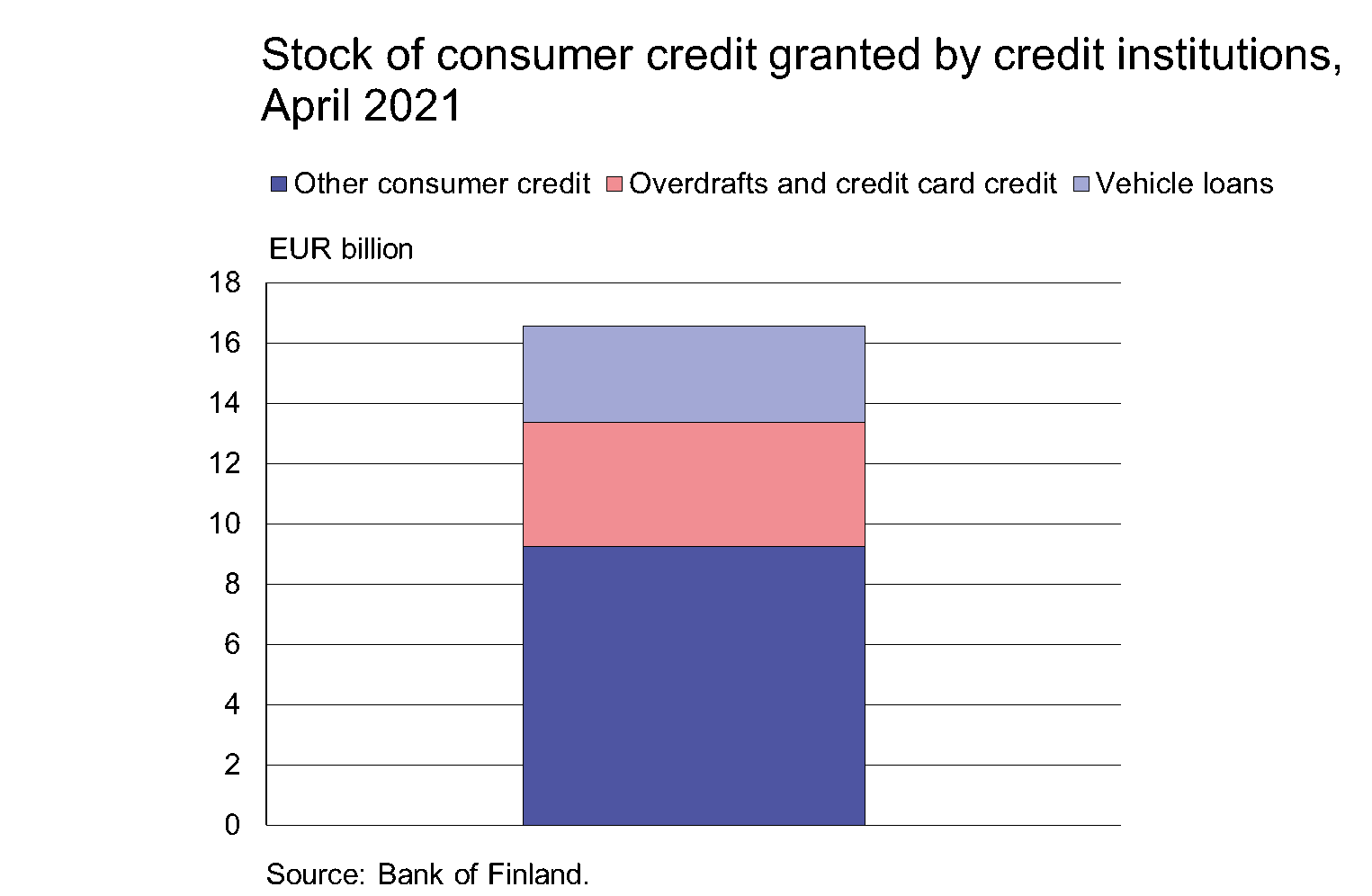

Vehicle loans account for almost one fifth of consumer credit granted by credit institutions

According to new statistical data, nearly one fifth (19.2%) of consumer credit[1] granted by credit institutions to households at the end of April 2021 were vehicle loans[2]. The stock of consumer credit amounted to EUR 16.5 bn, of which vehicle loans accounted for EUR 3.2 bn[3], overdrafts and credit card credit for 4.1 bn and other consumer credit for EUR 9.3 bn. Most of the vehicle loans (EUR 2.4 bn) were uncollateralised. Collateralised vehicle loans totalled EUR 0.8 bn.

