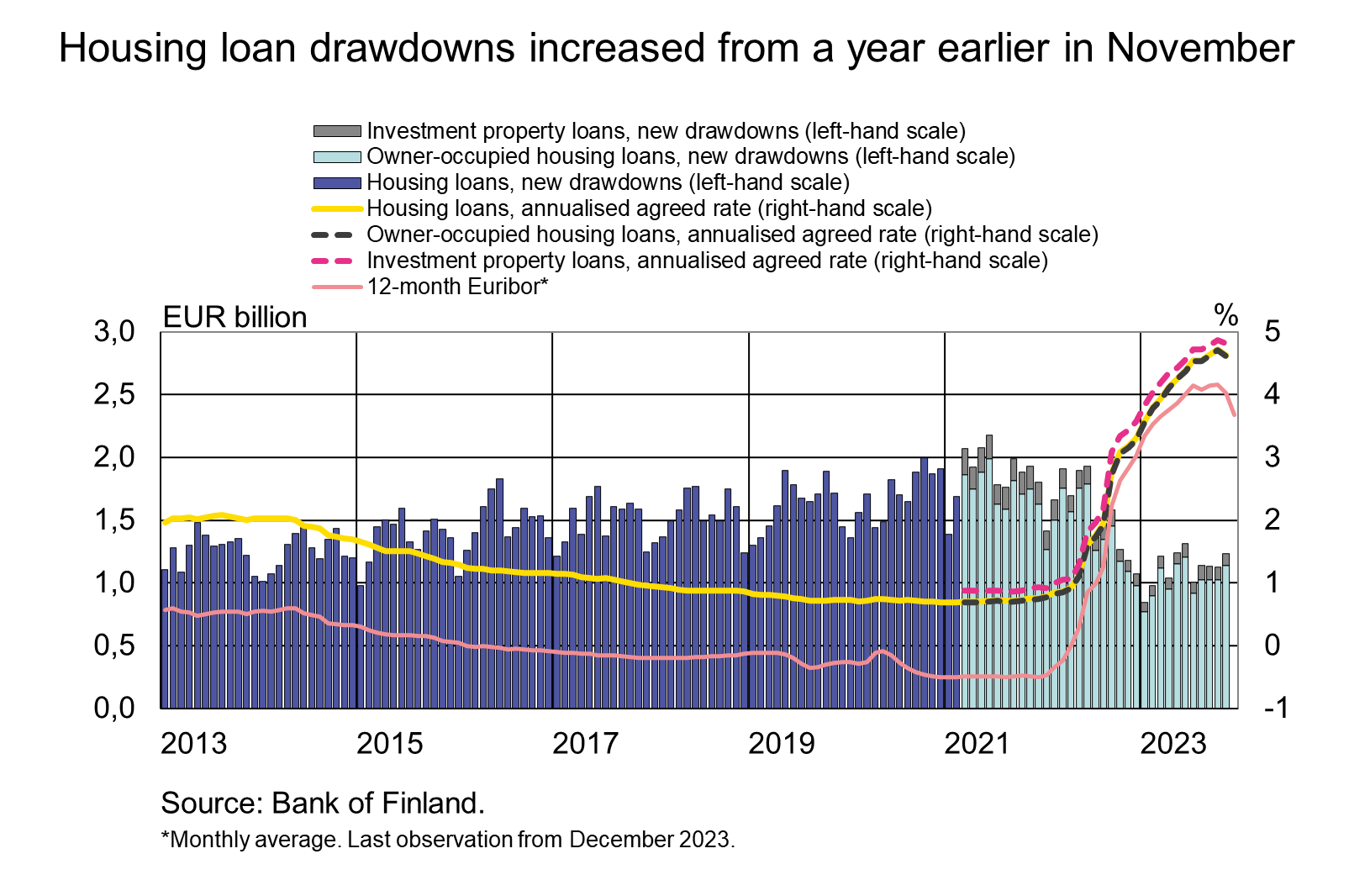

Housing loan drawdowns increased from a year earlier in November

Drawdowns of new housing loans totalled EUR 1.2 billion in November 2023, up 5% on the same month a year earlier. The average interest rate on new housing loans declined from October 2023 and stood at 4.63% in November 2023.

