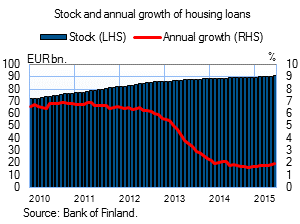

Steady increase in the growth of the housing-loan stock in the first part of the year

| Growth of the stock of housing loans slowed through most of 2014, but has gradually accelerated in the course of 2015, to 2.0% in June. The higher annual growth of the housing-loan stock is accounted for, in part, by a pick-up in new drawdowns of housing loans and the use of interest-only periods in housing loans. In the first part of 2015, new housing-loan drawdowns were a good EUR 700 million up from the same period a year ago. In addition, interest-only periods have led to housing loans not being repaid at the same pace as earlier, which increases the housing-loan stock and boosts its annual growth. During the campaign for interest-only periods in housing loans, households renegotiated EUR 11,6 bn worth of their housing loan agreements, which is almost 13% of the housing-loan stock. Banks have announced a maximum duration of one year for interest-only periods. |  |

In June 2015, households’ new drawdowns of housing loans amounted to EUR 1.6 bn, i.e. EUR 0.2 bn more than a year earlier in June. The average interest rate on new housing-loan drawdowns was 1.51% in June. The stock of euro-denominated housing loans totalled EUR 90.7 bn at the end of June, and the annual growth rate of the housing-loan stock was 2.0%. At end-June, household credit comprised EUR 13.9 bn in consumer credit and EUR 15.7 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in June to EUR 3.4 bn. The average interest rate on new corporate-loan drawdowns declined from May and was 1.73%. The stock of euro-denominated loans to non-financial corporations at the end of June was EUR 71.0 bn, of which loans to housing corporations accounted for EUR 22.3 bn. | ||||||||||||||||||||||||||||||||||||

Deposits At the end of June, the stock of household deposits totalled EUR 81.9 bn, and the average interest rate on the deposits was 0.33%. Overnight deposits accounted for EUR 57.1 bn and deposits with agreed maturity for EUR 11.6 bn of the total deposit stock. In June, households concluded EUR 1.0 bn of new agreements on deposits with agreed maturity. The average interest rate on new deposits with agreed maturity decreased from May, to 0.95% in June. Notes: | ||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

For further information, please contact The next news release will be published at 1 pm on 30 August 2015. |