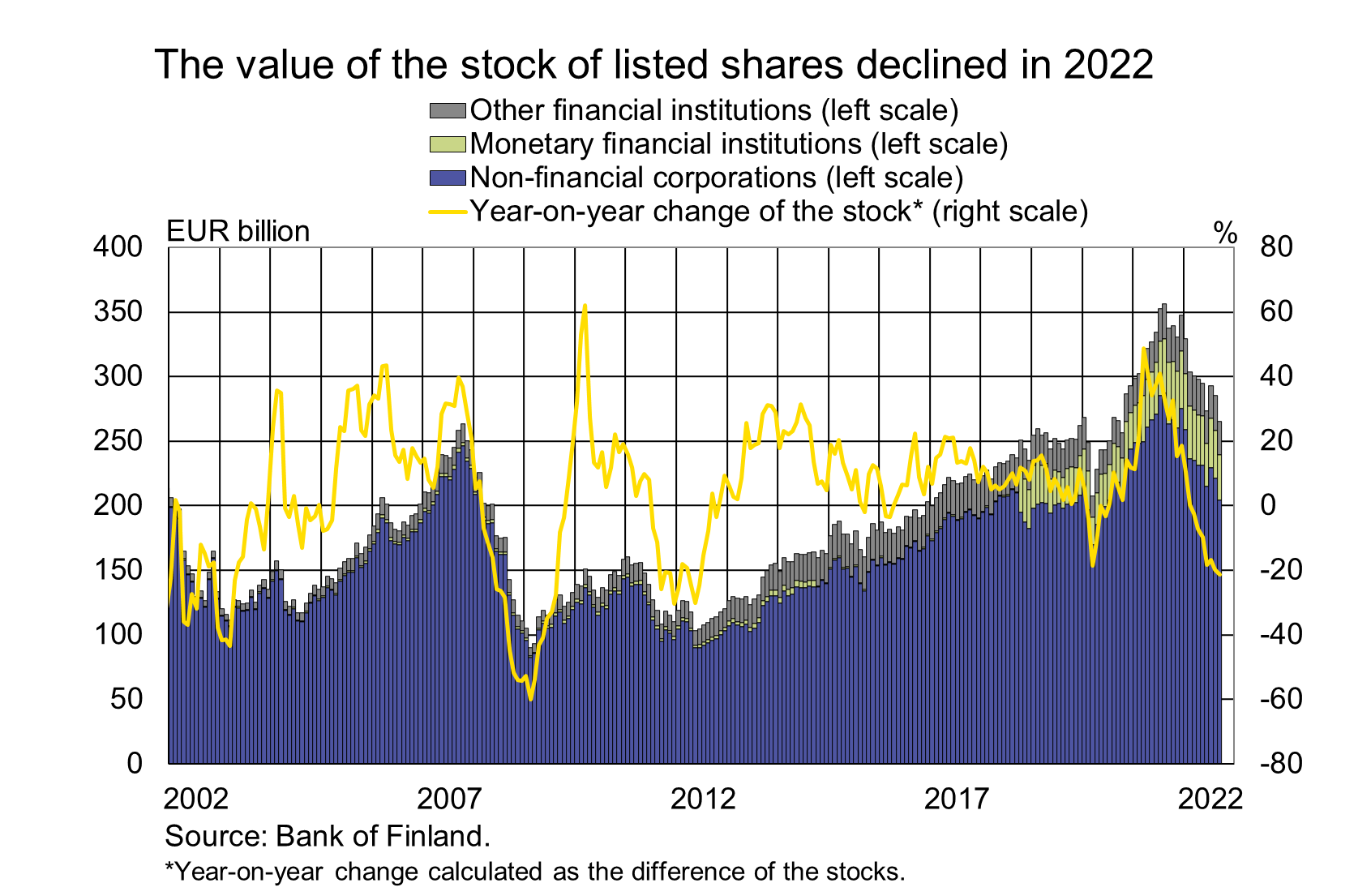

Market value of listed Finnish equities and debt securities declined in 2022

The market value of listed Finnish equities has declined rapidly in the course of 2022. In September 2022, the market value of the equities stood at EUR 265 billion, 21% less than a year earlier.

Less than half of listed shares issued by Finnish companies are held by domestic owners. The proportion of domestic shareholders has decreased somewhat in recent years, to stand at 46% at the end of September 2022. The value of domestic shareholdings totalled EUR 121.5 billion. Among domestic residents, households are the largest holder of Finnish equities, with a share of 14%. The next largest shareholdings belong to the central government (11%) and employee pension institutions (6%). The largest foreign shareholdings[1] were in the United States, Sweden and the United Kingdom.

Following the rise of interest rates, the value of bonds on the secondary markets has declined

At the end of September 2022, the market value of debt securities issued by Finnish residents amounted to EUR 351 billion, 7% less than at end-2021. In September, bonds accounted for EUR 291 billion of the debt securities, with the rest of the debt securities having an initial maturity of up to one year. Following the rise of interest rates, the value of bonds has declined on the secondary markets. From January to September 2022, the value of the stock of bonds declined by EUR 38 billion. At the end of September 2022, the nominal value of the stock of bonds was EUR 321 billion, which was EUR 30 billion more than the market value at the same point in time.

In January–September 2022, the issuance of new bonds exceeded redemptions by EUR 7.9 billion, contributing to the growth of the stock.

| Finnish deposits and investments (EUR million), 2022Q3 | ||||||

| All | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 197 645 | -7 237 | 42 459 | -2 025 | 33 117 | -1 261 |

| (-960) | (-83) | (1 158) | ||||

| - in domestic shares | 121 468 | -5 176 | 37 566 | -1 842 | 15 633 | -807 |

| (270) | (-136) | (229) | ||||

| Bonds | 224 839 | -6 010 | 1 126 | -15 | 25 838 | -567 |

| (-1 644) | (-72) | (-675) | ||||

| - in domestic bonds | 103 723 | -3 410 | 577 | -14 | 3 436 | -114 |

| (-1 716) | (-39) | (0) | ||||

| Fund shares | ||||||

| Domestic investment funds | 104 036 | -2 134 | 29 238 | -695 | 4 915 | -100 |

| (-823) | (165) | (-2) | ||||

| Foreign funds | 179 474 | 1 489 | 5 039 | -126 | 125 148 | 2 247 |

| (-2 290 ) | (110) | (-2 813) | ||||

| Finnish bank deposits | ||||||

| Overnight deposits (transaction accounts) | 187 560 | 132 | 104 494 | 18 | 6 916 | 5 |

| (-1 143) | (450) | (-1 317) | ||||

| Other deposits | 13 421 | 8 | 9 064 | 2 | -* | -* |

| (1 093) | (52) | -* | ||||

*confidential

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: shttps://www.suomenpankki.fi/en/Statistics/saving-and-investing/.

The next news release on saving and investing will be published at 10 am on 9 February 2023.

[1] As at end-June 2022.