Growth in Finnish private equity funds reflected in domestic investments

The Bank of Finland collects data on private equity funds registered in Finland. The related statistical tables are now published for the first time.

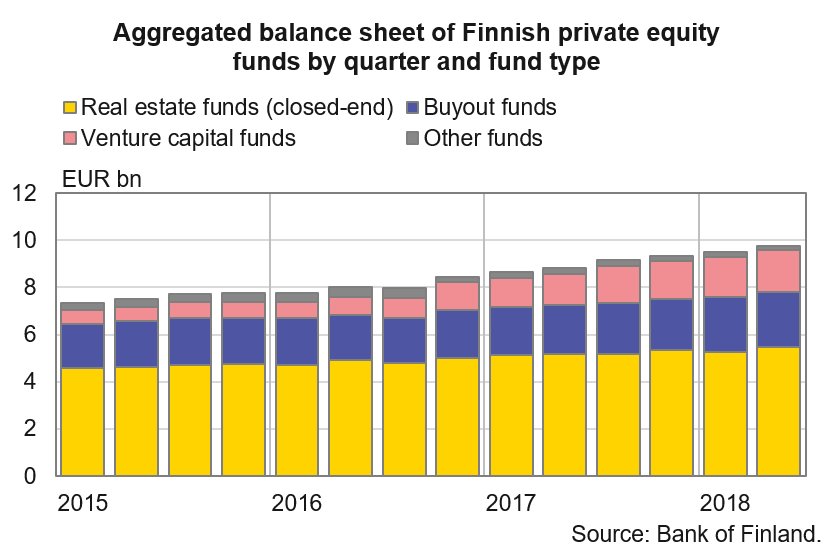

Since the beginning of 2015, Finnish private equity funds have gained EUR 0.5 bn of new investments, on average, per annum. At the end of June 2018, the value of assets under management in the funds totalled EUR 9.8 bn. Of this, EUR 5.5 bn was in closed-end real estate funds, EUR 2.3 bn in buyout funds and EUR 1.8 bn in venture capital funds.

Broken down by investor sectors, the largest investments in private equity funds, EUR 2.1 bn, were made by employee pension institutions. They were followed by non-financial corporations and insurance companies, with EUR 1.4 bn and EUR 1.3 bn, respectively. The value of households' direct investments in private equity funds totalled EUR o.3 bn.

Nearly 95% of Finnish private equity funds' shares are held by domestic investors. In addition, at end-June, about 83% of the funds' investments were made in Finnish companies.

*) Private equity funds refer to funds directed at a restricted group of professional investors and other collective investment schemes which are generally closed to new investments after the subscription period. In the Bank of Finland statistics, private equity funds also include, in addition to private equity funds investing in companies, closed-end real estate funds and other closed-end funds.

Statistical tables on private equity funds registered in Finland:

- Private equity funds' liabilities by sector of holder

- Private equity funds' securities-based assets by instrument, area and sector

For further information, please contact:

Topias Leino, tel. +358 9 183 2315, email: topias.leino(at)bof.fi

Katja Haavanlammi, tel. +358 9 183 2415, email: katja.haavanlammi(at)bof.fi

The Bank of Finland publishes data on private equity funds in connection with news releases on fund statistics. The next investment fund news release will be published at 1 pm on 1 November 2018.