Value of households’ equity holdings decreased significantly

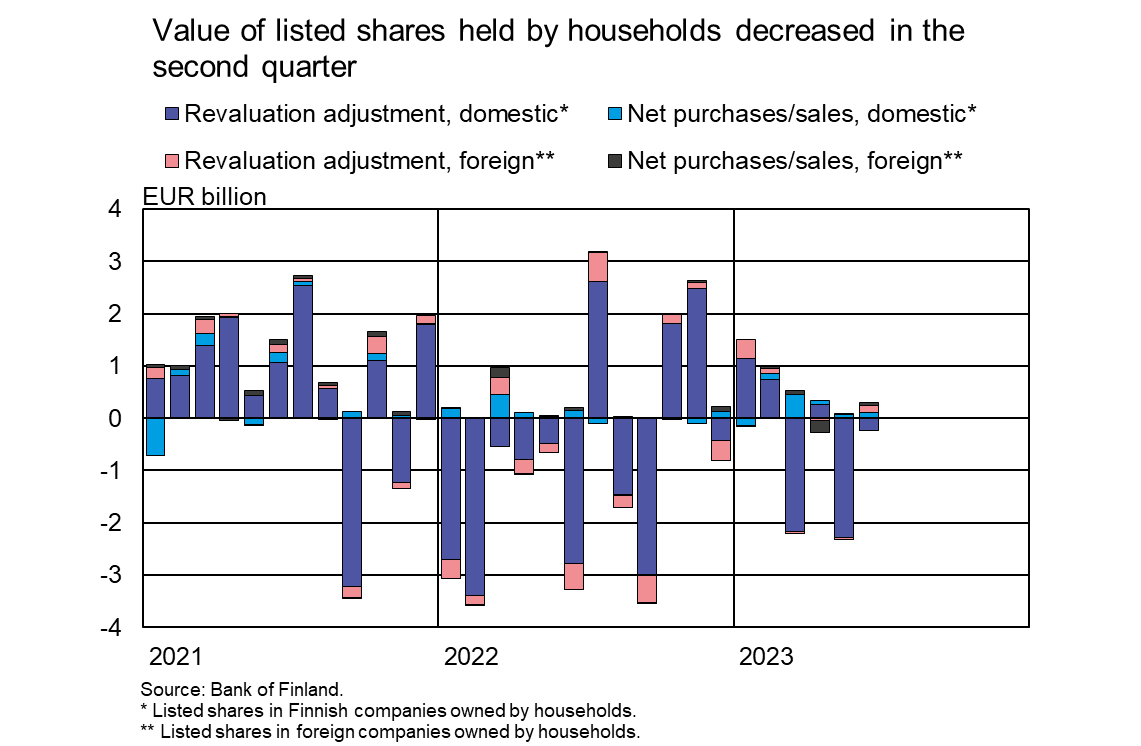

The value of listed shares held by Finnish households decreased by EUR 2.2 billion in the second quarter of 2023. The value of the holdings decreased as the value of domestic companies’ shares declined.

The value of listed shares held by Finnish households decreased by EUR 2.2 billion in the second quarter of 2023. The value of the holdings decreased as the value of domestic companies’ shares declined. Meanwhile, the value of foreign listed shares held by households increased slightly (EUR 44 million) in the second quarter of the year. The decrease in the value of domestic equity holdings occurred mainly in May, when it contracted by EUR 2.3 billion. In June, the value of domestic equity holdings decreased more moderately, by EUR 229 million.

In the second quarter of 2023, households invested a further EUR 251 million in net terms in domestic equities. At the same time, more foreign companies’ equities were sold than bought: net sales amounted to EUR 151 million.

At the end of June 2023, households’ listed equity holdings amounted to EUR 45.0 billion, which was 4.5% less than at the end of the previous quarter. The majority (88%) of households’ equity holdings were in domestic companies’ shares. The proportion of foreign companies’ shares in households’ equity portfolios has increased in recent years, while still remaining low. At the end of 2019, foreign companies’ shares accounted for less than 9% of the equity holdings.

Popularity of fixed-term deposits continued and value of investment fund holdings grew

The popularity of deposits with an agreed maturity continued in the second quarter of 2023, when Finnish households made EUR 2.0 billion worth of new deposit agreements with an agreed maturity. In the corresponding period a year earlier, they amounted to just EUR 128 million. The popularity of fixed income investments has increased as interest rates have risen. In June 2023, the average interest rate on new deposits with an agreed maturity was 2.90%, as opposed to 0.65% in last year’s June.

As a result of the recent popularity, the stock of households’ deposits with an agreed maturity (EUR 7.2 billion) has grown fast, and at the same time, its proportion of the entire deposit stock (EUR 110.9 billion) has also increased considerably. At the end of June 2023, deposits with an agreed maturity accounted for 6.6% of the deposit stock, in contrast to only 1.9% a year earlier. However, the majority (74%) of households’ deposits still consists of overnight deposits[1].

Households’ holdings in Finnish investment funds grew 2.7% from the previous quarter to stand at EUR 32.0 billion at the end of June.[2] In the second quarter, households made net subscriptions of EUR 466 million in investment funds. More than half of the net subscriptions were made in bond funds and a good third in equity funds. Households’ redemptions exceeded subscriptions only in the real estate fund category. In addition to the net subscriptions, the value of investment funds holdings appreciated by EUR 364 million in April-June. Most of the increase in value occurred in equity funds, but also bond funds and mixed funds appreciated. In contrast, the value of real estate funds declined slightly in the second quarter (EUR 62 million).

| Finnish deposits and investments (EUR million), 2023Q2 | ||||||

| All** | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 210 599 | -6 934 | 44 971 | -2 191 | 34 754 | -104 |

| (6 889) | (100) | (-59) | ||||

| - in domestic shares | 122 275 | -9 535 | 39 621 | -2 234 | 16 391 | -1 084 |

| (775) | (251) | (313) | ||||

| Bonds | 218 050 | -1 103 | 1 330 | -2 | 29 850 | -132 |

| (-5 505) | (-14) | (226) | ||||

| - in domestic bonds | 99 042 | -295 | 798 | -3 | 4 774 | 1 |

| (-4 366) | (1) | (605) | ||||

| Fund shares | ||||||

| Domestic investment funds | 112 500 | 1 524 | 32 017 | 364 | 5 207 | 50 |

| (1 708) | (466) | (-2) | ||||

| Foreign funds | 172 043 | 2 501 | 5 858 | 158 | 127 563 | 1 582 |

| (1 859) | (198) | (2 145) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 156 343 | -39 | 81 825 | -3 | 4 152 | -1 |

| (-3 966) | (132) | (-1 236) | ||||

| Other deposits | 36 920 | 0 | 29 052 | 0 | -* | -* |

| (1 911) | (835) | -* | ||||

* Confidential.

** Insurance corporations' securities and mutual fund information is missing.

For further information, please contact:

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics2/.

The next news release on saving and investing will be published at 10 am on 9 November 2023.

[1] A classification change has been made to the deposit data for June, which reduced overnight deposits’ share of the deposit stock and correspondingly increased the share of reposits redeemable at notice.

[2] Households’ holdings in Finnish investment funds amounted to EUR 12.9 billion in equity funds, EUR 8.5 billion in bond funds, EUR 6.3 billion in mixed funds, EUR 3.1 billion in real estate funds and EUR 1.2 billion in other funds.