Mediated crowdfunding and P2P lending volume at an all-time-high in 2021

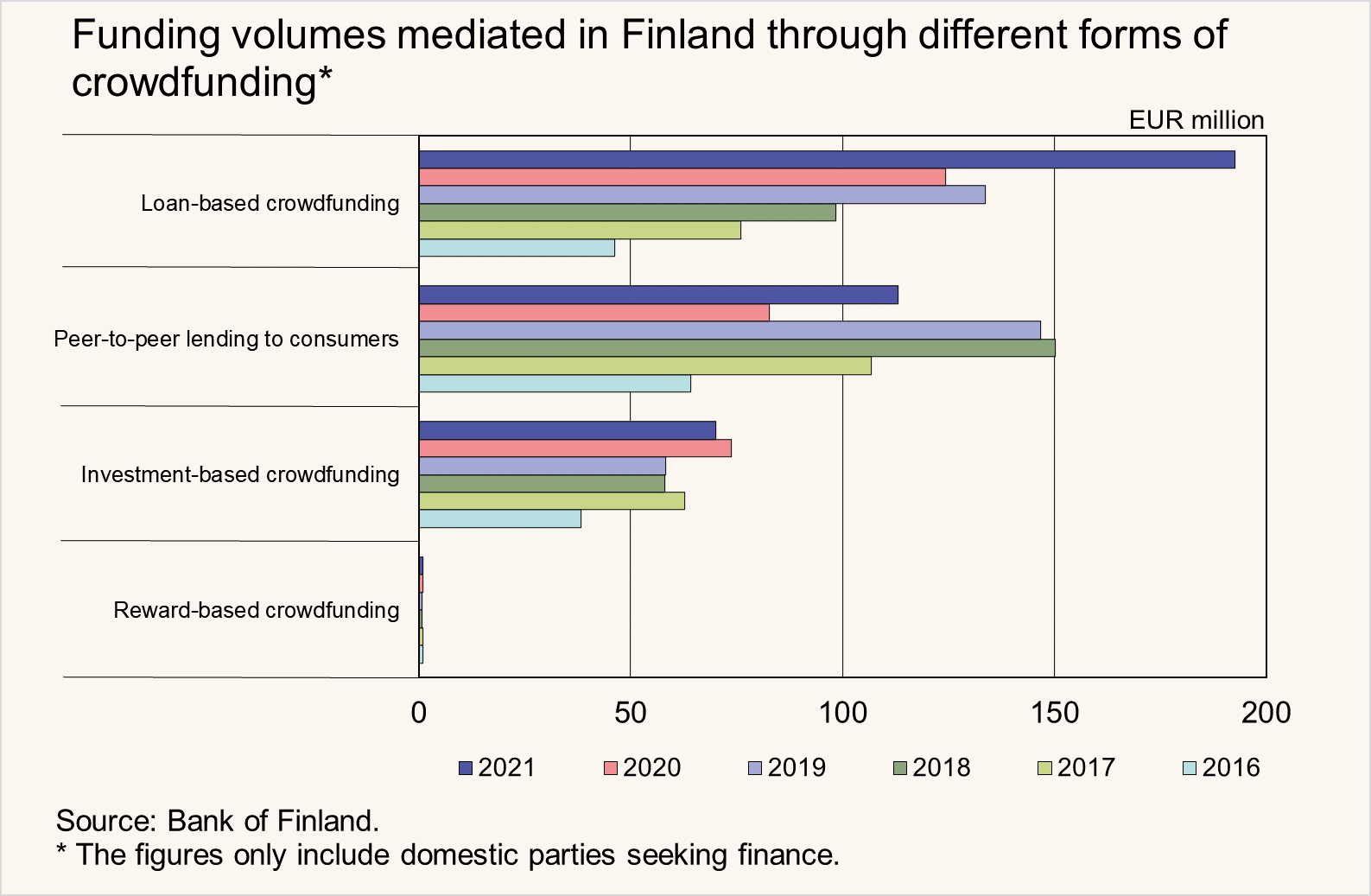

The volume of funding mediated to consumers and companies in Finland on peer-to-peer (P2P) and crowdfunding platforms in 2021 was higher than ever. Growth was particularly strong in loan-based crowdfunding and P2P lending. Despite the strong growth in the volume of funding mediated, it remains small comparison with loan finance extended by credit institutions.

