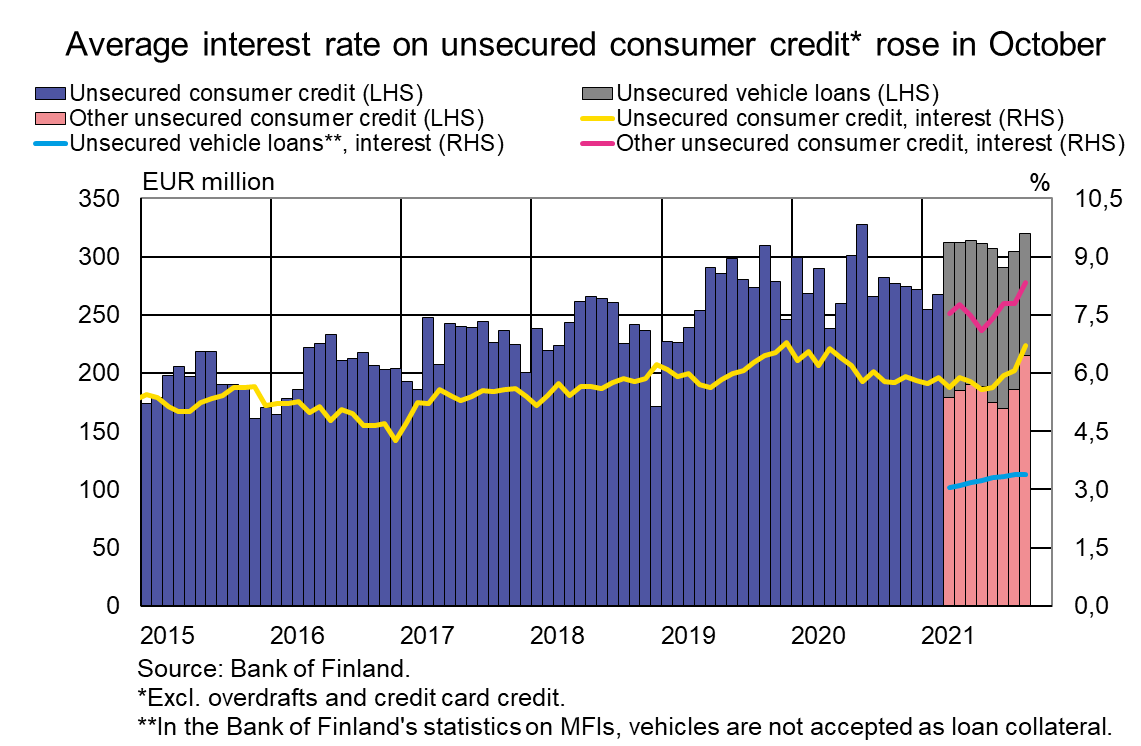

October 2021 sees large drawdowns of unsecured consumer credit at higher interest rates

In October 2021, Finnish households drew down unsecured consumer credit[1] from Finnish credit institutions in the amount of EUR 320 million, an increase of 5.0% on September and 15.5% on a year earlier. Within a single month, drawdowns of unsecured consumer credit have been higher only once before, in July 2020. Growth in the drawdowns in October 2021 was only recorded for unsecured consumer credit other than vehicle loans. These drawdowns totalled EUR 215 million, an increase of 15.8%, on September. Drawdowns of unsecured vehicle loans[2] totalled EUR 105 million, a decrease of 11.9% on September.

After the expiry of the temporary interest rate cap on consumer credit[3], the average interest rate on unsecured consumer credit (6.72%) rose in October 2021, exceeding the level prior to the temporary interest rate cap, i.e. 6.19% in June 2020. The average interest on new unsecured consumer credit other than vehicle loans rose by 0.55 percentage point from September, to 8.34% in October. The average interest on new unsecured vehicle loans remained unchanged at 3.39%. In October 2021, unsecured consumer credit other than vehicle loans grew on September especially in the case of credit institutions offering high-interest consumer credit. The average interest on new unsecured consumer credit granted by these institutions was over 11% in October.

At the end of October 2021, the stock of consumer credit granted to households by credit institutions operating in Finland stood at EUR 16.6 bn. Of this, unsecured consumer credit totalled EUR 6.8 bn, secured consumer credit EUR 5.6 bn and overdrafts and credit card credit EUR 4.2 bn. These consumer credits account for about 69% of total household consumer credit.

Loans

Finnish households’ drawdowns of new housing loans in October 2021 amounted to EUR 1.9 bn, down EUR 111 million on the same month last year. Of the new housing loans, 9.3% were buy-to-let mortgages. At the end of October 2021, the stock of housing loans stood at EUR 106.3 bn, and the annual growth rate of the stock was 4.1%. Buy-to-let mortgages accounted for 8.0% of the housing loan stock. Out of all loans of Finnish households at end-October, consumer credit totalled EUR 16.6 bn and other loans EUR 18.1 bn.

Drawdowns of new loans[4] by Finnish non-financial corporations in October amounted to EUR 1.9 bn, of which loans to housing corporations accounted for EUR 510 million. The average interest rate on the new drawdowns declined from September, to 1.72%. The stock of loans to Finnish non-financial corporations at end-October stood at EUR 96.4 bn, of which loans to housing corporations accounted for EUR 39.1 bn.

Deposits

The stock of Finnish households’ deposits at end-October 2021 stood at EUR 110.2 bn, and the average interest rate on the deposits was 0.03%. Overnight deposits accounted for EUR 101.0 bn and deposits with agreed maturity for EUR 2.4 bn of the deposit stock. In October, Finnish households concluded EUR 53 million of new agreements on deposits with agreed maturity, at an average interest rate of 0.19%.

The Bank of Finland would like feedback on the usefulness and ease of use of our statistics, the assistance provided by our experts, and the topics covered by our releases. We value your views on how our statistical services could be improved.

Link to the survey: https://link.webropolsurveys.com/S/F1B204FF827BDA83

Answering the survey will only take a moment and answers will be processed anonymously. You can answer the survey until 31 December 2021.

Loans and deposits to Finland, preliminary data |

|||||

| August, EUR million | September, EUR million | October, EUR million | October, 12-month change1, % | Average interest rate, % | |

| Loans to households, stock | 140,118 | 140,628 | 141,052 | 4,1 | 1,29 |

| - of which housing loans | 105,535 | 105,954 | 106,329 | 4,1 | 0,79 |

| - of which buy-to-let mortgages | 8,408 | 8,465 | 8,528 | 0,91 | |

| Loans to non-financial corporations2, stock | 95,781 | 95,995 | 96,439 | -0,4 | 1,26 |

| Deposits by households, stock | 108,202 | 109,498 | 110,163 | 6,6 | 0,03 |

| Households' new drawdowns of housing loans | 1,764 | 1,994 | 1,884 | 0,74 | |

| - of which buy-to-let mortgages | 176 | 177 | 175 | 0,87 | |

* Includes loans and deposits in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this table differ from those in the aforementioned releases.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Non-financial corporations also include housing corporations.

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 3 January 2022.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Excl. overdrafts and credit card credit.

[2] In the Bank of Finland’s statistics on monetary financial institutions, unsecured consumer credit also includes consumer credit were the collateral securing the loan is, for example, a vehicle. Only those items are accepted as collateral that are recognised under the Regulation of the European Parliament and of the Council on prudential requirements for credit institutions and investment firms. Such collateral includes, for example, real estate.

[3] In 1 July 2020–30 September 2021, new consumer credit other than credit card credit and goods-or-services-related credit was subject to a maximum interest rate of 10%.

[4] Excl. overdrafts and credit card credit.