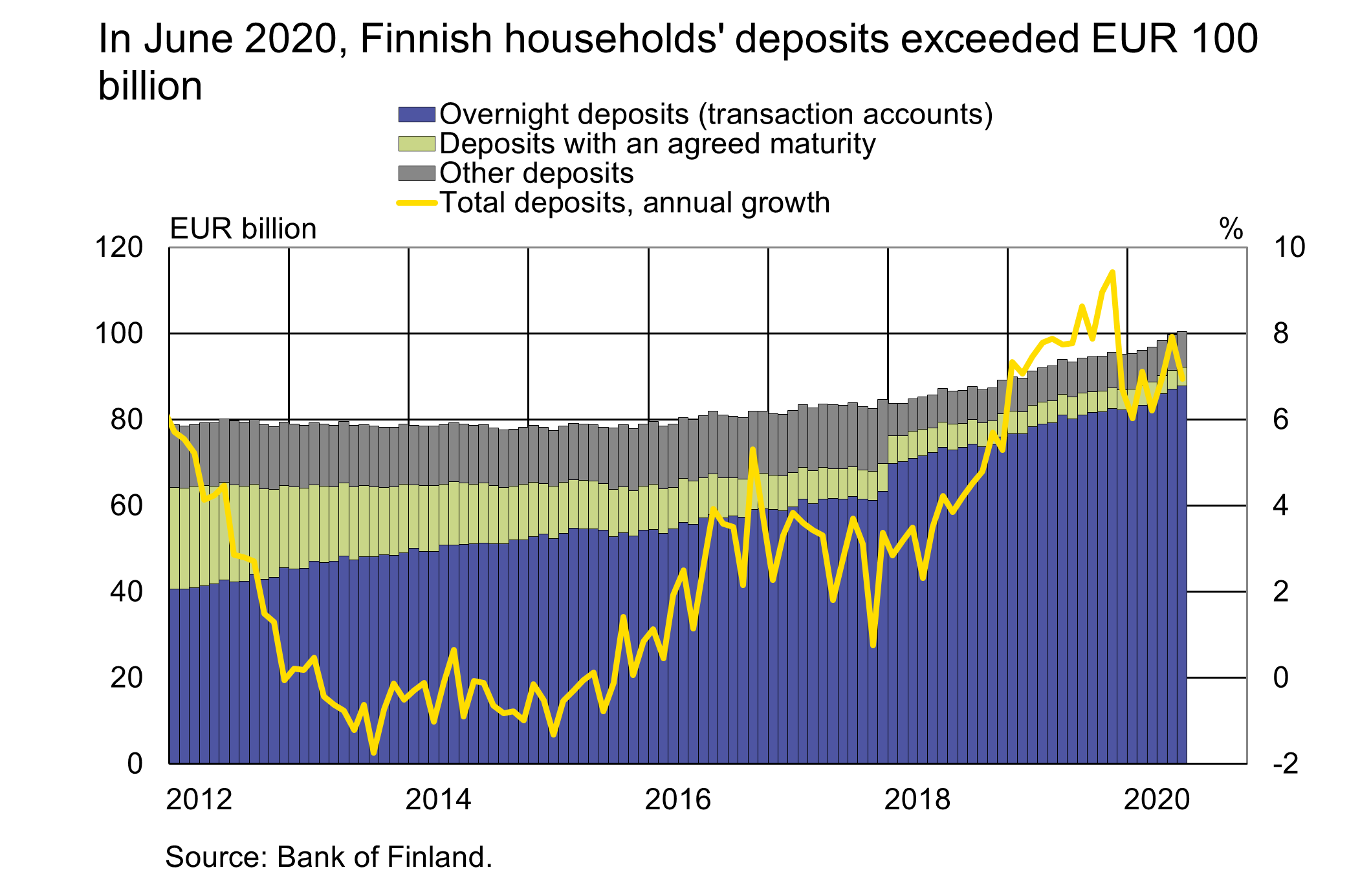

Finnish households’ deposits exceeded EUR 100 billion

Finnish households’ deposit stock[1] exceeded EUR 100 billion to stand at EUR 100.4 billion at the end of June 2020. The majority (EUR 87.8 bn) of households’ assets on deposit accounts were on transaction accounts[2] (overnight deposits). The growth of the deposit stock has also primarily consisted of the growth of assets on transaction accounts for a long time. The stock of deposits with an agreed maturity has contracted for a long time, while other deposits have grown moderately. Households held a total of EUR 4.4 billion of deposits with an agreed maturity and EUR 8.3 billion of other deposits. In June, the average interest rate on the deposit stock as a whole was 0.07%. The average interest rate on transaction accounts was 0.04%, as opposed to 0.50% for deposits with an agreed maturity.

