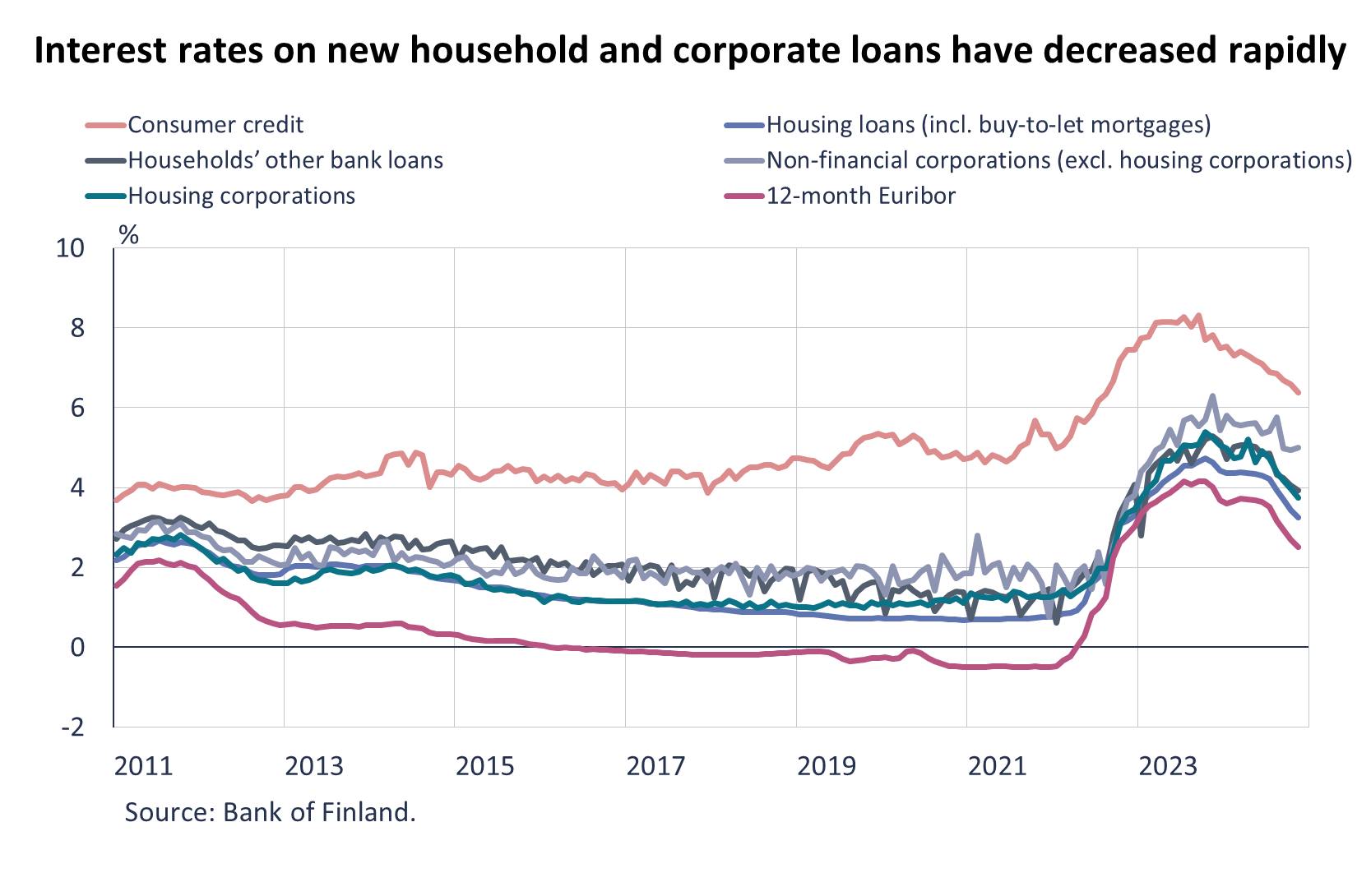

Interest rates on new household and corporate loans have decreased rapidly

In November 2024, the average interest rate on new household loans declined below 4% for the first time in over two years. Just a year ago in November, the average interest rate stood at 5.42%. In November, the average interest rate on new loans to non-financial corporations (excl. housing corporations) was slightly below 5%, as opposed to an average of 6.29% a year earlier. The average interest rate on loans to housing corporations has also declined rapidly. In November 2024, the average interest rate on new loans stood at 3.74%, as opposed to 5.24% just in November last year.

