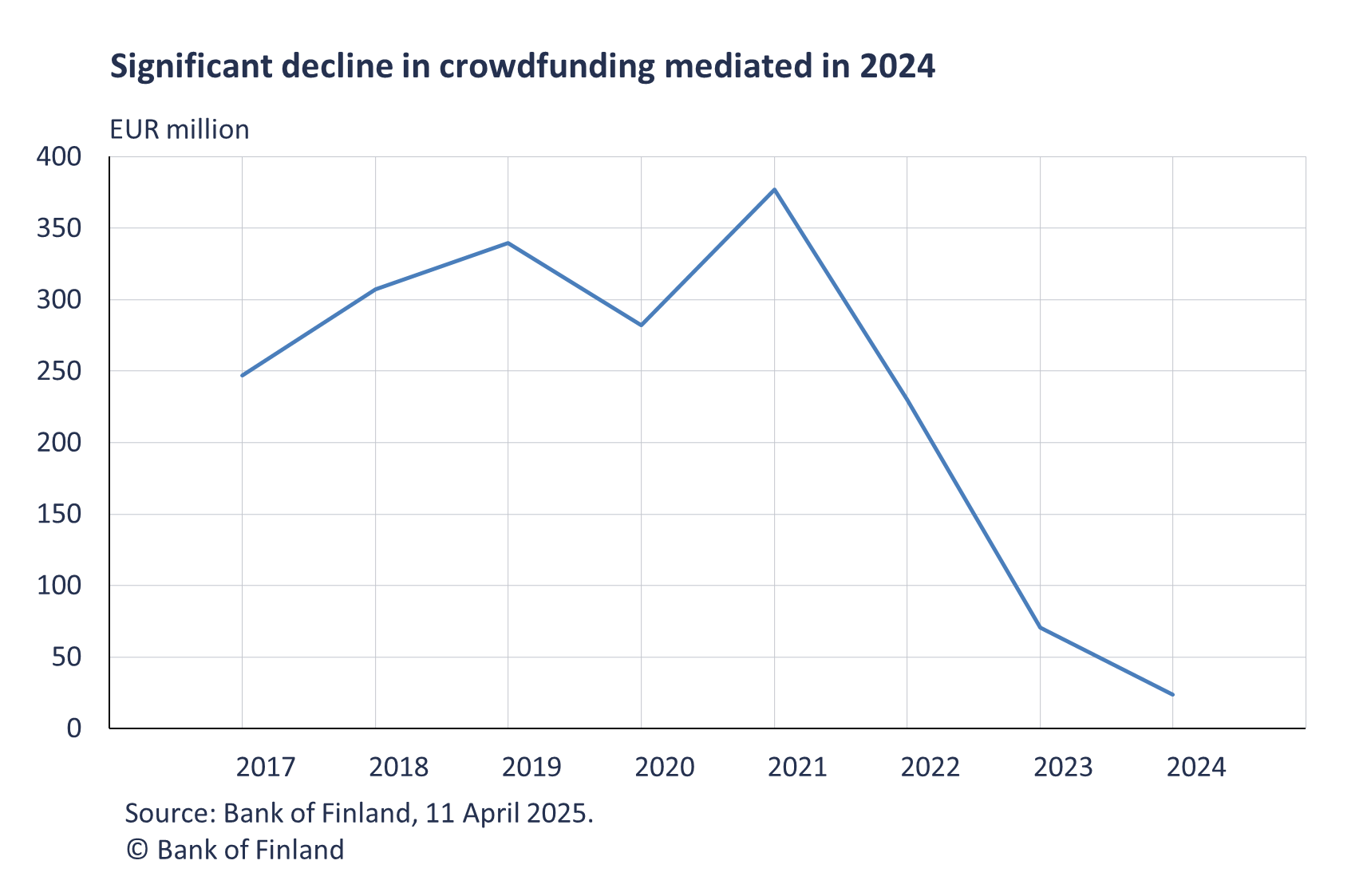

Volume of crowdfunding decreased significantly from the previous year in 2024

In 2024, the volume of crowdfunding and peer-to-peer (P2P) loans raised by domestic seekers of finance amounted to EUR 23.8 million. This marks a significant deviation from the peak year 2021, when this funding still amounted to EUR 377 million. The number of Finnish service providers has decreased in recent years, and the operations of the remaining ones have contracted. However, the Bank of Finland’s statistics does not provide a comprehensive view to the crowdfunding and P2P loan market in Finland because it excludes foreign service providers.

In 2024, the volume of funding mediated to domestic parties on crowdfunding platforms amounted to EUR 23.8 million. This was the lowest volume in the history of the statistics (2017–2024). The volume of crowdfunding decreased significantly (66.3%) from 2023.

P2P lending to individuals halted since 2023

P2P loans have no longer been mediated to private individuals in 2023–2024[1]. The operating conditions of the P2P loan markets have tightened in recent years, driven by factors such as interest rate regulation. P2P loans mediated to Finnish consumers during 2022 still amounted to EUR 33.5 million, which was 70% less than a year earlier. P2P lending peaked in 2018, with about EUR 150.1 million granted.

The Bank of Finland’s statistics is based on a separate data collection. The data are collected from companies registered in Finland and mediating P2P loans. On the other hand, both foreign and domestic companies currently submit data on P2P loans mediated to Finns to the positive credit register. Going forward, the positive credit register would enable a more comprehensive view of P2P loan volumes in Finland.

Data collection began in Finland when crowdfunding grew and regulation eased

The Crowdfunding Act (734/2016) prepared by the Ministry of Finance entered into force on 1 September 2019 and eased the regulation of companies mediating crowdfunding. The volumes of P2P lending between private individuals also showed significant growth at the time. The Ministry of Finance collected data from the sector on an annual basis in 2013–2016 since crowdfunding was a rapidly growing form of corporate funding in Finland. The Bank of Finland began the compilation of statistics on crowdfunding and P2P loans in 2017. According to the data collection, Finnish companies have not mediated significant amounts of crowdfunding in recent years. The Bank of Finland monitors the crowdfunding market and P2P lending in Finland, but the Board of the Bank of Finland has not yet made a decision regarding this data collection about next year 2026.

Volumes of funding mediated via crowdfunding and P2P lending in Finland*

|

|

2021, EUR million (12-month change) |

2022, EUR million (12-month change) |

2023, EUR million (12-month change) |

2024, EUR million (12-month change) |

|

Total |

376.9 (34%) |

230.4 (−39 %) |

70.7 (−69 %) |

23.8 (−66 %) |

* The figures include domestic parties seeking finance.

[1] The reporting population did not include any entities providing new P2P loans to consumers in 2023–2024.