After the end of March 2020, Finnish households’ deposit stock has grown by EUR 3.6 billion, EUR 3.5 billion of which consisted of the growth of financial assets on transaction accounts. Deposits grew briskly in April and May 2020, when the annual rate of growth of the deposit stock, which had slowed down since the end of 2019, accelerated again to nearly 8%. However, the growth slowed down in June 2020 to stand at 6.9%. In June, the deposit stock grew considerably less in euro terms than in April and May 2020 and the corresponding period in the previous year.

By the end of June 2020, the consumer confidence indicator had recovered clearly from its all-time low in April 2020. In July 2020, consumer confidence already exceeded its long-term average. Changes in consumer confidence and consumption possibilities may also have played a role in the growth trend of deposits.

Households’ overnight bank deposits have also grown steeply in other euro area countries

The growth of households’ overnight deposits[3] also accelerated in other euro area countries than Finland after February and March 2020. The growth of euro area households’ overnight deposits accelerated by May 2020 to above 11% but decelerated somewhat in June. In June, the only country with slower annual growth of households’ overnight deposits than Finland was Italy, although the growth rate was brisk in Finland, too (over 8%).

All types of deposits accounted for almost a third of Finnish household's financial assets[4]. Most euro area households have a higher proportion of their financial assets in deposits than Finnish households. For example, German households held 37% of their financial assets in deposits. The highest share of deposits as a proportion of financial assets was attributed to Greek households, whose financial assets included 58% deposits.

Finnish deposits and investments (EUR million), 2020Q2 |

||||||

| All | Households | Employment pension schemes | ||||

| stock (flows) | change in valuation | stock (flows) | change in valuation | stock (flows) | change in valuation | |

| Finnish investments | ||||||

| Listed shares | 174 125 | 24 396 | 37 726 | 5 253 | 26 943 | 3 583 |

| (119) | (409) | (379) | ||||

| - in domestic shares | 118 653 | 16 898 | 34 314 | 4 736 | 14 631 | 2 082 |

| (519) | (267) | (-168) | ||||

| Bonds | 209 615 | 3 893 | 1 970 | 43 | 29 822 | 910 |

| (8 657) | (-69) | (-1 548) | ||||

| - in domestic bonds | 80 557 | 681 | 1 242 | 27 | 3 865 | 57 |

| (10 614) | (-71) | (136) | ||||

| Fund shares | ||||||

| Domestic investment funds | 94 953 | 7 541 | 24 511 | 2 132 | 5 557 | 442 |

| (652) | (444) | (75) | ||||

| Foreign funds | 141 912 | 5 727 | 2 872 | 326 | 99 785 | 2 539 |

| (831) | (181) | (-251) | ||||

| Finnish bank deposits | ||||||

| Transaction accounts | 172 253 | 11 | 87 770 | 1 | 9 100 | -4 |

| (9 841) | (3 490) | (1 342) | ||||

| Other deposits | 67 973 | -99 | 12 674 | 0 | -* | -* |

| (13 713) | (76) | -* | ||||

| *confidential | ||||||

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, e-mail: markus.aaltonen(at)bof.fi,

Antti Alakiuttu, tel. +358 9 183 2495, e-mail: antti.alakiuttu(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing.

The next news release on saving and investing will be published at 1 pm on 12 November 2020.

[1] Deposit stock at credit institutions operating in Finland

[2] Transaction accounts refer to overnight deposits payable on demand, which include, in addition to current accounts, other household accounts without withdrawal limitations but which are only be used for cash withdrawals or through another account.

[3] Incl. euro area households and non-profit institutions serving households.

[4] According to Statistics Finland’s financial accounts, household financial assets totalled EUR 319 billion at the end of March 2020.