The average interest rate on new household and corporate loans has decreased rapidly, and the average interest rates on the loan stocks have begun to recede. The one-year Euribor has declined from its autumn-2023 peak of 4.2% to below 2.5%. In November 2024, 86% of the stock of bank loans[1] to Finnish households and non-financial corporations[2] (EUR 249.1 bn) and 85% of new drawdowns[3] was linked to Euribor rates.

In November, the average interest rate on new household loans declined below 4% for the first time in over two years. Just a year ago in November, the average interest rate stood at 5.42%. Out of all bank loans drawn down by households in November 2024, 69% was housing loans, 21% was consumer credit and 10% was other loans. The average interest rate on the stock of household loans (EUR 141.2 bn) continued to decline in November, to reaching 4.24% for the month. In addition to the decline in the interest rates on new loans, the drop in the average interest rate on the loan stock reflects a decrease in the interest rates on old variable-rate loans due to scheduled interest rate resets.

In November 2024, the average interest rate on new loans to non-financial corporations (excl. housing corporations) was slightly below 5%, as opposed to an average of 6.29% a year earlier. The average interest rate on the corporate loan stock (EUR 62.5 bn) has decreased to 4.39% starting from the beginning of 2024.

The average interest rate on loans to housing corporations has also declined rapidly. In November 2024, the average interest rate on new loans stood at 3.74%, as opposed to 5.24% just in November last year. At the end of November 2024, the average interest rate on the stock of loans to housing corporations was an even 4%. It has declined by 0.5 percentage points during 2024. A little over half of the stock of housing corporations’ loans was housing company loans payable by households[4].

Loans

New drawdowns of housing loans by Finnish households amounted to EUR 1.3 billion in November 2024, which is 6% more than in the same period a year earlier. Buy-to-let housing loans accounted for EUR 124 million of the new housing loan drawdowns. The average interest rate on new housing loans decreased from October, to stand at 3.26% in November. At the end of November 2024, the housing loan stock totalled EUR 106.0 billion, and its year-on-year change amounted to 0.4%. Buy-to-let housing loans accounted for EUR 8.8 billion of the housing loan stock. At the end of November, Finnish households held EUR 17.8 billion of consumer credit and EUR 17.4 billion of other loans.

In November, Finnish households drew down new loans worth EUR 2.1 billion, including EUR 659 million of housing corporations’ loans. The average interest rate on new corporate-loan drawdowns declined from October to 4.60%. At the end of November, the stock of loans granted to Finnish non-financial corporations stood at EUR 107.9 billion, including EUR 45.4 billion of loans to housing corporations.

Deposits

At the end of November 2024, Finnish households’ aggregate deposit stock totalled EUR 111.0 billion, and the average interest rate on these deposits was 1.29%. Overnight deposits accounted for EUR 67.7 billion and deposits with an agreed maturity for EUR 15.1 billion of the total deposit stock. In November, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 1.2 billion. In November, the average interest rate on new deposits with an agreed maturity was 2.98%.

Loans and deposits to Finland, preliminary data |

|||||

| September, EUR million | October, EUR million | November, EUR million | November, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 141,255 | 141,230 | 141,218 | -0.2 | 4.24 |

| - of which housing loans | 105,838 | 105,883 | 106,019 | -0.4 | 3.66 |

| - of which buy-to-let mortgages | 8,726 | 8,748 | 8,786 | 3.83 | |

| Loans to non-financial corporations2, stock | 108,146 | 108,150 | 107,885 | 0.3 | 4.30 |

| Deposits by households, stock | 110,685 | 110,517 | 110,974 | 2.8 | 1.29 |

| Households' new drawdowns of housing loans | 1,143 | 1,371 | 1,313 | 3.26 | |

| - of which buy-to-let mortgages | 111 | 127 | 124 | 3.37 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

The next news release on money and banking statistics will be published at 10:00 on 30 January 2025.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics/.

[1] Loans granted by credit institutions operating in Finland.

[2] Including housing corporations.

[3] Excluding overdrafts and credit card credit.

[4] According to an estimate by Statistics Finland, the total amount of housing company loans payable by households was EUR 23.0 billion at the end of September 2024 (link).