Stock of consumer credit granted by OFIs contracted in 2023

At the end of 2023, the stock of consumer credit granted by other financial institutions (OFIs) to Finnish households stood at EUR 4.7 billion, 3% less than a year earlier. Almost 90% of consumer credit consists of vehicle loans.

At the end of 2023, the stock of consumer credit granted by other financial institutions (OFIs) to Finnish households stood at EUR 4.7 billion, 3% less than a year earlier. Almost 90% of consumer credit consists of vehicle loans.

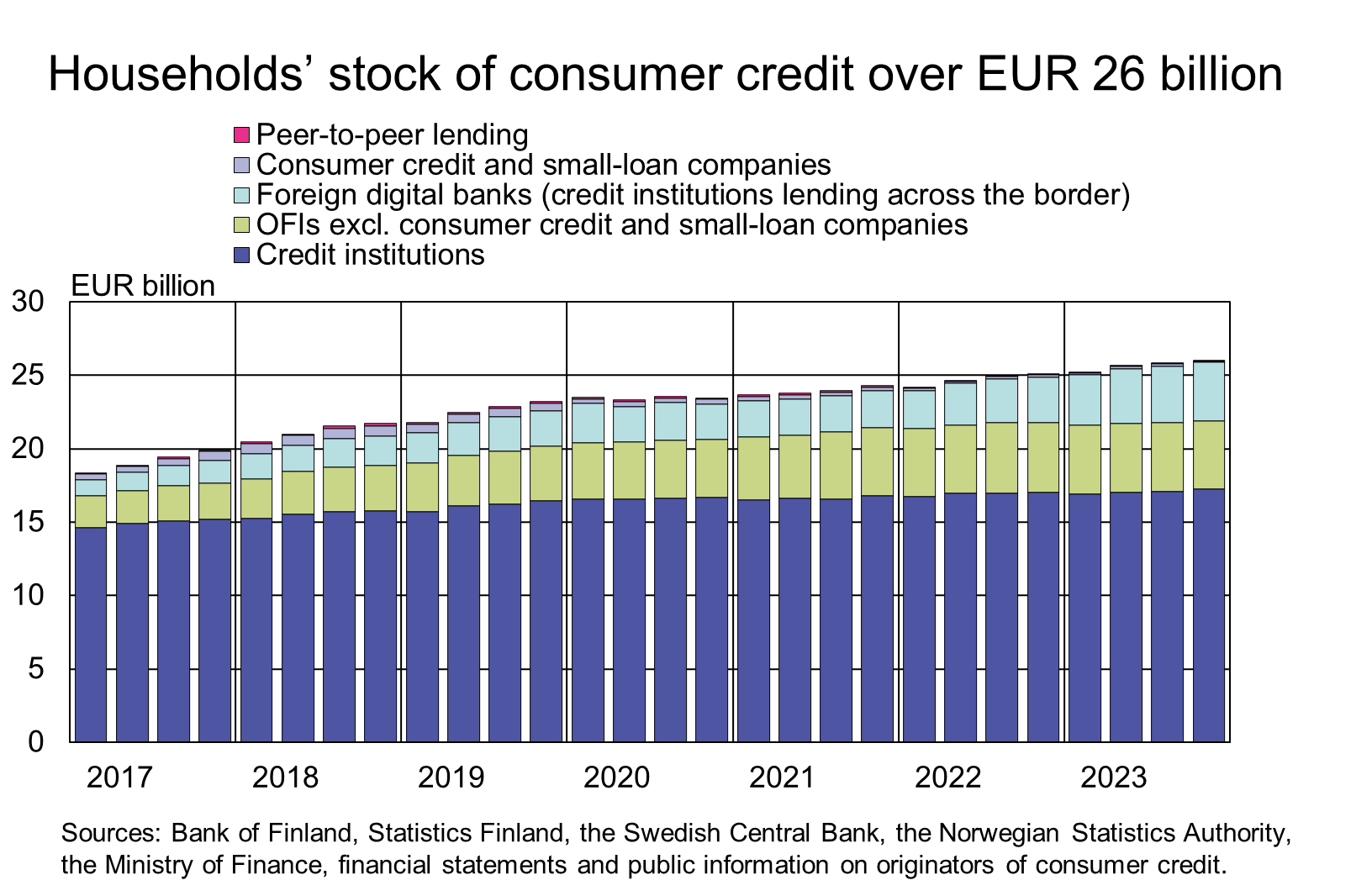

However, the total stock of households’ consumer credit (EUR 26 billion) grew further in 2023. Consumer credit granted by OFIs accounted for 18% of households’ total stock of consumer credit. The majority (66%) of households’ consumer credit has been granted by banks (credit institutions) operating in Finland. Among different originators of consumer credit, foreign credit institutions engaged in cross-border lending have recently increased their share (15%) the most.

Stock of consumer credit granted by payday lenders included OFIs declined below EUR 100 million

The stock of consumer credit granted by consumer credit and small-loan companies, also known as payday lenders, declined further, and the average interest rate on the stock (29.3%) also declined in 2023.[1] By the end of 2023, the stock of consumer credit granted by consumer credit and small-loan companies had fallen below EUR 100 million. Payday lenders’ stock of consumer credit has contracted significantly since 2018, when payday lenders had an estimated EUR 700 million of loan receivables from households. An interest rate cap of 20% on consumer credit entered into force in September 2019.[2] Since then, most of the companies granting small loans have discontinued either the origination of new loans or their activities entirely. The contraction of the loan stock also reflects the selling of loans off OFIs’ balance sheets to other market participants. Some of the providers have also continued their activities as credit institutions.

Actual annual interest rate on vehicle loans granted by OFIs was 7.6%

In the last quarter of 2023, Finnish households drew down EUR 743 million of new vehicle loans from OFIs, which was 8% less than in the same period a year earlier. Meanwhile, vehicle loans drawn down from credit institutions amounted to EUR 488 million. The total amount of vehicle loans drawn down in the last quarter of 2023 was EUR 1.2 billion, 4% more than in the corresponding period a continue year earlier.

The agreed annual interest rate (5.1%) on new vehicle loans drawn down from OFIs in the last quarter of 2023 was lower than the interest rate on vehicle loans from credit institutions (5.8%). The effective annual interest rate, including other expenses[3], on vehicle loans granted by OFIs was also lower (7.6%) compared to those granted by banks (8.1%).

Vehicle loans (EUR 8.0 billion) accounted for over 30% of households’ all consumer credit. OFIs had a share of 53% of these loans while credit institutions operating in Finland had 47%,

The stock of loans granted by OFIs to Finnish non-financial corporations and households, 2023Q4:

|

|

Non-financial corporation loans (EUR million) |

Household loans (EUR million) |

|

Secured |

1,802 |

4,251 |

|

Unsecured and with collateral deficit |

4,141 |

589 |

|

Total |

5,943 |

4,840 |

For further information, please contact:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi

The next Other financial institutions release will be published on 5 September 2024.

Name & Shame process:

Financial corporations intentionally dropping out of the OFI statistics for the period 2023Q4:

Creditstar Finland Oy (2023Q3)

Lahden Pantti Oy (2023Q4)

[1] At the end of 2022, the stock stood at EUR 140 million, with an average interest rate 33.6%.

[2] The interest rate cap tightened in October 2023. Since October, the interest rate cap has stood at 15% + the reference rate under the Interest Rates Act, but no more than 20%. The reference rate under the Interest Rates Act for the period 1 January – 30 June 2023 is 4.50%.

[3] In the OFI data collection, effective annual interest rate refers to new drawdowns, while in banking statistics, it refers to new agreements.