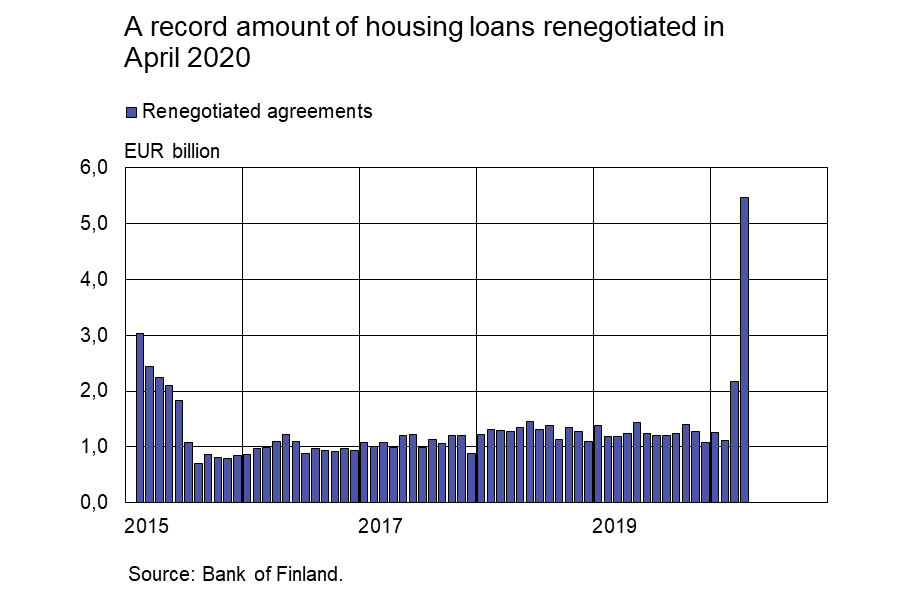

A large amount of loan agreements renegotiated in April

In April 2020, households and non-financial corporations renegotiated more loans than ever before[1]. The record volume of renegotiated loans[2] reflects the interest-only periods3 offered by many banks to households and non-financial corporations due to the current exceptional situation.

In April 2020, renegotiated household loans4 totalled EUR 6.2 bn, representing 4.6% of the household loan stock as at the end of April. Renegotiated housing loans4 totalled EUR 5.5 bn, which is 5.5% of the housing loan stock5. Renegotiations of student loans, holiday cottage loans and consumer loans were also record high in April.

Households’ drawdowns of housing loans6 in April 2020 amounted to EUR 1.4 bn, a decline of 10,8% on the corresponding period a year earlier. The stock of housing loans at end-April totalled EUR 100.9 bn and the annual growth rate of the stock was 2.8%.

Renegotiated loans to non-financial corporations (excl. housing corporations) in April 2020 totalled EUR 2.3 bn, which is 3.9% of the end-April corporate loan stock. The renegotiated volumes were record high in all size categories of corporate loans. Drawdowns of corporate loans were also high in April, at over EUR 1.9 bn.

In connection with the April statistical press release, the loans and deposits dashboard was supplemented with new visualisations of renegotiated loan agreements and industry-specific corporate loan stocks.

Loans

At the end of April 2020, household credit comprised EUR 16.6 bn in consumer credit and EUR 17.7 bn in other loans. The average interest rate on new drawdowns of loans by non-financial corporations rose slightly from March, to 1.83%. The stock of euro-denominated corporate loans at end-April totalled EUR 96.2 bn, of which loans to housing corporations accounted for EUR 36.0 bn.

Deposits

The stock of deposits by Finnish households at end-April totalled EUR 98.4 bn and the average interest rate on the deposits was 0.09%. Overnight deposits accounted for EUR 86.0 bn and deposits with an agreed maturity for EUR 4.2 bn of the deposit stock. In April, households concluded EUR 0.2 bn of new agreements on deposits with an agreed maturity, at an average interest rate of 0.11%.

Key figures of Finnish MFIs' loans and deposits, preliminary data |

|||||

| February, EUR million | March, EUR million | April, EUR million | April, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 135,011 | 135,115 | 135,165 | 3,1 | 1,43 |

| - of which housing loans | 100,541 | 100,694 | 100,878 | 2,8 | 0,88 |

| Loans to non-financial corporations2, stock | 92,357 | 94,166 | 96,213 | 11,4 | 1,30 |

| Deposits by households2, stock | 99,973 | 100,989 | 102,637 | 0,09 | |

| Households' new drawdowns of housing loans | 1,563 | 1,713 | 1,447 | 0,75 | |

* Includes euro-denominated loans and deposits to euro area.

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

- Imputed interest rate margins on loans from MFIs

For further information, please contact:

Anu Karhu, tel. +358 10 183 2228, email: anu.karhu(at)bof.fi

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi

The next news release will be published at 1 pm on 30 June 2020.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

1 The collection of statistical data on renegotiated loan agreements was commenced in 2014.

2 Renegotiated loan agreements refer to new loan agreements concluded as a result of renegotiations of the terms of existing loans.

3 Interest-only periods included in the terms of original loan agreements are excluded from the volume of renegotiated agreements.

4 Loans granted by credit institutions to households (excl. non-profit institutions serving households) in Finland.

5 See the news release on the impact of the interest-only periods of 2015 on the housing loan stock.

6 Euro-denominated loans granted by credit institutions to households and non-profit institutions serving households in the euro area.