Market value of Finnish shares and shareholdings soared

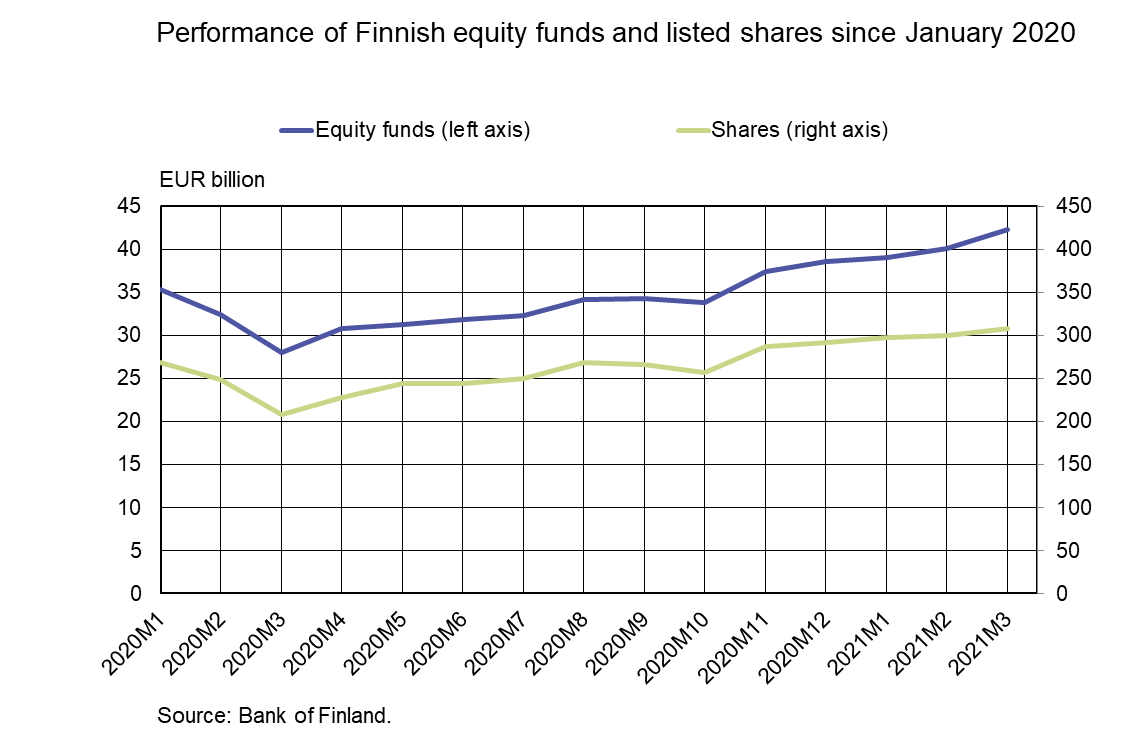

The market value of shares issued by listed Finnish companies[1] has increased for several consecutive years. It declined temporarily because of the COVID-19 crisis, but since March 2020, the market capitalisation of Finnish equities has risen by 48% to stand at EUR 307 billion at the end of March 2021. Half of Finnish companies’ listed shares are held by domestic owners.[2] In addition to appreciation, the total value of equities was boosted somewhat by several initial public offerings by Finnish companies in early 2021. In January-March, Finnish companies issued new equities worth EUR 360 million.[3]

Listed shares constitute a significant proportion of Finns’ financial assets. At the end of March 2021, Finns’[4] equity holdings totalled EUR 236.2 billion, 35% of which in foreign equities. In March 2021, the market value of the holdings increased by EUR 7.3 billion. Meanwhile, Finns made net equity investments of EUR 790 million, EUR 600 million of which was allocated to foreign equities.

Finnish households’ holdings in listed shares reached a record high (EUR 48.9 billion) in March. The value of households’ equity holdings increased by EUR 1.6 billion, while households made EUR 290 million of new net equity investments in March 2021. 90% of equities held by households were in Finnish companies. Households are the largest domestic owner sector in Finnish equities. In addition to direct equity holdings, households have indirect holdings through investment funds and unit-linked insurance policies made with insurance companies.

Equity funds surpassed bond funds as the largest fund type in Finland

The price performance of the equity markets has driven the rise of Finnish investment funds’ fund share liability into a record-high level. At the end of March 2021, the fund share liability stood at EUR 143.6 billion. The growth was particularly strong in equity funds, which surpassed bond funds as Finland’s largest investment fund type in March 2021.

The fund share liability of Finnish equity funds totalled EUR 60.7 billion at the end of March 2021. It had grown by EUR 6.2 billion in the first quarter of 2021. The appreciation of the underlying investments boosted the fund share liability by EUR 5.1 billion, in addition to which there were EUR 1.1 billion of net subscriptions in equity funds.

Finnish equity funds’ investments in foreign shares experienced a particularly strong appreciation (EUR 3.7 billion) in early 2021. At the end of March 2021, Finnish equity funds had a total of EUR 43.6 billion of foreign shareholdings and EUR 7.8 billion of domestic shareholdings. The funds invested a further EUR 1.5 billion in foreign equities while reducing EUR 0.1 billion from their domestic equity holdings during the first quarter of 2021.

At the end of March 2021, Finnish households held in Finnish investment funds’ units worth EUR 11.5 billion. If households’ indirect holdings through unit-linked insurance policies are included, households are the largest group of unitholders in Finnish equity funds. The appreciation of equity funds increased the value of households’ holdings by EUR 0.9 billion in January–March. In addition, households made net subscriptions of EUR 0.3 billion in equity funds in January–March 2021.

Finnish deposits and investments (EUR million), 2021Q1 |

||||||

| All | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 236 197 | 13 489 | 48 855 | 3 437 | 36 597 | 2 614 |

| (8 020) | (-162) | (-520) | ||||

| - in domestic shares | 153 220 | 6 380 | 43 707 | 2 947 | 18 643 | 1 130 |

| (975) | (-356) | (-281) | ||||

| Bonds | 225 151 | -1 616 | 1 770 | 55 | 30 900 | -179 |

| (9 922) | (-107) | (1 323) | ||||

| - in domestic bonds | 96 498 | -1 071 | 1 072 | 36 | 3 971 | -18 |

| (8 230) | (-100) | (222) | ||||

| Fund shares | ||||||

| Domestic investment funds | 111 442 | 4 059 | 29 718 | 1 278 | 5 800 | 224 |

| (1 895) | (579) | (-248) | ||||

| Foreign funds | 163 173 | 7 825 | 4 142 | 235 | 111 856 | 5 676 |

| (1 950) | (269) | (1 198) | ||||

| Finnish bank deposits | ||||||

| Transaction accounts | 188 343 | 110 | 94 771 | 11 | 8 100 | 9 |

| (2 389) | (2 009) | (-1 799) | ||||

| Other deposits | 80 875 | 2 | 10 054 | 0 | -* | -* |

| (12 094) | (-401) | -* | ||||

| *confidential | ||||||

For further information, please contact:

Antti Alakiuttu, tel. + 358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing.

The next news release on saving and investing will be published on 10 August 2021.

[1] Incl. both non-financial corporations (S.11) and financial corporations (S.12).

[2] Source: Bank of Finland's securities statistics.

[3] The IPOs were concentrated on March in particular.

[4] Holdings of investment funds, households and employment pension schemes accounted for 60% of Finns’ total equity holdings.