Popularity of higher-interest deposits increased

In the wake of rising interest rates, Finnish households have moved their funds to higher-interest deposit accounts. In the course of 2023, households moved EUR 7.3 of their funds to deposit accounts with an agreed maturity and a little over EUR 2 billion to investment deposit accounts .

In the wake of rising interest rates, Finnish households have moved[1] their funds to higher-interest deposit accounts. In the course of 2023, households moved EUR 7.3 of their funds to deposit accounts with an agreed maturity and a little over EUR 2 billion to investment deposit accounts[2]. Overall, however, the household deposit stock[3] (EUR 108.7 billion) contracted by over EUR 3 billion, as the amount in overnight deposit accounts[4] decreased by EUR 12.4 billion over the same period.

Despite the decrease, the most (65%) of households’ deposits are still in overnight deposit accounts (incl. transaction accounts). At the end of 2023, EUR 70.6 billion of households’ deposits were overnight, EUR 10.9 billion with an agreed maturity and EUR 27.2 billion investment deposits.

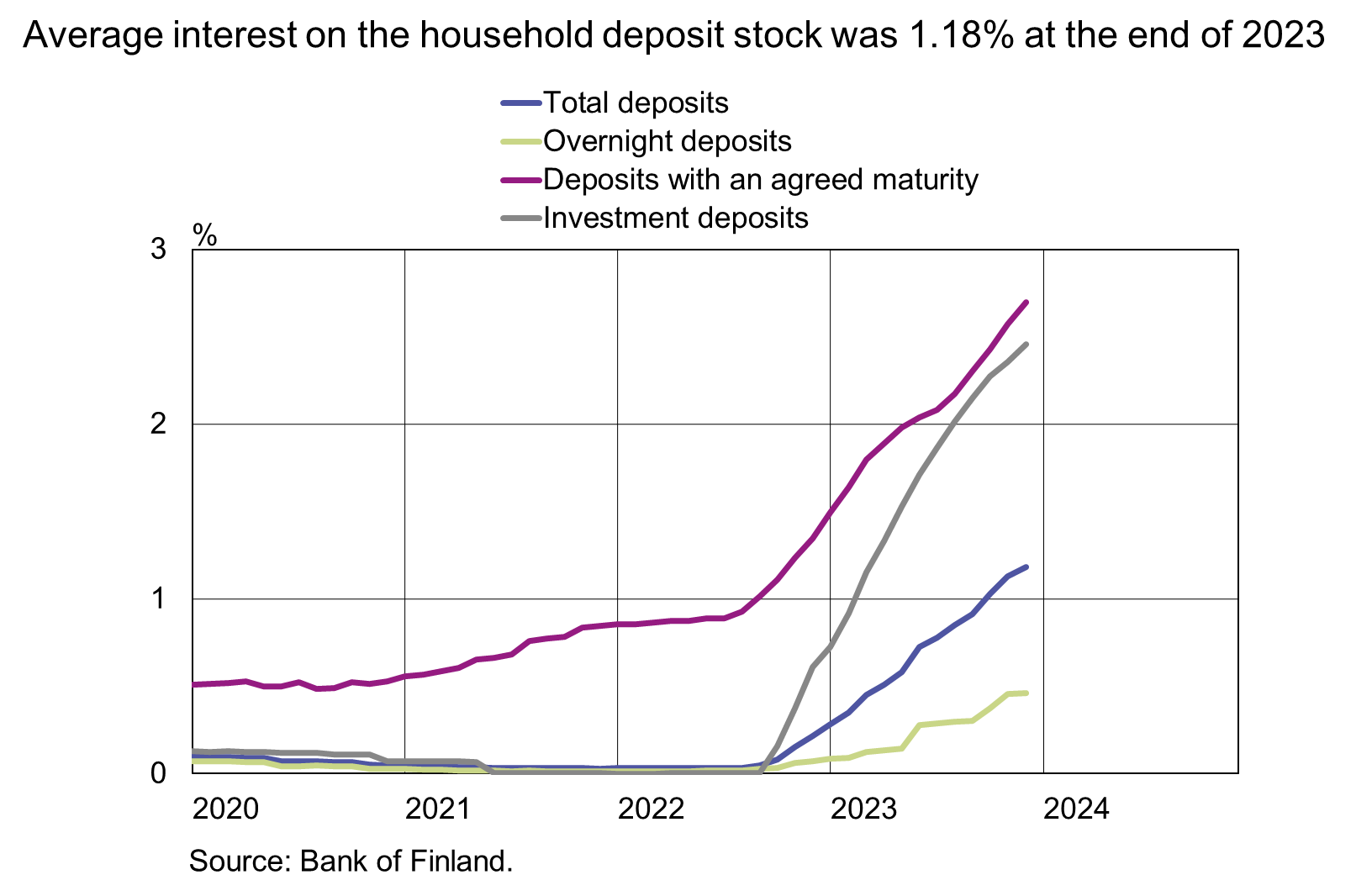

As the level of interest rates has risen, the interest rate differentials between different types of deposit accounts have widened. The average interest on households’ agreed-maturity and investment deposits has risen rapidly. At the end of December 2023, the average interest on the stock of deposits with an agreed maturity was 2.70%, and the average interest on the investment deposit stock was 2.46%. Meanwhile, the average interest on the overnight deposit stock has also risen, to stand at 0.46% at the end of December.

In end-December 2023, the average interest rate on the aggregate household deposit stock was 1.18%, as opposed to 0.21% a year earlier. The average interest on the household deposit stock has not been any higher since 2009.

The average interest on new deposit agreements with an agreed maturity concluded by households declined slightly from November 2023 to 3.42% in December. Until then, the average interest rate on new deposits with an agreed maturity had risen without an interruption since July 2022. In Finland, the average interest on new agreed-maturity deposits in December was slightly higher than in the euro area on average. In December 2023, the average interest on new agreed-maturity deposits in the euro area was 3.29%, also showing a slight decline from November.

