The amount of student loan available for drawing down was raised in August

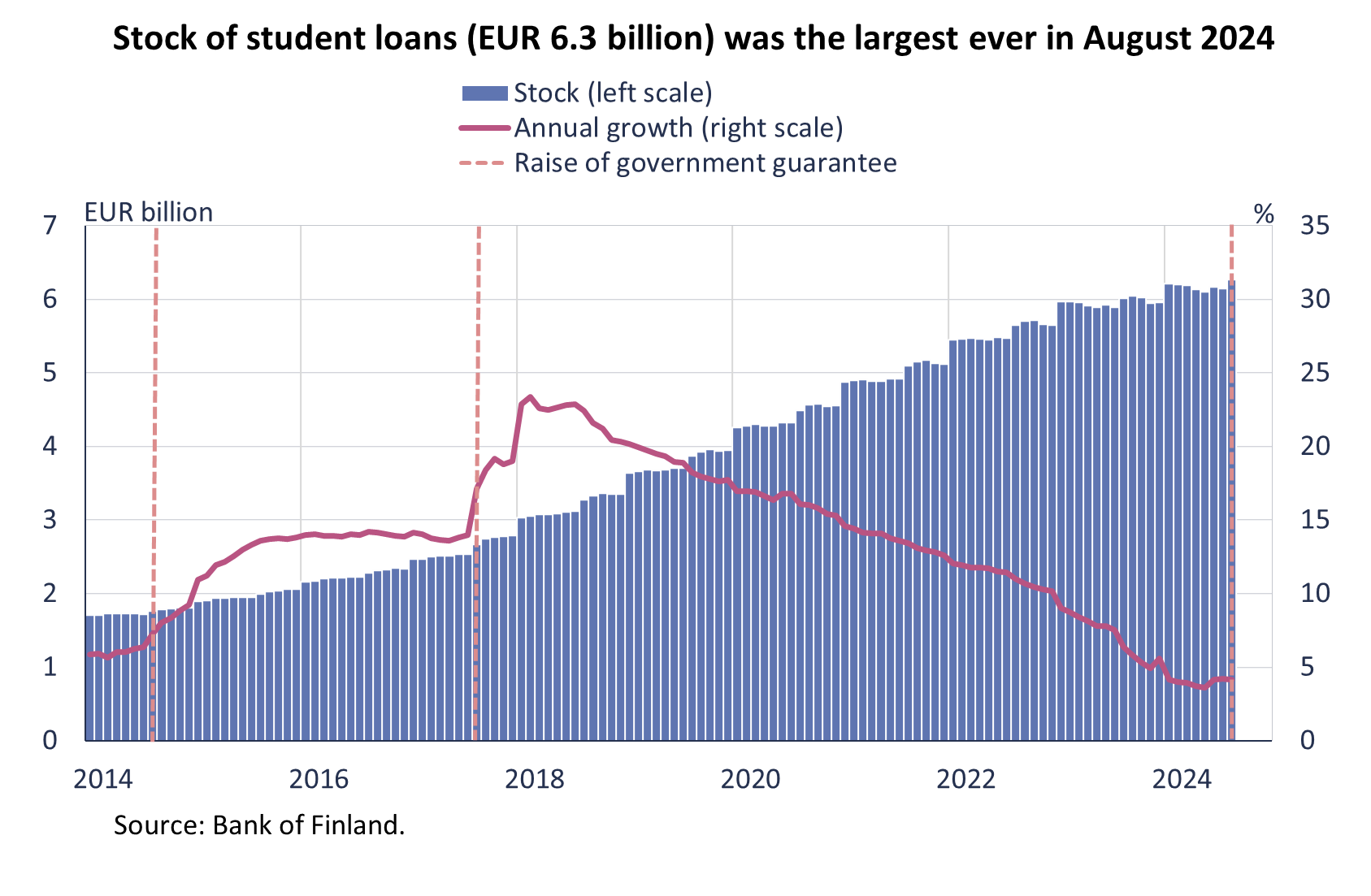

In August 2024, drawdowns of student loans totalled EUR 165 million – almost the same as in the corresponding month last year. At the beginning of August, the amount of student loan available for drawdown per month was raised by up to 30%. In August 2024, the stock of student loans (EUR 6.3 billion) was the largest ever.

