Average interest rate on new corporate loans granted by other financial institutions in Q2/2022 almost 8%

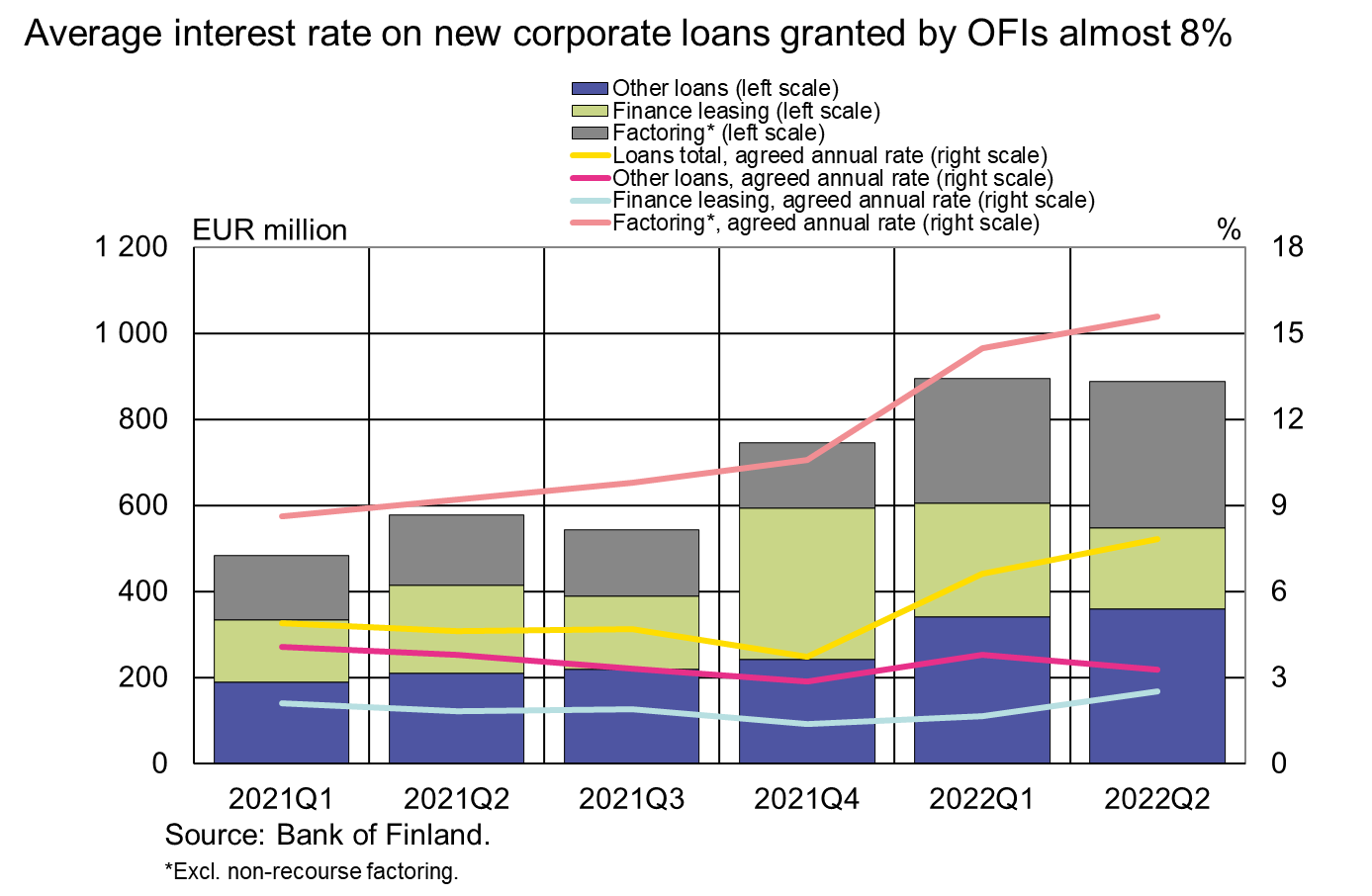

In the second quarter of 2022, Finnish non-financial corporations drew down a total of EUR 890 million of new corporate loans[1] from other financial institutions (OFIs). Over half of these drawdowns were made by micro and small enterprises. Among OFIs, the largest volume of new loans to non-financial corporations was granted by vehicle finance companies, which accounted for two thirds of the new lending.

In the second quarter of 2022, the most common type of newly drawn corporate loan was conventional corporate loans (EUR 360 million), followed by factoring (EUR 340 million). The average interest rate on new corporate credit was 7.8%.[2] However, there was large variation in average interest rates on different forms of finance. For example, the average interest rate on conventional corporate loans was 3.3%, as opposed to 15.6% on factoring.

At the end of June 2022, the stock of loans granted by OFIs to Finnish non-financial corporations stood at EUR 5.5 billion, with an average interest rate of 2.26%[3]. The most common type of loan in the stock was finance leasing (EUR 3.2 billion), before conventional corporate loans (EUR 2 billion). Most of the corporate loan stock was unsecured and with collateral deficit (EUR 3.7 billion).

The largest share of the OFIs’ corporate loan stock was attributable to banks’ finance companies (EUR 3.2 billion). At the end of June 2022, the largest sectors by lending volume were energy, industry as well as transportation and warehousing. Energy was the only sector with an aggregate corporate loan stock in excess of EUR 1 billion.

OFIs grew their corporate loan stock grew faster than credit institutions

At the end of June 2022, the stock of corporate loans granted by credit institutions (banks) stood at EUR 62.1 billion, and its year-on-year growth was 6.5%. At the end of June, OFIs’ corporate loan stock grew at a considerably faster rate (12.5%) than credit institutions’. In June 2022, the average interest rate on credit institutions’ corporate loan stock (1.51%) was lower in comparison to OFIs’ corporate loan stock (2.26%). The interest rate differentials are explained for example by differences in the corporate customer base of the different types of institutions: in relative terms, credit institutions have lent mostly to large enterprises, whereas the new drawdowns suggest micro and small enterprises represent the largest customer group for OFIs.

THE STOCK OF LOANS GRANTED BY OFIS TO FINNISH NON-FINANCIAL CORPORATIONS AND HOUSEHOLDS, 2022Q2:

|

|

Non-financial corporation loans (EUR million) |

Household loans (EUR million) |

|

Secured |

1 763 |

4 242 |

|

Unsecured and with collateral deficit |

3 719 |

680 |

|

Total |

5 482 |

4 922 |

For further information, please contact:

Tommi Salenius, tel. +358 9 183 2156, email: tommi.salenius@bof.fi

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

The next Other financial institutions release will be published at the beginning of 2023.

Name & Shame process:

Financial corporations intentionally dropping out of the OFI statistics for the period 2022Q2:

Creditstar Finland Oy (2021Q4-2022Q2)

SAV-Rahoitus Oyj (2022Q1)

Aputoiminimet / Bifirma / Auxiliary company name:

SAVOY-Rahoitus

Suomen Asuntovakuus

Suomen Automaailma

Suomen Autovakuus

VFS Finland Ab (2020Q4-2022Q2)

Aputoiminimet / Bifirma / Auxiliary company name:

Volvo Kuorma-autorahoitus / Volvo Lastvagnsfinans / Volvo Truck Finance

Volvo Rahoitus / Volvo Finans / Volvo Finance

Volvo Rahoitus Suomi / Volvo Finans Finland / Volvo Finance Finland

[1] Excl. overdrafts, card credit and non-recourse factoring.

[2] Excl. overdrafts, card credit and non-recourse factoring.

[3] Excl. non-recourse factoring.