| Finnish deposits and investments (EUR million), 2023Q4 | ||||||

| All** | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 211 498 | 10 745 | 46 011 | 2 228 | 36 509 | 2 188 |

| (-3 265) | (147) | (475) | ||||

| - in domestic shares | 123 443 | 4 858 | 40 259 | 1 702 | 17 158 | 901 |

| (1 569) | (187) | (340) | ||||

| Bonds | 222 325 | 7 546 | 2 414 | 60 | 29 320 | 1050 |

| (953) | (38) | (-1 062) | ||||

| - in domestic bonds | 97 115 | 3 831 | 1 912 | 48 | 4 498 | 195 |

| (-892) | (5) | (-462) | ||||

| Fund shares | ||||||

| Domestic investment funds | 118 577 | 5 392 | 34 062 | 1567 | 5 331 | 189 |

| (543) | (381) | (-14) | ||||

| Foreign funds | 176 391 | 2 005 | 6 484 | 378 | 129 512 | -55 |

| (649) | (182) | (1 083) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 142 484 | -61 | 70 557 | -4 | 5 760 | -4 |

| (-390) | (-3 995) | (2 130) | ||||

| Other deposits | 46 929 | -9 | 38 116 | -1 | -* | -* |

| (2 493) | (2 563) | -* | ||||

| * Confidential. | ||||||

| ** Insurance corporations' securities and mutual fund information is missing. | ||||||

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi,

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics2/.

The next news release on saving and investing will be published at 10 am on 8 May 2024.

[1] In net terms.

[2] Investment deposits are deposits redeemable at notice. They do not have an agreed maturity date (unlike deposits with an agreed maturity), but they have a notice period, during which the deposit cannot be converted into cash without consequences (unlike overnight deposits). This class also includes investment accounts without a period of notice or agreed maturity, but which have restrictive drawing provisions.

[3] Several deposits subject to restrictive drawing provisions were reclassified for statistical purposes from overnight deposits to investment deposits. This change increased the volume of investment deposits and reduced overnight deposits. The historical data has been revised as of October 2022. For more detailed information on reclassifications concerning deposits, see (link).

[4] Includes transaction accounts and other types of accounts from which funds may be withdrawn or transferred freely.