In August 2024, drawdowns of student loans totalled EUR 165 million – almost the same as in the corresponding month last year. However, the volume of student loan drawdowns was affected by opposing forces.

At the beginning of August 2024, the amount of student loan available for drawdown per month was raised by up to 30%.[1] As a result of an amendment to the Act on Financial Aid for Students, persons over 18 years studying in Finland have been able to draw down EUR 850 per month of government-guaranteed loan, instead of the previous EUR 650. The previous raise to the government-guaranteed amount of student loan was made in August 2017.

Another change affecting the monthly drawdown volume was that students in secondary education now have more frequent student loan disbursements than before.[2] From now on, there are four disbursement dates in an academic year, regardless of the duration of studies. The change of the number of disbursements reduces the drawdowns in August and January and correspondingly increases them in March and November. According to Kela’s statistics, students in secondary education drew down approximately 19% of all student loans in the academic year 2022/2023.

The rise in level of interest rates has reduced the volume of student loan drawdowns. However, interest rates on student loans have declined in 2024. In August 2024, the average interest rate on new student loans drawn down declined further, to stand at 4.07% in August. The average interest rate was slightly lower than at the same time a year earlier. 89% of the student loans drawn down were linked to Euribor rates and 11% to banks’ own reference rates.

The reduced drawdown volume has contributed to the slowdown in the growth rate of the student loan stock in recent years.[3] However, the annual rate of growth of the student loan stock (4.2% in August) has picked up somewhat in recent months, and the increase of the government guarantee and lower interest rates may accelerate it further going forward. In August 2024, the stock of student loans (EUR 6.3 billion) was the largest ever.

Loans

In August 2024, Finnish households drew down EUR 1.1 billion of new housing loans, which is EUR 40 million less than in the same period a year earlier. Buy-to-let mortgage loans accounted for EUR 110 million of the new housing loan drawdowns. The average interest rate on new housing loans decreased from July, to stand at 3.93% in August. At the end of August 2024, the housing loan stock totalled EUR 105.9 billion, and its year-on-year change amounted to -0.7%. Buy-to-let mortgages accounted for EUR 8.7 billion of the housing loan stock. At the end of August, Finnish households’ loan stock included EUR 17.9 billion of consumer credit and EUR 17.6 billion of other loans.

Drawdowns of new loans by Finnish non-financial corporations in August totalled EUR 1.5 billion, including EUR 440 million of loans to housing corporations. The average interest rate on new corporate-loan drawdowns rose from July, to stand at 5.36 %. At the end of August, the stock of loans granted to Finnish non-financial corporations was EUR 107.7 billion, whereof housing corporations accounted for EUR 44.8 billion.

Deposits

At the end of August 2024, the total stock of Finnish households’ deposits was EUR 110.6 billion, and the average interest rate on these deposits was 1.35%. Overnight deposits accounted for EUR 67.1 billion and deposits with an agreed maturity for EUR 14.6 billion of the total deposit stock. In August, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 1.1 billion. The average interest rate on these new term deposits was 3.39%.

| Loans and deposits to Finland, preliminary data* | |||||

| June, EUR million | July, EUR million | August, EUR million | August, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 141,421 | 141,223 | 141,425 | -0.4 | 4.53 |

| - of which housing loans | 106,032 | 105,861 | 105,914 | -0.7 | 3.95 |

| - of which buy-to-let mortgages | 8,682 | 8,680 | 8,708 | 4.14 | |

| Loans to non-financial corporations2, stock | 108,10 | 107,497 | 107,747 | 1.1 | 4.62 |

| Deposits by households, stock | 110,784 | 109,951 | 110,644 | 1.2 | 1.35 |

| Households' new drawdowns of housing loans | 1,096 | 1,049 | 1,104 | 3.93 | |

| - of which buy-to-let mortgages | 96 | 96 | 111 | 4.06 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

For further information, please contact:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 28 October 2024.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics/.

[1] A larger amount of student loan can be taken out starting from August | Kela

[2] Amount of the student loan | Our services| Kela. For students in higher education, there are two disbursement dates.

[3] To a limited extent, the slowdown also reflects student loan compensations paid by Kela. Student loan compensation | Our services| Kela.