Increase in funding volumes mediated through crowdfunding platforms

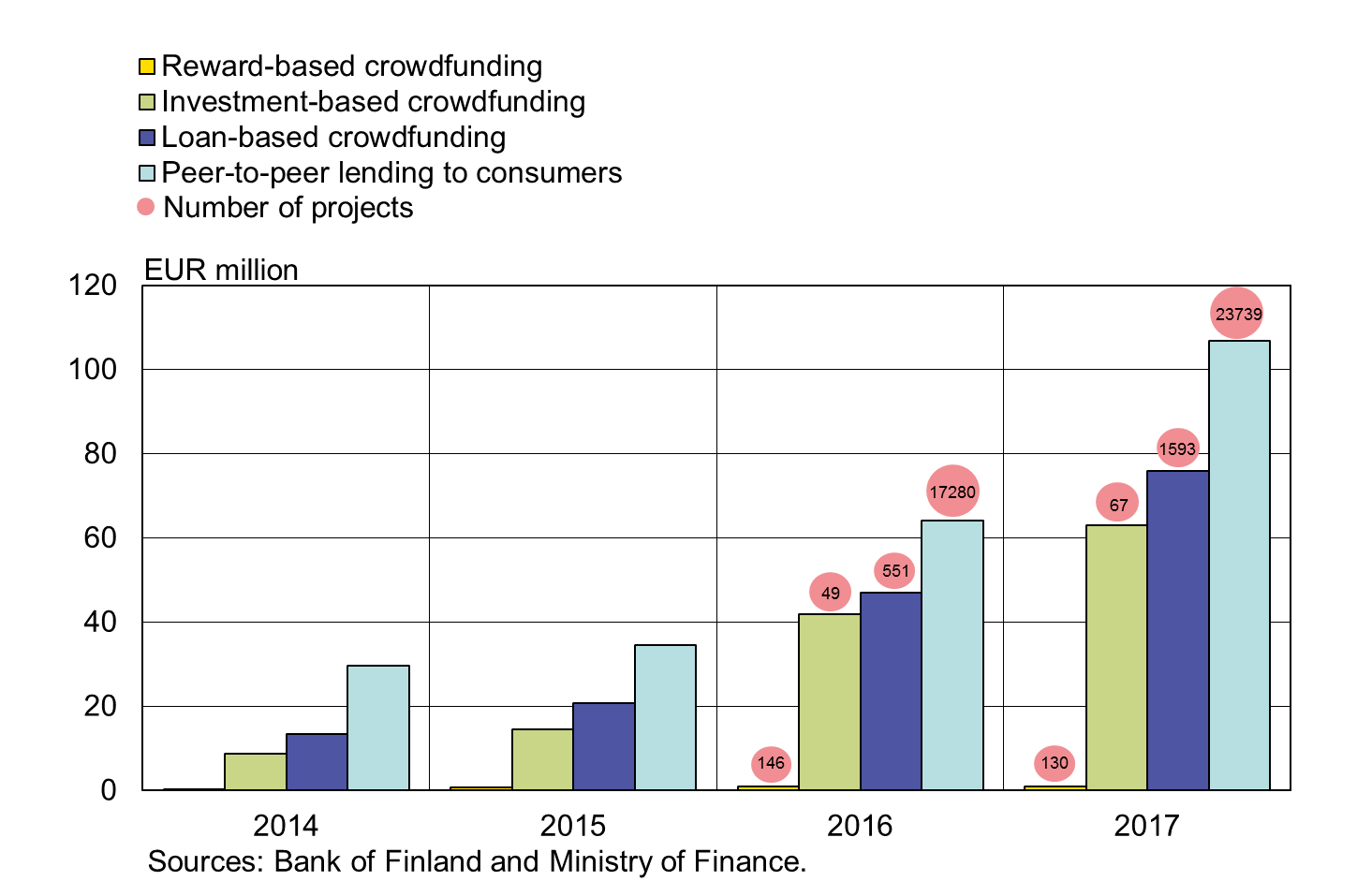

Even though crowdfunding and peer-to-peer markets are still relatively small in Finland, they have been growing at a rapid pace in recent years. An increasing share of projects seek finance through crowdfunding, and the number of projects on service platforms has risen.

The total amount of crowdfunding[1] raised in 2017 was almost EUR 247 million, which is over 61% more than in 2016 (EUR 153 million). Compared with 2014, Finland’s crowdfunding market has almost quintupled in size.[2] According to the 3rd report on alternative finance by the University of Cambridge, the Finnish market was the fifth largest in Europe in 2016 in terms of crowdfunding volumes.

The most important forms of crowdfunding for businesses are loan-based and investment-based crowdfunding. In 2017, EUR 75.8 million was mediated through loan-based crowdfunding, which is about 64% more than in 2016. Funds mediated through investment-based crowdfunding, in turn, totalled EUR 63.0 million, which is almost 51% more than a year earlier. Reward-based crowdfunding grew more moderately, i.e. by 5% from the previous year and by EUR 1.0 million in volume terms.

The number of crowdfunding projects on service platforms has increased substantially. A total of 1,790[3] successful projects were recorded in 2017, compared with 746 in 2016. The average project size in 2017 was EUR 940,800 for investment-based crowdfunding and EUR 47,600 for loan-based crowdfunding.

Increase in the number of projects on service platforms

Increase in peer-to-peer lending volumes to individuals

The volume of peer-to-peer (P2P) lending mediated to consumers grew by 67% in 2017, totalling almost EUR 107 million. P2P loans are estimated to account for about 1% of the total stock of consumer credit to households (EUR 19 billion). 58% of P2P loans to individuals was funded by other consumers, while the remaining share was funded by other investors. In 2017, the average size of a P2P consumer loan was EUR 4,500.

Compilation of Bank of Finland statistics on crowdfunding and peer-to-peer lending was commenced in 2018. The statistics provide information on, for example, the different forms of crowdfunding, such as investment- and loan-based crowdfunding and peer-to-peer consumer lending. Data is collected on e.g. crowdfunding volumes, the number of investments and investors as well as successful and unsuccessful crowdfunding projects. The statistics are compiled on an annual basis.

Funding volumes mediated in Finland through different forms of crowdfunding

|

|

2016, EUR million |

2017, EUR million |

2017, year-on-year change, % |

|

Loan-based crowdfunding |

46.3 |

75.8 |

64 |

|

Investment-based crowdfunding |

41.8 |

63.0 |

51 |

|

Reward-based crowdfunding |

0.96 |

1.0 |

5 |

|

Peer-to-peer lending to consumers |

64.2 |

106.8 |

67 |

|

Total |

153.2 |

246.7 |

61 |

For further information, please contact:

Johanna Honkanen, tel. +358 9 183 2992, email: johanna.honkanen(at)bof.fi,

Katja Haavanlammi, tel. +358 9 183 2415, email: katja.haavanlammi(at)bof.fi.