Drawdowns of new housing loans totalled EUR 1.2 billion in November 2023, up 5% on the same month a year earlier. Despite a slight pick-up, drawdowns of new housing loans were below the usual level, as the average for November has been EUR 1.5 billion. The amount of housing loan drawdowns is typically at its lowest in December–February.

The slight pick-up in housing loan drawdowns may have reflected changes in the transfer tax[1]. The most common reference rate for housing loans – the 12-month Euribor – fell slightly in November and edged down further in December. This may also have stimulated the housing loan market. At the end of December 2023, the 12-month Euribor was 3.51%.

The average interest rate on new housing loans declined from October 2023 and stood at 4.63%. A total of 90% of the new housing loans were linked to Euribor rates, compared with 97% a year earlier in November. The share of new housing loans linked to banks’ own reference rates (prime rates) has increased over the past year and was 7% in November. The average interest rate on new Euribor-linked housing loans was 4.68% in November, while the average interest on loans linked to banks’ own reference rates was 4.14%.

With the rise in interest rates, fewer housing loans have been linked to the 12-month Euribor and, correspondingly, the number of loans linked to shorter-term Euribor rates has increased. In November 2023, 46% of new housing loans were linked to the 12-month Euribor, 12% to the 6-month Euribor and 32% to the 3-month Euribor. During the recent period of low interest rates, the share of new housing loans linked to the 12-month Euribor typically varied between 80% and 90%.

The average interest rate on the stock of households’ housing loans exceeded 4% in November 2023. Despite the rapid rise in interest rates, the amount of non-performing loans[2] has not increased significantly. In November, non-performing loans accounted for 1.6% of the housing loan stock.

Loans

Finnish households drew down new housing loans in November 2023 to a total of EUR 1.2 billion, an increase of EUR 60 million on the same month a year earlier. Of the new housing loans, investment property loans accounted for EUR 95 million. The average interest rate on new housing loans declined from October and stood at 4.63%. At the end of November, the stock of housing loans amounted to EUR 106.5 billion, and the the annual growth rate of the loan stock was -1.8%. Investment property loans accounted for EUR 8.6 billion of the housing loan stock. The stock of all loans to Finnish households at end-October included EUR 17.1 billion in consumer credit and EUR 17.6 billion in other loans.

Finnish non-financial corporations drew down new loans[3] in November 2023 in the amount of EUR 1.8 billion, of which EUR 370 million was taken out by housing corporations. The average interest rate on the new loans was up from October, at 6.08%. At the end of November, the stock of loans to Finnish non-financial corporations stood at EUR 106.3 billion. Of this, loans to housing corporations accounted for EUR 43.9 billion.

Deposits

At the end of November 2023, the aggregate stock of Finnish households’ deposits stood at EUR 108.0 billion. The average interest rate on the deposits was 1.13%. Overnight deposits accounted for EUR 70.7 billion and deposits with agreed maturity for EUR 10.3 billion of the deposit stock. In November, households concluded EUR 1.3 billion of new agreements on deposits with agreed maturity, at an average interest rate of 3.45%.

| Loans and deposits to Finland, preliminary data* | |||||

| September, EUR million | October, EUR million | November, EUR million | November, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 141,596 | 141,257 | 141,151 | -1.5 | 4.57 |

| - of which housing loans | 106,719 | 106,535 | 106,524 | -1.8 | 4.04 |

| - of which buy-to-let mortgages | 8,650 | 8,641 | 8,638 | 4.24 | |

| Loans to non-financial corporations2, stock | 106,10 | 105,873 | 106,306 | 0.1 | 4.73 |

| Deposits by households, stock | 110,110 | 108,351 | 107,987 | -3.6 | 1.13 |

| Households' new drawdowns of housing loans | 1,131 | 1,128 | 1,237 | 4.63 | |

| - of which buy-to-let mortgages | 101 | 100 | 95 | 4.82 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 31 January 2024.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/statistics2/.

[1] The transfer tax was lowered and the tax exemption for fist-time homebuyers was abolished starting from the beginning of 2024. The Act entered into effect at the turn of the year, but the lower transfer tax rates are applied retroactively to transfers on or after 12 October 2023, the date of submission of the government proposal to the Parliament.

[2] A loan is non-performing when it is more than 90 days past due or it is assessed that the debtor is unlikely to pay its credit obligaitons.

[3] Excl. overdrafts and credit card credit.