Finnish companies, but the value of domestic equities declined by almost an equal amount. The value of foreign equity holdings increased in turn by EUR 0.9 billion in 2024, and households’ dividends from foreign companies totalled EUR 170 million.

Interest rates on deposits with agreed maturity and investment deposits have declined

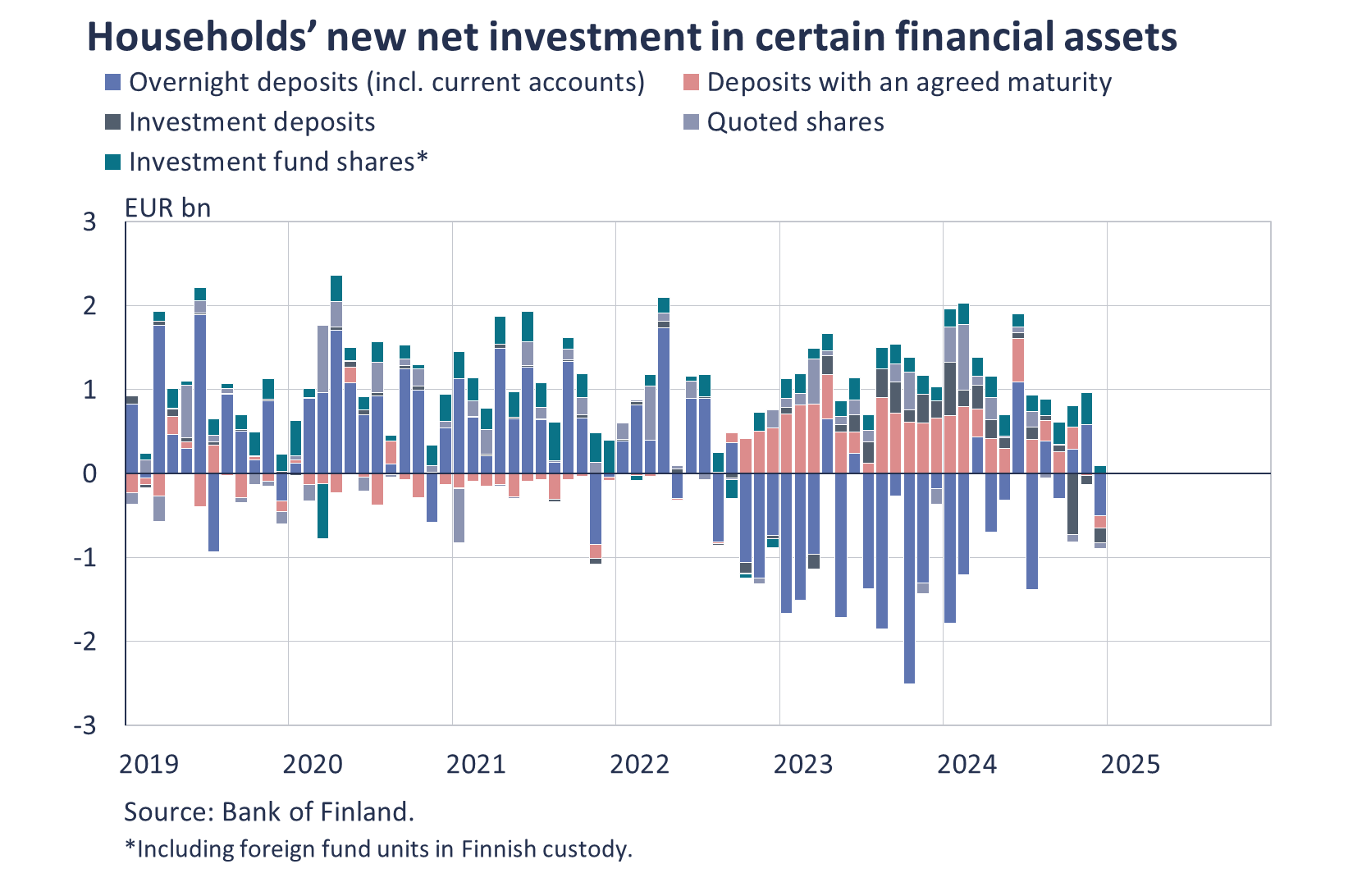

At the end of 2024, the stock of Finnish households’ deposits stood at EUR 110.2 billion, and the annual growth rate of the deposit stock was 1.4%. Over the year, households moved EUR 4.9 billion of their funds to higher-interest deposit accounts. This was notably less than in the previous year, when the corresponding inflows totalled EUR 9.3 billion. At the end of 2024, 61% of households’ assets on deposit accounts were on overnight deposit accounts (incl. current accounts), 14% were deposits with an agreed maturity and 25% were investment deposits[7].

The average interest rate on the deposit stock started to decline in 2024, standing at 1.23% in December. The average interest rate on the stock of deposits with an agreed maturity fell below 3% in December, while that on the stock of investment deposits fell below 2%. The average interest rate on new deposit agreements with an agreed maturity stood at 2.79% in December 2024, compared with 3.42% in December a year earlier.

Finnish deposits and investments (EUR million), 2024Q4 |

||||||

| All** | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 238 310 | -7 258 | 46 532 | -3 639 | 46 117 | -378 |

| (-7 137) | (-168) | (-96) | ||||

| - in domestic shares | 113 082 | -12 612 | 39 406 | -3 833 | 17 090 | -1759 |

| (168) | (-228) | (368) | ||||

| Bonds | 233 816 | 328 | 2 440 | -36 | 28 177 | 99 |

| (7 051) | (179) | (-2551) | ||||

| - in domestic bonds | 93 038 | -39 | 1 746 | -36 | 3 877 | -3 |

| (1 235) | (-77) | (-674) | ||||

| Fund shares | ||||||

| Domestic investment funds | 133 321 | 1 658 | 38 673 | 366 | 5 649 | 30 |

| (1 381) | (384) | (-134) | ||||

| Foreign funds | 189 583 | 7 286 | 8 598 | 191 | 137 475 | 5 952 |

| (1 471) | (353) | (1 368) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 138 682 | 165 | 67 165 | 11 | 6 422 | 11 |

| (561) | (366) | (643) | ||||

| Other deposits | 52 072 | 15 | 42 987 | 1 | -* | -* |

| (-926) | (-911) | -* | ||||

* Confidential.

** Insurance corporations' securities and mutual fund information is missing.

Related statistical data and graphs are also available on the Bank of Finland website at: https://www.suomenpankki.fi/en/statistics/?epslanguage=en.

The next news release on saving and investing will be published at 10:00 on 8 May 2025.

[1] Including UCITS and non-UCITS investment funds registered in Finland.

[2] At the end of September 2024. The estimate is calculated based on Finance Finland’s insurance savings statistics and the Bank of Finland’s statistics on insurance corporations.

[3] Investment fund units held in custody in Finland.

[4] Held in custody in Finland.

[5] Purchases – sales.

[6] The return has been calculated from revaluation adjustments based on monthly changes in equity prices and dividends received.

[7] Investment deposits are deposits redeemable at notice. They do not have a fixed maturity date (unlike deposits with an agreed maturity), but have a notice period, during which the deposits cannot be converted into cash without consequences (unlike overnight deposits). This category also includes investment accounts without a period of notice or agreed maturity but which have restrictive drawing provisions.