Record volume of loan-based crowdfunding mediated

In 2021, loan-based crowdfunding mediated to Finnish companies amounted to EUR 192.5 million. This was approximately 55% more than in 2020 and a good 44% more than in 2019, the previous peak year of loan-based crowdfunding. At the same time, the number of projects funded has grown significantly. In 2021, there were 17,200 successfully completed funding projects, as opposed to a good 11,200 in 2020. The average loan size in loan-based crowdfunding has remained almost unchanged in previous years.[1] The average effective interest rate of loans mediated rose slightly from a year earlier (8.2%) to stand at 9.0%. Although the volume of loan-based crowdfunding increased steeply in 2021, it remains small in comparison with corporate loans granted by credit institutions, approximately 1.25%.

At the same time, the volume of investment-based crowdfunding decreased slightly in 2021. In 2021, the volume of investment-based crowdfunding mediated was EUR 70.2 million, almost 5% less than a year ago. The number of projects funded has also declined significantly. In 2021, a total of 26 investment-based crowdfunding rounds were completed succesfully on the platforms, as opposed to 39 a year earlier. Hence, while the number of rounds declined, the average project size increased.

The volume of reward-based crowdfunding mediated in Finland remained low in comparison to other forms of crowdfunding. In 2021, investment- and reward-based crowdfunding mediated totalled EUR 1.0 million, on a par with the previous year.

Volume of P2P loans extended to private inviduals increased

In 2021, P2P loans mediated to Finnish consumers amounted to EUR 113 million, or 37% more than a year earlier. However, the volume of P2P loans mediated was lower than in 2019, when it amounted to EUR 147 million. The share of P2P loans out of households’ total unsecured consumer credit stock (EUR 11.6 billion) is estimated at about 1.2%. A total of 42% of P2P loans extended to private individuals comes from other consumers, with the remainder coming from other investors. In 2021, the average P2P loan mediated to a consumer amounted to EUR 3,600.

The average interest rate on loans mediated to private individuals rose somewhat from the previous year. On average, consumer paid an interest of approximately 14.9% on loans taken out in 2021. The operating conditions of the P2P loan markets have tightened in recent years for example owing to the temporary interest rate caps, and therefore the number of companies offering P2P loans in Finland has been reduced.

Funding volumes mediated in Finland through different forms of crowdfunding*

|

|

2019, EUR million (12-month change) |

2020, EUR million (12-month change) |

2021, EUR million (12-month change) |

|

Loan-based crowdfunding |

133.6 (36%) |

124.4 (-7%) |

192.5 (55%) |

|

Investment-based crowdfunding |

58.3 (1%) |

73.7 (27%) |

70.2 (-5%) |

|

Reward-based crowdfunding |

0.8 (8%) |

1.0 (30%) |

1.0 (-4%) |

|

Peer-to-peer lending to consumers |

146.7 (-2%) |

82.8 (-44%) |

113.2 (37%) |

|

Total |

339.4 (11%) |

282.0 (-17%) |

376.9 (34%) |

* The figures include domestic parties seeking finance.

For further information, please contact:

Johanna Honkanen, tel. +358 9 183 2992, email: johanna.honkanen(at)bof.fi,

Miska Jokinen, tel. +358 9 183 2122, email: miska.jokinen(at)bof.fi,

Maija Keskinen, tel. +358 9 183 2004, email: maija.keskinen(at)bof.fi.

[1] The figures also include loans mediated for factoring.