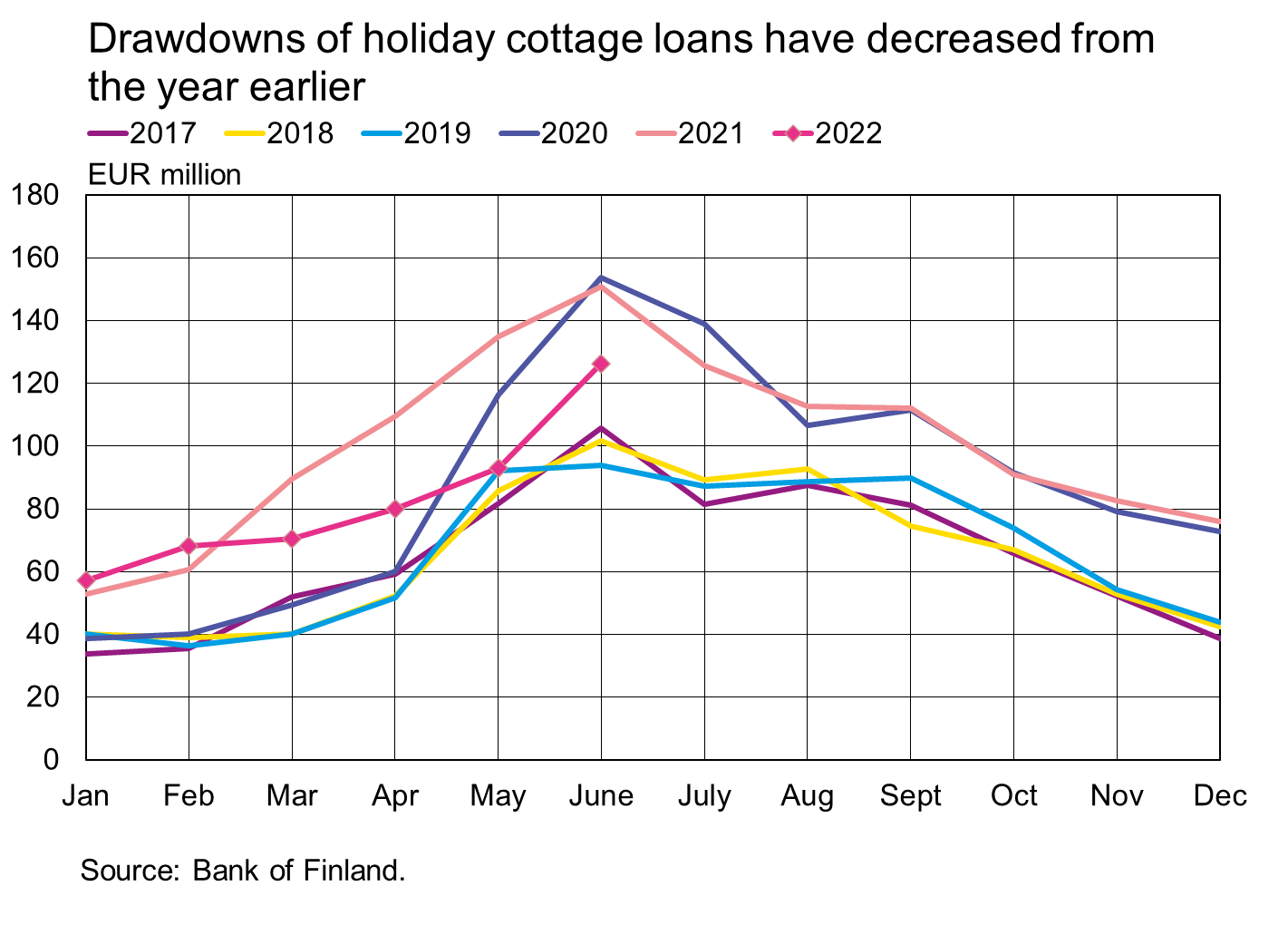

June 2022 saw a decrease in holiday cottage loan drawdowns from the year earlier

In June 2022, Finnish households drew down new housing loans for the purchase of holiday homes (holiday cottage loans) to the value of EUR 126 million, which is 16% less than a year earlier in June. Holiday cottage loans were drawn down at an exceptionally high rate in 202o and 2021. Compared to the period before the pandemic, i.e. June 2019, drawdowns of holiday cottage loans were 35% higher in June 2022.

The average interest rate on new housing loans for purchase of a holiday home rose in June, to stand at 1.71%. This was 0.050 percentage points higher than in May 2022 and 0.78 percentage points higher than in June 2021. The higher average interest rate on new loans for holiday cottages is explained mainly by the rise in Euribor rates. The average interest rate on these loans was last higher in March 2015.

At the end of June, the stock of holiday cottage loans stood at EUR 4.6 billion. Due to the lower number of drawdowns, the annual growth rate of the stock slowed in June, to 6.7%. The average interest rate on the stock of loans for holiday residences rose from May, to stand at 1.14%.

Loans

New drawdowns of housing loans by Finnish households amounted to EUR 1.9 billion in June 2022, which is EUR 255 million less than in the same period a year earlier. Investment property loans accounted for EUR 139 million of the newly drawn housing loans. The average interest rate on new housing loans rose from May to stand at 1.60% in June. At the end of June 2022, the stock of housing loans totalled EUR 107.9 billion, and the year-on-year growth was 2.9%. Investment property loans accounted for EUR 8.8 billion of the housing loan stock. At the end of June, Finnish households’ loan stock included EUR 17.0 billion of consumer credit and EUR 18.1 billion of other loans.

In June, Finnish non-financial corporations drew down new loans worth EUR 4.8 billion, including EUR 637 million of housing corporations’ loans. The average interest rate on new corporate-loan drawdowns declined from May, to 1.49%. At the end of June, the stock of loans granted to Finnish non-financial corporations was EUR 102.9 billion, of which loans to housing corporations accounted for EUR 40.8 billion.

Deposits

At the end of June 2022, the total stock of Finnish households’ deposits was EUR 113.0 billion, and the average interest rate on these deposits was 0.03%. Overnight deposits accounted for EUR 104.0 billion and deposits with agreed maturity for EUR 2.1 billion of the deposit stock. In June, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 46 million, at an average interest rate of 0.65%.

| Loans and deposits to Finland, preliminary data | |||||

| April, EUR million | May, EUR million | June, EUR million | June, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 142,475 | 142,667 | 143,011 | 2,9 | 1,44 |

| - of which housing loans | 107,451 | 107,674 | 107,907 | 2,9 | 0,92 |

| - of which buy-to-let mortgages | 8,782 | 8,789 | 8,797 | 1,02 | |

| Loans to non-financial corporations2, stock | 100,546 | 100,817 | 102,919 | 6,8 | 1,29 |

| Deposits by households, stock | 112,421 | 112,153 | 113,036 | 4,8 | 0,03 |

| Households' new drawdowns of housing loans | 1,698 | 1,900 | 1,927 | 1,60 | |

| - of which buy-to-let mortgages | 128 | 143 | 139 | 1,82 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Anu Karhu, tel. +358 9 183 2228, email: anu.karhu(at)bof.fi.

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi.

The next news release will be published at 1 pm on 31 August 2022.

Related statistical data and graphs are also available on the Bank of Finland website https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.