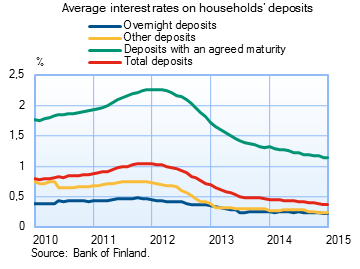

Continued decrease in household deposits with agreed maturity

The stock of household deposits with agreed maturity decreased by EUR 2.2 bn year-on-year, to EUR 13.0 bn at the end of January 2015. Households have transferred their investments to investment funds producing higher yields and to overnight deposits affording easier transferability. The stock of overnight deposits, in fact, increased by EUR 2.8 bn year-on-year, to EUR 54.9 bn at the end of January 2015. The decline in deposits with agreed maturity has been partly due to their low interest rates. In January, the rate of interest paid on deposits with agreed maturity was 1.14%, compared with 1.32% in the same period a year earlier. The rate of interest on overnight deposits in January was 0.22%. The interest rate has dropped by 0.03 percentage point in a year. Although the interest rate is close to zero, customers have preferred to put money into accounts from which it is quickly transferable. Nor are people willing to have their deposits linked to low interest rates for longer periods of time. |

|

In January 2015, households' new drawdowns of housing loans amounted to EUR 1.0 bn. The average interest rate on new housing-loan drawdowns was 1.66%, slightly down on December. The stock of euro-denominated housing loans totalled EUR 89.8 bn at the end of January, and the annual growth rate of the stock was 1.8 %. At the end of January, household credit comprised EUR 13.5 bn in consumer credit and EUR 15.6 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in January to EUR 1.9 billion, which is as much as in January 2014. The average interest rate on new corporate-loan drawdowns increased slightly from December, to 2.50%. At the end of January, the stock of euro-denominated loans to non-financial corporations was EUR 68.8 bn, of which loans to housing corporations accounted for EUR 21.3 bn. | ||||||||||||||||||||||||||||||||||||||||||

At the end of January, the stock of household deposits totalled EUR 81.2 bn, and the average interest rate on the deposits was 0.37%. Overnight deposits accounted for EUR 54.9 bn and deposits with agreed maturity for EUR 13.0 bn of the total deposit stock. In January, households concluded EUR 0.8 bn of new agreements on deposits with agreed maturity. The average interest rate on these was 1.05%. Notes: | ||||||||||||||||||||||||||||||||||||||||||

Key figures of Finnish MFIs' loans and deposits, preliminary data

1 Rate of change has been calculated from monthly differences in levels adjusted for classification and other revaluation changes. | ||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||

For further information, please contact: The next news release will be published at 1 pm on 31 March 2015. |