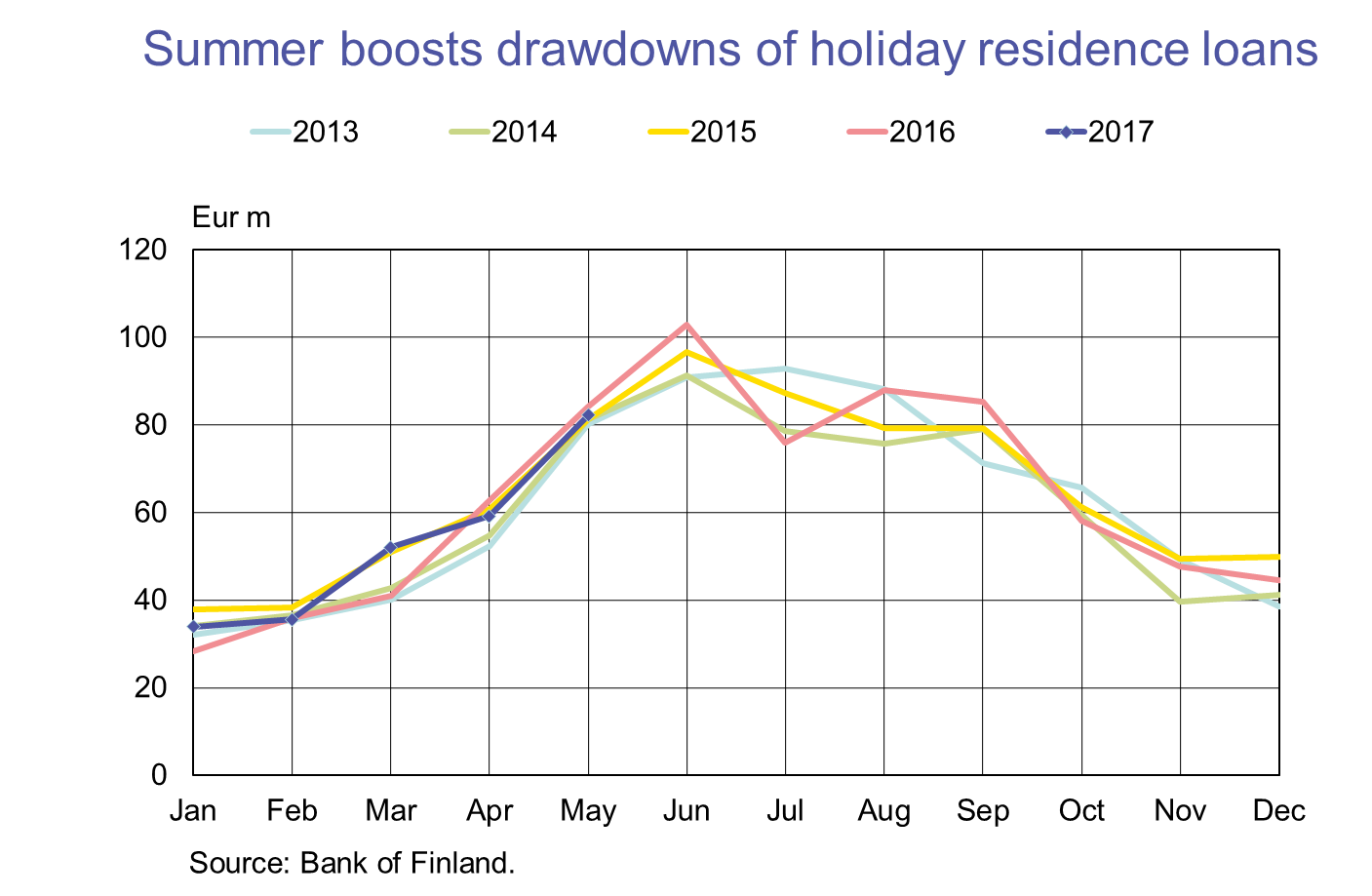

Summer boosts drawdowns of holiday cottage loans

Demand for loans for holiday residences usually peaks in May–September. In May 2017, drawdowns of holiday residence loans amounted to EUR 82 million, which was slightly less than a year earlier in May. The average interest rate on new holiday residence loans was 1.31% in May 2017, compared with 1.41% a year earlier. The interest rates on holiday residence loans differ considerably between credit institutions.1 In May 2017, the spread in interest rates on new holiday residence loans between credit institutions was 1.8 percentage points. Credit institutions with the lowest interest rate granted holiday residence loans with an average interest rate of below 1%, while those with the highest rate offered these loans with an average rate of over 2.5%. The majority of holiday residence loans are secured by real estate.

Holiday residence loans typically have shorter maturities than housing loans. The average maturity of holiday residence loans drawn down in May was 16 years, 5 months, while that for housing loans was exactly 3 years longer. The maturities of holiday residence loans and housing loans alike have lengthened in recent years. In May 2017, as much as 92% of all new holiday residence loans were linked to the 12-month Euribor rate. All in all, 98% of new holiday residence loans were linked to Euribor rates.

At the end of May 2017, the stock of holiday residence loans totalled EUR 3.5 bn, and these loans accounted for 3% of all loans to households. The stock of holiday residence loans grew in May 2017 at the same pace as the stock of housing loans, at an annual rate of 2.1%.

Loans

Households' new drawdowns of housing loans in May 2017 amounted to EUR 1.7 bn. The average interest rate on new housing-loan drawdowns was 1.08% and the imputed margin was 1.05%. At the end of May 2017, the stock of euro-denominated housing loans totalled EUR 94.7 bn and the annual growth rate of the stock was 2.1%. Household credit at end-May comprised EUR 14.8 bn in consumer credit and EUR 16.4 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 1.9 bn in May 2017. The average interest rate on new corporate-loan drawdowns declined from April, to 1.79%. At the end of May, the stock of euro-denominated loans to non-financial corporations was EUR 78.3 bn, of which loans to housing corporations accounted for EUR 26.9 bn.

Deposits

At the end of May, the stock of household deposits totalled EUR 86.3 bn and the average interest rate on the deposits was 0.16%. Overnight deposits accounted for EUR 63.6 bn and deposits with agreed maturity for EUR 7.8 bn of the deposit stock.‑ In May, households concluded EUR 0.8 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.36%.

1 Covers 90% of credit institutions in the 5th–95th percentile range.

Key figures of Finnish MFIs' loans and deposits, preliminary data

| March, EUR million | April, EUR million | May, EUR million | May, 12-month change1, % | Average interest rate, % | |

| Loans to households2, stock | 125,383 | 125,677 | 125,900 | 2,5 | 1,55 |

| - of which housing loans | 94,279 | 94,484 | 94,651 | 2,1 | 1,05 |

| Loans to non-financial corporations2, stock | 77,548 | 78,039 | 78,252 | 7,0 | 1,42 |

| Deposits by households2, stock | 85,317 | 86,823 | 86,302 | 3,6 | 0,16 |

| Households' new drawdowns of housing loans | 1,599 | 1,387 | 1,689 | 1,08 |

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes.

2 Households also include non-profit institutions serving households; non-financial corporations also include housing corporations

- Euro-denominated deposits and loans of euro area residents: stock, 12 month rate of change and average interest rate

- Euro-denominated loans and deposits of Finnish households

- New business on loans and new drawdowns of household loans

- Finnish contribution to the euro area monetary aggregates and their main counterparts

For further information, please contact

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

Jenni Keskinen, tel. +358 9 183 2480, email: jenni.keskinen(at)bof.fi.

The next news release will be published at 1 pm on 31 July 2017.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.