At the end of April 2021, the average interest rate on the consumer credit stock was 4.61%. For the stock of vehicle loans, the average interest rate was 2.79%, for the stock of other consumer credit 4.29% and for overdrafts and credit card credit 6.73%. Meanwhile, the average interest rate on the stock of uncollateralised vehicle loans stood at 2.92% and on the stock of other uncollateralised consumer credit at 6.70%. The average interest rate on the stock of collateralised vehicle loans (2.40%) was almost the same as the average rate on the stock of other collateralized consumer credit (2.26%).

Drawdowns of consumer credit[4] in April 2021 amounted to EUR 440 million, of which EUR 161 million were vehicle loans. Drawdowns of uncollateralised consumer credit were brisk, EUR 312 million, and 41% of this, or EUR 127 million, were vehicle loans. The average interest rate on new uncollateralised vehicle loans stood at 3.11% and on other uncollateralised consumer credit at 7.78%.

Besides credit institutions, other financial institutions (OFIs)[5] are important providers of vehicle loans in Finland. At the end of March 2021, the stock of vehicle loans granted by OFIs totalled EUR 3.9 bn, making it larger in size than the vehicle loan stock of credit institutions at that time (EUR 3.1 bn). The average interest rate on the stock of OFI vehicle loans at end-March was 2.2%.

Loans

Drawdowns of new housing loans by Finnish households in April 2021 totalled EUR 1.9 bn, up EUR 482 million on the same month last year. Of the total, 9.1% were buy-to-let mortgages. The stock of housing loans at end-April stood at EUR 104.0 bn, and the annual growth rate of the loan stock was 4.0%. Buy-to-let mortgages accounted for 7.9% of the housing loan stock. Out of all loans of Finnish households at end-April, consumer credit totalled EUR 16.5 bn and other loans EUR 17.4 bn.

Drawdowns of new loans (excl. overdrafts and credit card credit) by Finnish non-financial corporations (NFCs) in April amounted to EUR 1.7 bn. The average interest rate on these rose from March, to 1.78%. The stock of loans to Finnish NFCs at end-April stood at EUR 96.8 bn, of which EUR 37.9 bn were loans to housing corporations.

Deposits

The stock of Finnish households’ deposits at end-April 2021 amounted to EUR 106.2 bn, at an average interest rate of 0.04%. Overnight deposits accounted for EUR 96.3 bn and deposits with agreed maturity for EUR 3.2 bn of the deposit stock. In April, households concluded new agreements on deposits with agreed maturity to a total of EUR 56 million, at an average interest rate of 0.22%.

Loans and deposits to Finland, preliminary data |

|||||

| January, EUR million | February, EUR million | March, EUR million | March, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 136,890 | 137,164 | 137,473 | 3,6 | 1,33 |

| - of which housing loans | 103,029 | 103,248 | 103,640 | 3,8 | 0,82 |

| Loans to non-financial corporations2, stock | 96,505 | 96,723 | 96,710 | 3,2 | 1,30 |

| Deposits by households, stock | 104,155 | 104,734 | 104,825 | 8,2 | 0,05 |

| Households' new drawdowns of housing loans | 1,390 | 1,689 | 2,073 | 0,71 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Anu Karhu, tel. +358 9 183 2228, email: anu.karhu(at)bof.fi

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi

Antti Alakiuttu (other financial institutions), tel. +358 9 183 2495, email: antti.alakiuttu(at)bof.fi

The next monthly statistical release will be published at 10 a.m. on 30 June 2021.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Incl. overdrafts and credit card credit. comprises loans in all currencies to residents in Finland.

[2] Vehicle loans cover loans taken out for the purchase of passenger cars for private use, registered motorcycles, mopeds etc, recreational vehicles, utility and other trailers, caravans etc. The data are available as from March 2021.

[3] Before 2021, a breakdown of consumer credit into vehicle loans and other consumer credit was not available in respect of all credit institutions. Data provided by these institutions have been captured in the statistics on the stock of vehicle loans as from the beginning of 2021. For this reason, a small proportion of the vehicle loan stock is included in the group of other consumer credit.

[4] Excl. overdrafts and credit card credit.

[5] Other financial institutions are providers of household and corporate loans operating outside the credit institutions sector in Finland.