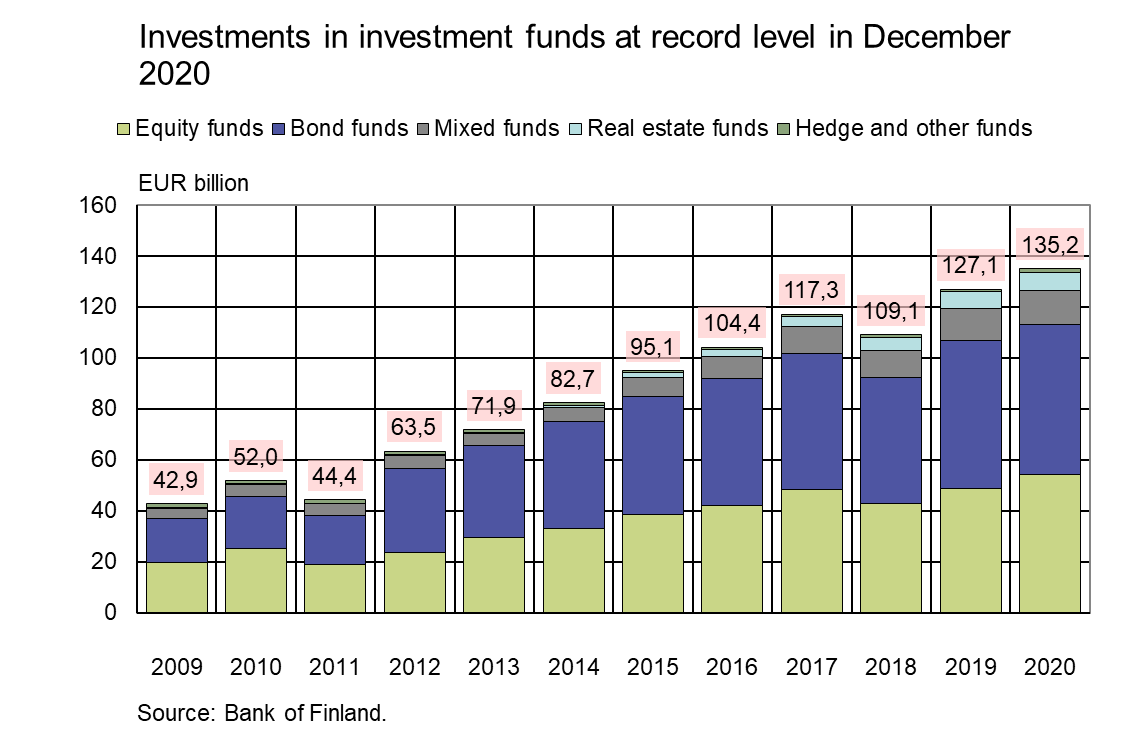

Investments made in Finnish investment funds at record level

In December 2020, investments in Finnish investment funds amounted to EUR 135.2 billion, more than ever before. Fund share liability grew by EUR 8.1 billion during 2020. In January-March 2020, investment funds’ market value declined by EUR 15.6 billion, in addition to net redemptions of EUR 2.8 billion due to the international coronavirus pandemic[1]. However, the appreciation of the invested assets and new subscriptions after April 2020 increased Finnish investment funds’ fund share liability by the end of 2020. In April-December 2020, the appreciation of investments increased the value of fund units by EUR 21.9 billion, while new subscriptions in these funds amounted to a further EUR 4.5 billion in net terms.

In 2020, the largest new net investments in Finnish investment funds were made by households (EUR 1.2 billion). In addition, the appreciation of asset prices increased households’ fund holdings by EUR 2.3 billion in 2020 despite the decline in the spring. At the end of December 2020, households’ holdings in domestic investment funds amounted to EUR 37.8 billion, of which domestic households accounted for EUR 27.8 billion. Households have their largest holdings in Finnish investment funds. In addition to direct investments, Finnish households hold investments worth EUR 31.6 billion through unit-linked insurance policies.

Finns own almost 80% of Finnish investment fund units. These holdings amounted to EUR 105,1 billion at the end of December 2020. The highest foreign holdings belonged to Swedes, Norwegians and Luxembourgers. In 2020, foreign investors made more net investments in Finnish funds than Finns did. Foreign investors made net fund subscriptions of EUR 1.3 billion while Finnish investors invested EUR 0.4 billion.

Where are the funds’ investments?

At the end of December 2020, out of Finnish investment funds’ aggregate investments of EUR 138.6 billion, 31% was allocated to Finland and 69% abroad. The largest foreign investments were made in the United States (EUR 20.0 billion), Sweden (EUR 13.4 billion) and Luxembourg (EUR 12.4 billion). The funds’ investments in the EU area amounted to EUR 52.7 billion.

During 2020, investment funds made new investments of EUR 2.1 billion in net terms. The funds invested EUR 3.8 billion abroad but reduced domestic holdings by EUR 1.8 billion. In addition to new subscriptions, changes in valuation increased the funds’ foreign holdings by EUR 2.1 billion. The funds’ domestic holdings increased by EUR 4.4 billion as a result of changes in valuation.

Finnish deposits and investments (EUR million), 2020Q4 |

||||||

| All | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 214 405 | 20 760 | 45 541 | 4 137 | 34 496 | 2 945 |

| (1 780) | (360) | (1 833) | ||||

| - in domestic shares | 145 823 | 15 096 | 41 117 | 3 700 | 17 794 | 1 633 |

| (-1 396) | (112) | (-545) | ||||

| Bonds | 216 809 | 1 353 | 1 818 | 80 | 29 760 | 181 |

| (189) | (-104) | (-152) | ||||

| - in domestic bonds | 89 328 | 316 | 1 136 | 47 | 3 770 | 34 |

| (4 252) | (-78) | (-200) | ||||

| Fund shares | ||||||

| Domestic investment funds | 105 488 | 5 819 | 27 860 | 1 741 | 5 824 | 347 |

| (856) | (360) | (-223) | ||||

| Foreign funds | 152 075 | 5 957 | 3 638 | 277 | 104 966 | 3 004 |

| (2 960) | (259) | (1 040) | ||||

| Finnish bank deposits | ||||||

| Transaction accounts | 184 092 | -27 | 91 000 | -4 | 9 890 | -2 |

| (4 891) | (958) | (-1 285) | ||||

| Other deposits | 70 531 | 1 | 12 207 | 0 | -* | -* |

| (2 102) | (-365) | -* | ||||

| *confidential | ||||||

For further information, please contact:

Antti Alakiuttu, tel. +358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing/.

The next news release on saving and investing will be published on 11 May 2021.

[1] In March-April, investment funds’ fund share liability was reduced both by changes in the value of equity funds’ fund share liability and net redemptions, in particular from short-term fixed income funds.